- United States

- /

- Media

- /

- NasdaqGS:LSXM.K

These 4 Measures Indicate That Liberty SiriusXM Group (NASDAQ:LSXM.K) Is Using Debt Extensively

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies. The Liberty SiriusXM Group (NASDAQ:LSXM.K) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Liberty SiriusXM Group

How Much Debt Does Liberty SiriusXM Group Carry?

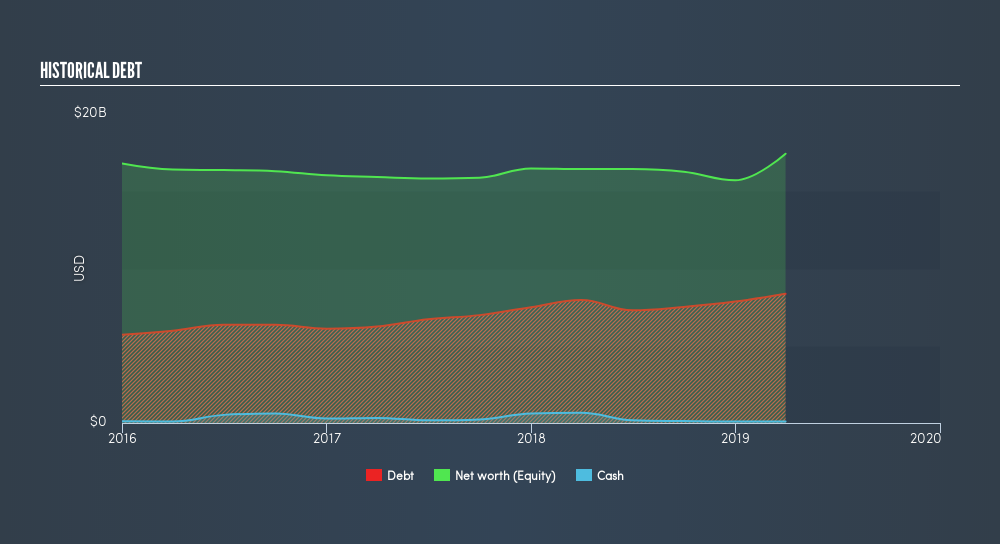

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Liberty SiriusXM Group had US$8.49b of debt, an increase on US$7.96b, over one year. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is Liberty SiriusXM Group's Balance Sheet?

The latest balance sheet data shows that Liberty SiriusXM Group had liabilities of US$3.21b due within a year, and liabilities of US$10.7b falling due after that. On the other hand, it had cash of US$98.0m and US$592.0m worth of receivables due within a year. So it has liabilities totalling US$13.3b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's huge US$12.5b market capitalization, you might well be inclined to review the balance sheet, just like one might study a new partner's social media. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Because it carries more debt than cash, we think it's worth watching Liberty SiriusXM Group's balance sheet over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Liberty SiriusXM Group's debt is only 4.12 times its EBITDA, and its EBIT cover its interest expense 4.15 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Fortunately, Liberty SiriusXM Group grew its EBIT by 3.9% in the last year, slowly shrinking its debt relative to earnings. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Liberty SiriusXM Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Liberty SiriusXM Group recorded free cash flow worth a fulsome 97% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

Neither Liberty SiriusXM Group's ability to handle its total liabilities nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. We think that Liberty SiriusXM Group's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:LSXM.K

Liberty SiriusXM Group

Through its subsidiaries, engages in the entertainment business in the United States, the United Kingdom, and internationally.

Good value with acceptable track record.

Market Insights

Community Narratives