- United States

- /

- Media

- /

- NasdaqGM:ICLK

iClick Interactive Asia Group Limited (NASDAQ:ICLK) Screens Well But There Might Be A Catch

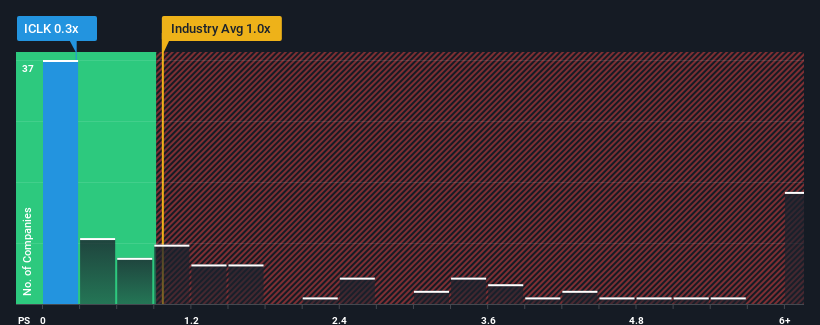

You may think that with a price-to-sales (or "P/S") ratio of 0.3x iClick Interactive Asia Group Limited (NASDAQ:ICLK) is a stock worth checking out, seeing as almost half of all the Media companies in the United States have P/S ratios greater than 1x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for iClick Interactive Asia Group

What Does iClick Interactive Asia Group's P/S Mean For Shareholders?

iClick Interactive Asia Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think iClick Interactive Asia Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is iClick Interactive Asia Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like iClick Interactive Asia Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. As a result, revenue from three years ago have also fallen 48% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 3.9%, which is noticeably less attractive.

In light of this, it's peculiar that iClick Interactive Asia Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at iClick Interactive Asia Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for iClick Interactive Asia Group (1 is potentially serious!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if iClick Interactive Asia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ICLK

iClick Interactive Asia Group

Provides online marketing services in Mainland China, Hong Kong, and internationally.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives