- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:IAC

How Do Buybacks and Profitability Shape IAC's (IAC) Growth Outlook Amid Revenue Declines?

Reviewed by Simply Wall St

- IAC Inc. recently reported its second quarter 2025 results, posting net income of US$211.45 million compared to a net loss a year ago, alongside ongoing share repurchases that have amounted to over 8.8 million shares since 2020.

- Remarkably, the company achieved this earnings turnaround despite a decline in quarterly and year-to-date revenues, highlighting improved profitability and margin execution.

- We'll explore how IAC's return to profitability and steady buybacks may influence the investment narrative and future growth expectations.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

IAC Investment Narrative Recap

To own shares in IAC today, an investor must believe in the company's ability to boost profitability through focused margin execution and capital returns, even amid shrinking revenue and digital advertising headwinds. The recent swing to net income is significant for sentiment but does not materially alter the biggest short-term catalyst, successful monetization from new product initiatives, or the central risk, ongoing weakness in digital ad pricing and secular pressure on search-driven traffic.

Among recent updates, IAC’s steady share repurchase program stands out, with over 8.8 million shares bought back since 2020. This move has consistently signaled management’s confidence while supporting the share price; however, with ongoing revenue declines, future buybacks may not fully offset the impact of external industry risks on value creation.

Yet, despite this renewed profitability, investors should be aware that ongoing market shifts in digital ad budgets could still pose...

Read the full narrative on IAC (it's free!)

IAC's narrative projects $2.5 billion revenue and $170.0 million earnings by 2028. This requires a 12.1% yearly revenue decline and a $989.9 million increase in earnings from the current -$819.9 million.

Uncover how IAC's forecasts yield a $51.00 fair value, a 47% upside to its current price.

Exploring Other Perspectives

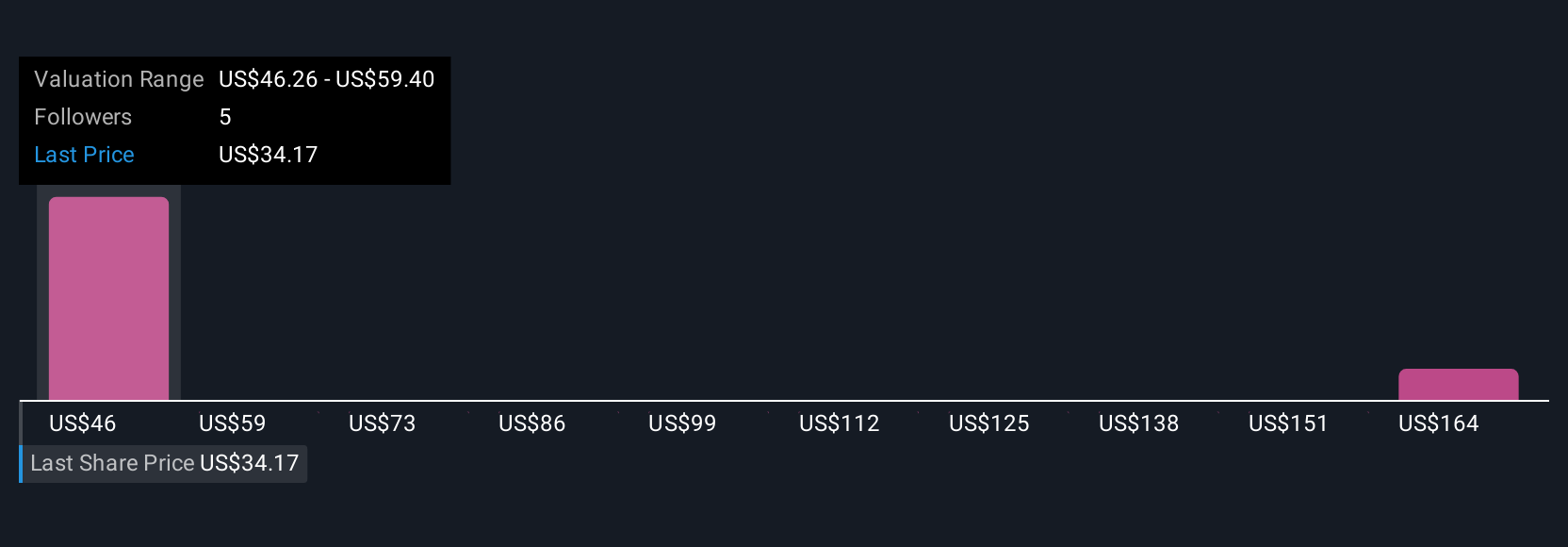

Three investors in the Simply Wall St Community estimate IAC’s fair value between US$46.26 and US$177.63 per share. While some see significant upside, persistent pressure on advertising revenue remains a central concern for the company’s outlook, explore the full range of market opinions.

Explore 3 other fair value estimates on IAC - why the stock might be worth over 5x more than the current price!

Build Your Own IAC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IAC research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free IAC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IAC's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IAC

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives