- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Does Meta's $1.5B AI Data Center Boost Its Long-Term Growth Story for META?

Reviewed by Sasha Jovanovic

- Meta Platforms recently broke ground on a major new AI-focused data center in El Paso, Texas, representing an investment of over US$1.5 billion and the company's 29th data center project.

- This facility is designed with flexibility for both current and future AI workloads, underlining Meta's intention to lead in artificial intelligence infrastructure while supporting the growing computational needs of its products and services.

- We'll explore how Meta's significant commitment to AI infrastructure in Texas could shift expectations for its long-term revenue growth and technology leadership.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Meta Platforms Investment Narrative Recap

To own Meta Platforms shares, an investor needs confidence in the company’s ability to convert large-scale AI investments into profitable business improvements, most notably through advancements in advertising and sustained platform engagement. The newly announced El Paso AI data center reinforces Meta's technology ambitions, yet it does not meaningfully change the most immediate catalyst, which remains driving ad revenue through better usage of AI across its properties. The main risk continues to be expense growth potentially outpacing revenue gains due to aggressive infrastructure bets, though this news does not materially alter that outlook.

Among recent developments, DoubleVerify’s expansion of brand suitability measurement to Meta’s Threads feed stands out. This move gives advertisers more confidence with improved transparency and independent verification of ad placements, aligning directly with Meta’s push for stronger ad performance, a core catalyst for near-term revenue drivers.

However, investors should also be aware that while optimism surrounds AI-driven ad growth, there are unresolved questions about...

Read the full narrative on Meta Platforms (it's free!)

Meta Platforms' forecast puts revenue at $275.9 billion and earnings at $92.1 billion by 2028. This outlook is based on an annual revenue growth rate of 15.6% and an earnings increase of $20.6 billion from current earnings of $71.5 billion.

Uncover how Meta Platforms' forecasts yield a $863.20 fair value, a 20% upside to its current price.

Exploring Other Perspectives

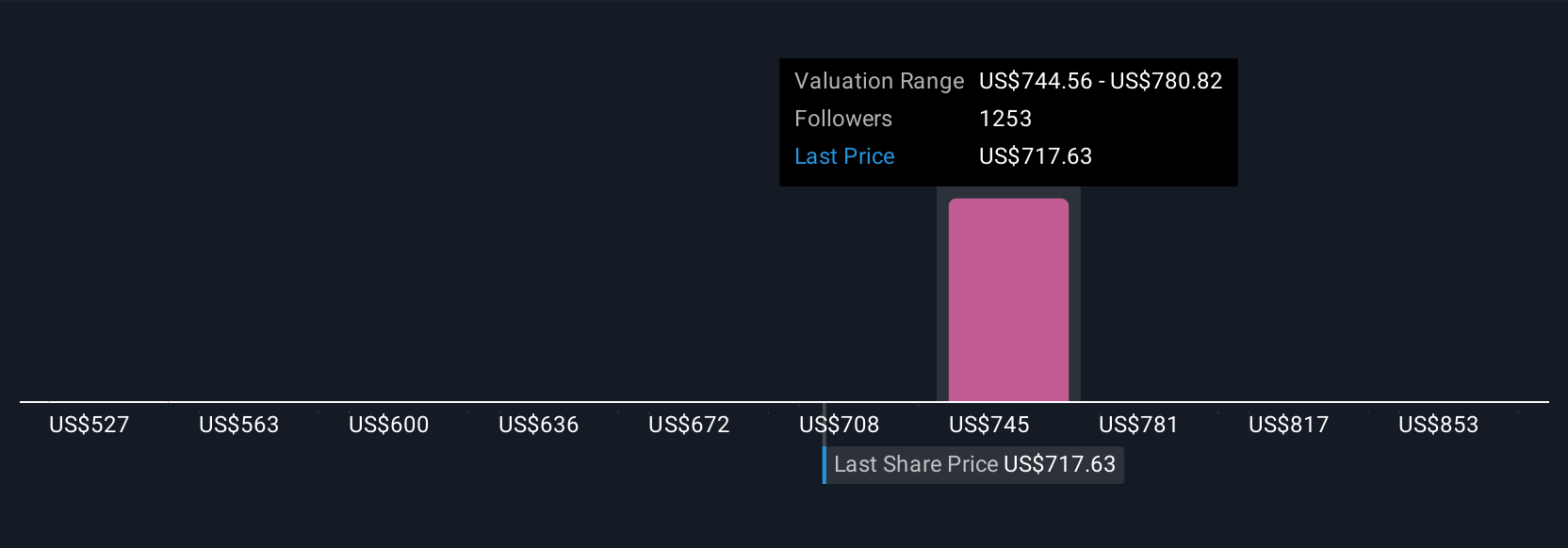

The Simply Wall St Community’s fair value estimates for Meta Platforms span from US$527 to over US$1,098 based on 104 individual forecasts. Many agree that AI-powered gains in ad targeting are crucial, but differing confidence in execution creates a broad range you may want to explore for yourself.

Explore 104 other fair value estimates on Meta Platforms - why the stock might be worth as much as 53% more than the current price!

Build Your Own Meta Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Meta Platforms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meta Platforms' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion