- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:IAC

How Investors Are Reacting To IAC (IAC) Layoffs Amid Ongoing Operational and Financial Challenges

Reviewed by Sasha Jovanovic

- Earlier this week, IAC announced plans to cut nearly 250 jobs across two Michigan automotive parts plants, including a mass layoff of 178 employees at the Mendon facility, following a WARN notice filed with state authorities.

- This wave of layoffs draws renewed attention to IAC's ongoing operational difficulties and follows several years of sluggish revenue growth, negative earnings, and unprofitable expansion initiatives in the broader automotive supplier sector.

- We'll explore how these significant job cuts and operational challenges inform IAC's investment narrative and the outlook for its future growth.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

IAC Investment Narrative Recap

To own IAC stock today, an investor needs to believe in a turnaround story, one that hinges on the company’s ability to restore profitable growth by delivering results from digital initiatives and offsetting secular pressure on its legacy businesses. The recent Michigan facility layoffs appear tied to specific challenges in IAC’s auto parts segment and, while significant, do not directly affect the near-term digital growth catalyst or alter the biggest risk: continued declines in revenue and earnings from underperforming major brands.

Among recent company announcements, the upcoming Q3 2025 earnings release set for November 3 is most relevant. This report will give the first concrete insight into whether restructuring efforts and cost control measures, including the recent layoffs, are leading to stabilization in the business, which is crucial given ongoing revenue declines and compressed margins.

Yet, in contrast to past optimism, investors should be aware that if traffic from key digital channels continues to drop...

Read the full narrative on IAC (it's free!)

IAC's narrative projects $2.5 billion in revenue and $85.5 million in earnings by 2028. This requires a 12.5% annual revenue decline and a $565.4 million earnings increase from the current earnings of $-479.9 million.

Uncover how IAC's forecasts yield a $48.69 fair value, a 44% upside to its current price.

Exploring Other Perspectives

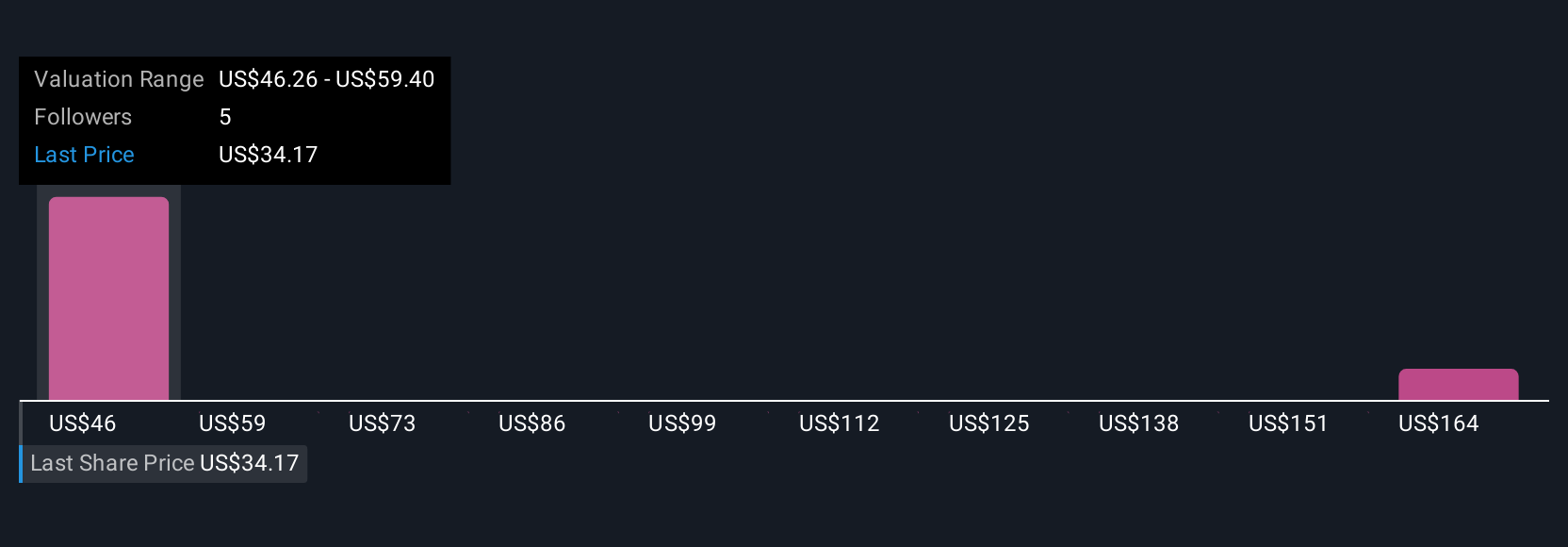

Simply Wall St Community fair value estimates for IAC span from US$46.26 to US$177.63, reflecting four unique viewpoints. While some contributors see substantial upside, the company’s ongoing dependence on a few key revenue streams remains a central concern for future performance, consider exploring multiple analyses to weigh these risks for yourself.

Explore 4 other fair value estimates on IAC - why the stock might be worth just $46.26!

Build Your Own IAC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IAC research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free IAC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IAC's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IAC

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives