- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:IZEA

IZEA Worldwide, Inc. (NASDAQ:IZEA) Could Be Riskier Than It Looks

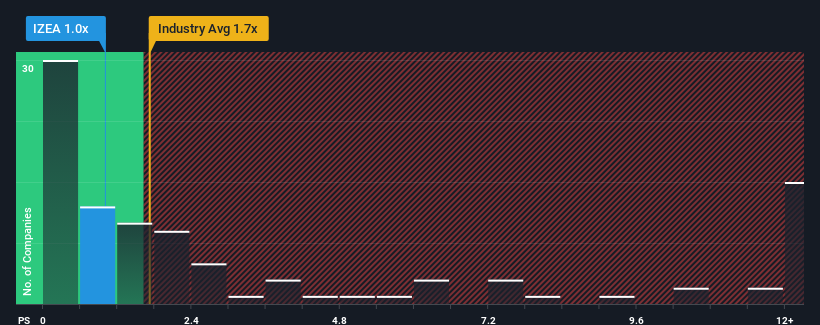

You may think that with a price-to-sales (or "P/S") ratio of 1x IZEA Worldwide, Inc. (NASDAQ:IZEA) is a stock worth checking out, seeing as almost half of all the Interactive Media and Services companies in the United States have P/S ratios greater than 1.7x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for IZEA Worldwide

What Does IZEA Worldwide's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, IZEA Worldwide's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on IZEA Worldwide.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as IZEA Worldwide's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. Even so, admirably revenue has lifted 103% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 19% over the next year. With the industry only predicted to deliver 14%, the company is positioned for a stronger revenue result.

With this information, we find it odd that IZEA Worldwide is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems IZEA Worldwide currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with IZEA Worldwide, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on IZEA Worldwide, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IZEA

IZEA Worldwide

Provides software and professional services to connect brands and content creators in North America, the Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives