- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:JOYY

The Bull Case For JOYY (JOYY) Could Change Following Morgan Stanley's Positive Advertising Outlook – Learn Why

Reviewed by Sasha Jovanovic

- Earlier this week, Morgan Stanley issued a positive outlook on JOYY, highlighting improvements in its live-streaming segment and robust growth in its advertising business, backed by consistent shareholder returns through dividends and share repurchases.

- A unique aspect of this development is the increasing emphasis on JOYY's advertising operations as the primary driver of future growth, supported by high advertiser demand and ongoing expansion into new sectors and markets.

- We’ll now examine how renewed momentum in JOYY’s advertising business could shape the company’s investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

JOYY Investment Narrative Recap

To see JOYY as a compelling opportunity today, an investor has to believe that the company’s rapid growth in advertising will more than offset the flattening of its live-streaming segment, and that its technology advantages and ongoing capital returns set it apart in a competitive digital landscape. Morgan Stanley’s upgraded target price adds weight to the view that ad revenue momentum could drive near-term upside, while regulatory and international expansion risks remain the biggest questions for the outlook, neither significantly diminished by this news.

One of the most relevant recent announcements is the expansion of JOYY’s quarterly dividend and share buyback program totaling US$300 million per year through 2027. This commitment underscores management’s focus on rewarding shareholders, even as the company invests in its advertising platform, and could support stability during periods of business transition or market volatility. But on the other hand, investors should also be aware that...

Read the full narrative on JOYY (it's free!)

JOYY's outlook anticipates $2.4 billion in revenue and $267.8 million in earnings by 2028. This is based on a projected revenue growth rate of 4.0% per year, but a substantial earnings decrease of $1.43 billion from current earnings of $1.7 billion.

Uncover how JOYY's forecasts yield a $59.69 fair value, a 5% upside to its current price.

Exploring Other Perspectives

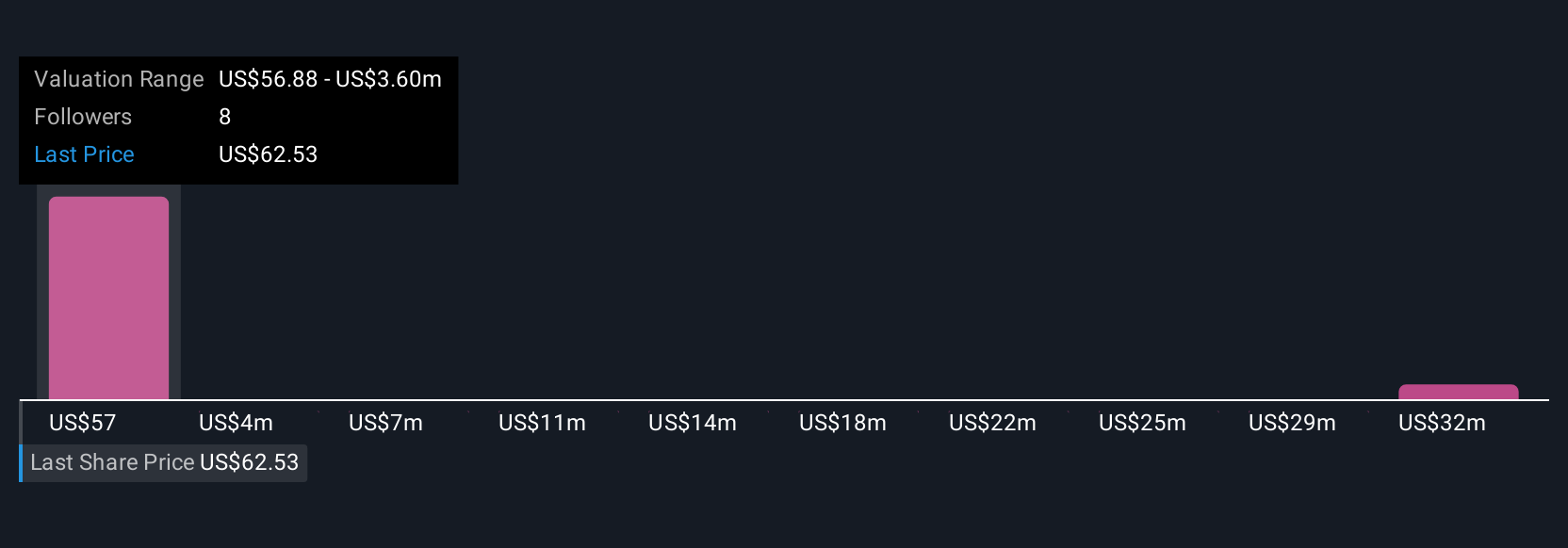

Five fair value estimates from the Simply Wall St Community for JOYY range from US$37 to over US$36 million per share. With so many different viewpoints, it’s clear that the company’s accelerating advertising growth and capital return strategy could have wide implications for future performance. Consider what other investors are seeing and compare these perspectives for a fuller picture.

Explore 5 other fair value estimates on JOYY - why the stock might be worth 35% less than the current price!

Build Your Own JOYY Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JOYY research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free JOYY research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JOYY's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JOYY

JOYY

Engages in the provision of social product matrix and communication technology.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives