- United States

- /

- Media

- /

- NasdaqGS:LBRD.K

Investors in Liberty Broadband (NASDAQ:LBRD.K) have unfortunately lost 69% over the last three years

If you love investing in stocks you're bound to buy some losers. But long term Liberty Broadband Corporation (NASDAQ:LBRD.K) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 69% in that time. And more recent buyers are having a tough time too, with a drop of 31% in the last year. The falls have accelerated recently, with the share price down 15% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Liberty Broadband

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, Liberty Broadband actually saw its earnings per share (EPS) improve by 35% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

We note that, in three years, revenue has actually grown at a 18% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Liberty Broadband more closely, as sometimes stocks fall unfairly. This could present an opportunity.

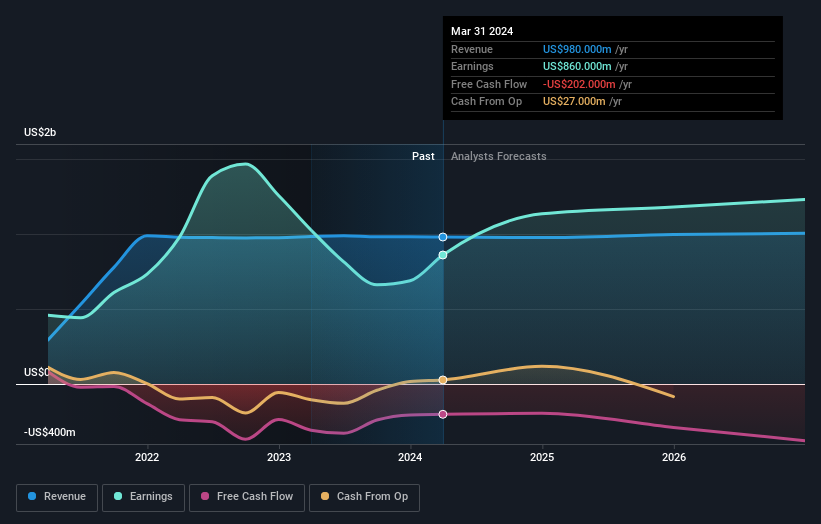

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Liberty Broadband has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Liberty Broadband's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Liberty Broadband shareholders are down 31% for the year, but the market itself is up 30%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Liberty Broadband better, we need to consider many other factors. For instance, we've identified 3 warning signs for Liberty Broadband (2 are potentially serious) that you should be aware of.

We will like Liberty Broadband better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LBRD.K

Fair value with questionable track record.