- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:IAC

IAC Jumps 8.2% on Strategic News But Does Market Price Reflect Its True Value?

Reviewed by Bailey Pemberton

- Curious if IAC might be a diamond in the rough or just another tech name on the Nasdaq? Let's break down what's been happening with its stock and why the valuation debate has never been more interesting.

- Over the past week, IAC’s share price has jumped 8.2%, building on a modest 2.9% rise over the past month. The stock is still trailing with a -18.8% return year-to-date.

- Investors took notice of IAC recently after news emerged about potential strategic moves within its media portfolio, as well as fresh analyst commentary around future growth opportunities. These headlines have put renewed focus on how the market is valuing IAC amid ongoing changes in the digital media space.

- Currently, IAC scores a 3 out of 6 on our value checks, meaning it appears undervalued on half of our measures. However, there is more to valuation than just the numbers. Keep reading as we dig into the standard ways to value IAC, and hint at a smarter approach for long-term investors later in the article.

Find out why IAC's -10.6% return over the last year is lagging behind its peers.

Approach 1: IAC Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future cash flows and then discounting those amounts back to today’s value. This helps investors get a sense of what the business is worth based on its expected profitability going forward.

For IAC, current annual Free Cash Flow is $53.7 Million. Analyst estimates project significant expansion, with Free Cash Flow expected to reach $183.9 Million by 2029. These forecasts are based on direct analyst input for the next five years. Projections beyond that, out to 2035, are extrapolated from industry trends and company guidance.

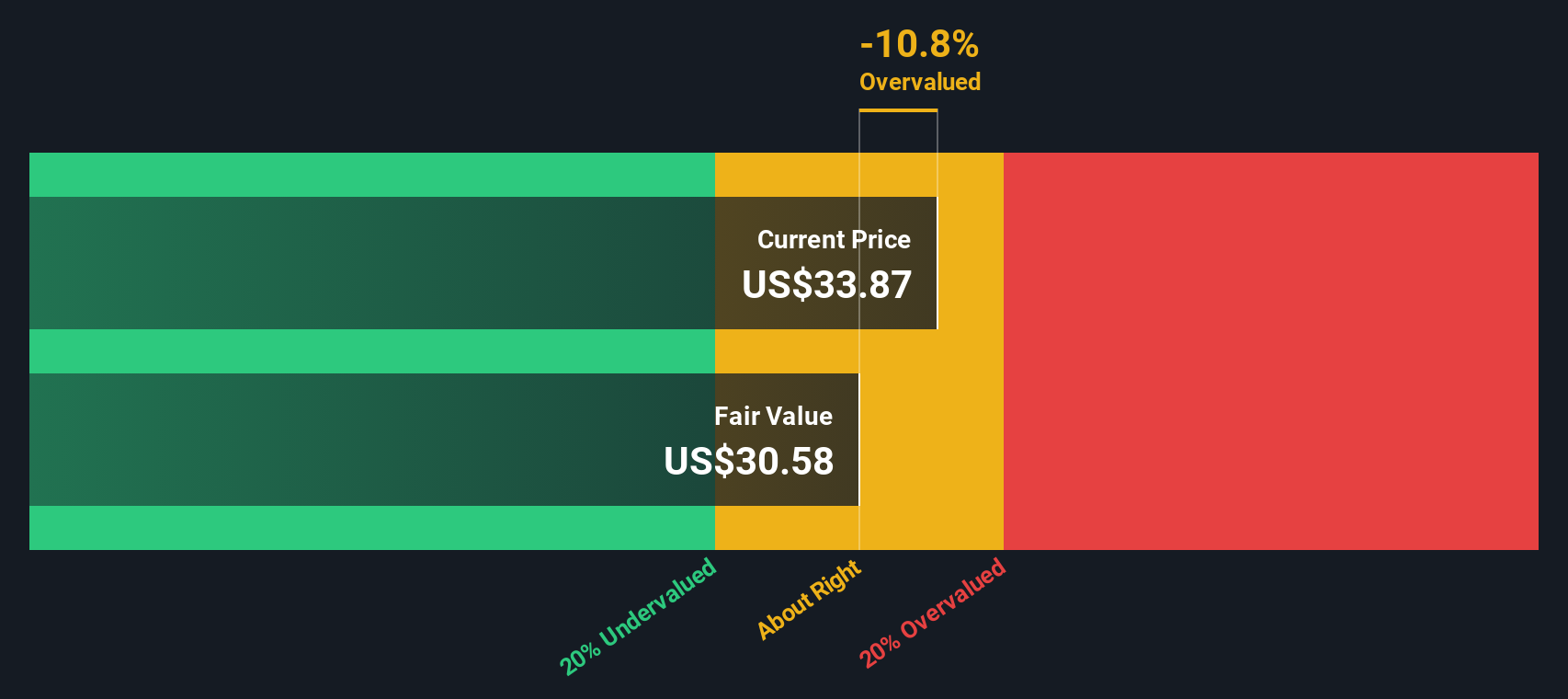

After running these figures through the 2-Stage Free Cash Flow to Equity model, IAC’s estimated intrinsic value is $30.63 per share. Compared to the stock’s current price, this implies a 13.0% overvaluation. In simple terms, the DCF model suggests IAC shares are trading above what their underlying cash flows can currently justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IAC may be overvalued by 13.0%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: IAC Price vs Sales

The Price-to-Sales (P/S) ratio is often a preferred valuation metric for companies like IAC, especially when profitability is inconsistent or net income is not a fully reliable measure. The P/S ratio lets investors assess valuation based on top-line revenue, making it especially relevant within interactive media and tech, where earnings may fluctuate due to reinvestment in growth or non-cash accounting impacts.

Growth expectations and risk have a direct influence on what constitutes a “normal” or “fair” P/S ratio. Companies with robust growth prospects or lower risk typically command higher P/S multiples, while those with muted outlooks or higher risks should trade at discounts to their industry average.

IAC’s current P/S ratio stands at 0.73x, significantly below the industry average of 1.05x and the peer group average of 2.39x. On the surface, this might suggest the stock is undervalued versus its competitors. However, a deeper analysis requires more than just comparing simple averages.

This is where the Simply Wall St "Fair Ratio" comes into play. The Fair Ratio, calculated to be 0.92x for IAC, represents a tailored multiple that incorporates the company’s expected revenue growth, risk profile, profit margins, industry sector and market capitalization. By accounting for these variables, it offers a more nuanced starting point for valuation than generic peer or sector comparisons.

Comparing IAC’s actual P/S multiple of 0.73x with its Fair Ratio of 0.92x, the difference suggests the stock is currently undervalued based on its underlying fundamentals and outlook.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IAC Narrative

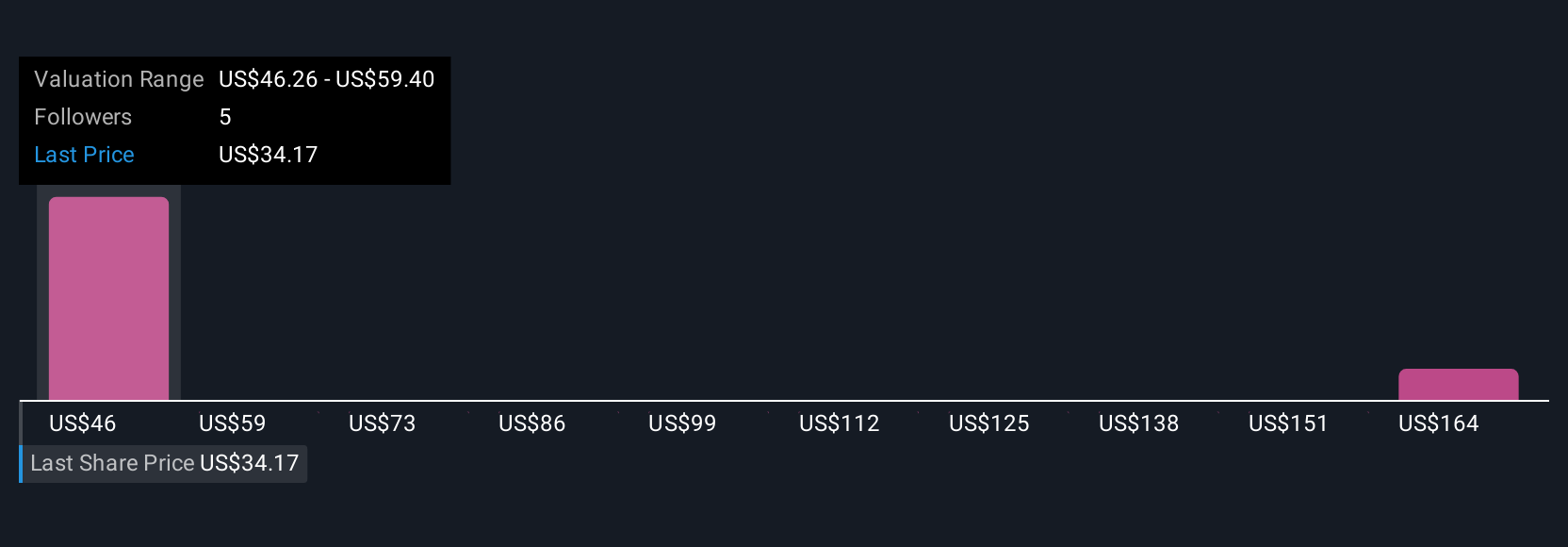

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, story-driven perspective that connects your view on a company’s journey to the financial forecasts and fair value estimates you believe in. In other words, a Narrative allows you to tie IAC’s evolving story, such as new initiatives, risks, or strategic pivots, directly to the numbers: your assumptions for revenue growth, profit margins, and justifiable price.

This approach does more than just crunch numbers. Narratives give you an accessible, interactive way to make informed investment decisions. They are available to everyone on the Simply Wall St platform’s Community page, used by millions of investors. The strength of Narratives is that they let you sense-check if a stock is a buy, sell, or hold by comparing your calculated Fair Value to the current share price, all through the lens of your own research and convictions.

Importantly, your Narrative isn’t static. Whenever new news or earnings are released, updates automatically refresh the data so your view stays relevant. For example, some investors currently see IAC as a potential $60 stock, projecting rapid growth and successful turnarounds, while others remain more cautious, setting fair value closer to $39 on concerns about execution risks and industry headwinds.

Do you think there's more to the story for IAC? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IAC

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success