- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GTM

ZoomInfo Technologies (GTM): A Fresh Look at Valuation After Wells Fargo's Underweight Rating and Sector AI Review

Reviewed by Kshitija Bhandaru

ZoomInfo Technologies (GTM) saw its shares dip after Wells Fargo initiated coverage on the company with an underweight rating, bringing attention to shifting expectations in the software space. The move was part of a broader sector review related to artificial intelligence trends.

See our latest analysis for ZoomInfo Technologies.

That latest dip reflects shifting sentiment in the software sector as investors weigh AI-driven opportunities against new competitive threats. While ZoomInfo’s one-year total shareholder return has shown modest positive growth, momentum has clearly cooled following a challenging multi-year stretch.

If big sector moves like this have you rethinking your approach, broaden your search and discover fast growing stocks with high insider ownership.

With analysts marking a cautious outlook, yet the shares trading at a notable discount to some price targets, investors must ask themselves: Is ZoomInfo undervalued at these levels, or is the market already accounting for its future growth?

Most Popular Narrative: 10.5% Undervalued

ZoomInfo Technologies is trading around $10.43, while the most popular narrative estimates fair value near $11.65. This sets up a case for upside if key assumptions hold. This analysis draws on expectations for margin expansion and recurring revenue, offering a perspective distinct from simple market sentiment.

Enterprises are prioritizing digital transformation and high-quality, unified data as essential for enabling successful AI initiatives and workflow automation, pushing customers to increase reliance on ZoomInfo's integrated solutions (Data as a Service, Copilot, Go-To-Market Studio). This is strengthening customer retention rates and positioning the company for rising recurring revenues and improved net revenue retention.

What’s fueling these bullish projections? The main narrative hints at a future where platform adoption, operating leverage, and improved profitability drive robust fair value. But the specific forecast behind these claims may surprise you. Uncover the pivotal numbers and bold financial leaps at the heart of this call for upside.

Result: Fair Value of $11.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on large enterprise clients and ongoing declines in downmarket revenues could quickly challenge ZoomInfo’s growth and stability narrative.

Find out about the key risks to this ZoomInfo Technologies narrative.

Another View: Putting the Price in Perspective

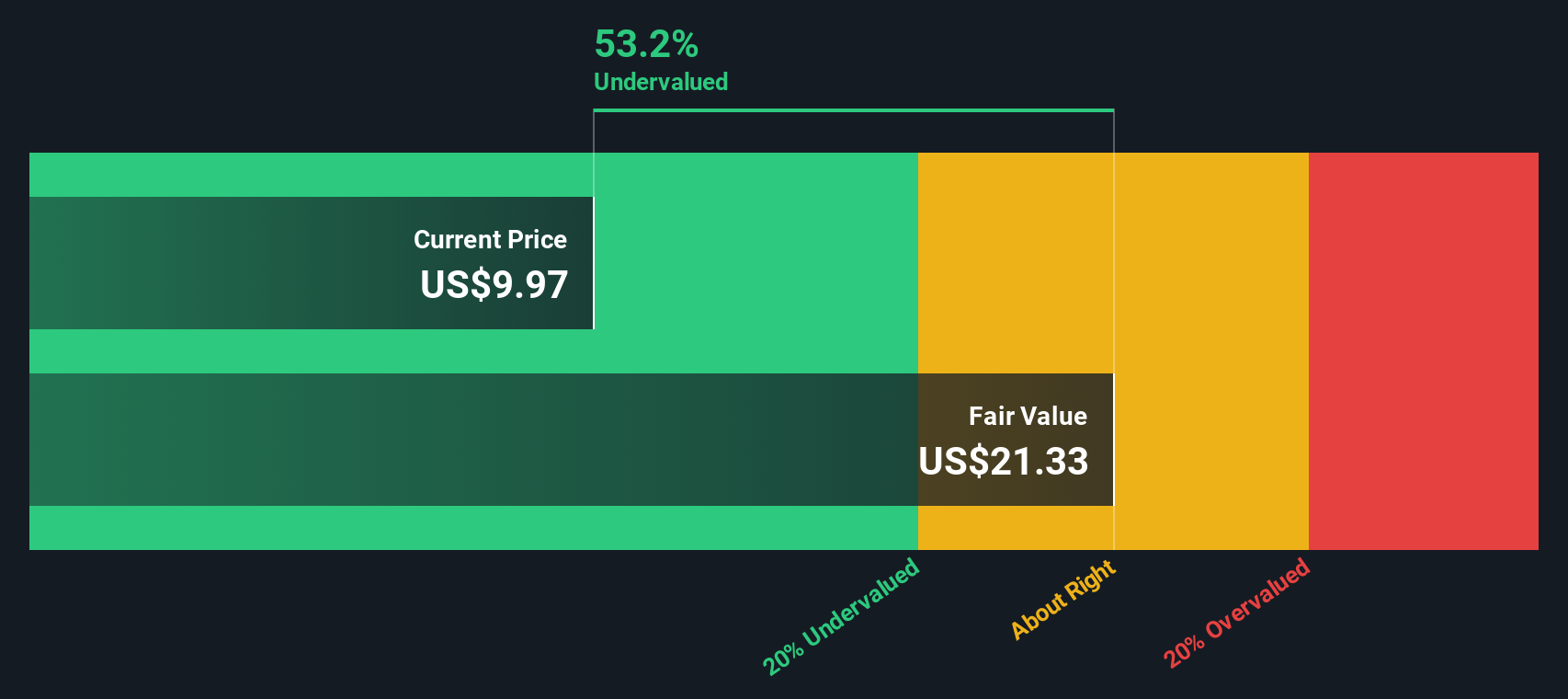

While analysts see upside based on future earnings and sales growth, the latest SWS DCF model offers a starkly different view. By discounting future cash flows, our DCF model estimates ZoomInfo’s fair value at $21.36, which is sharply above today’s market price and the analyst target. Could the market be overlooking real value, or does hidden risk explain this gap?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ZoomInfo Technologies Narrative

If you have a different perspective or want to dive deeper into the numbers, it's easy to analyze the data and shape your own story in just a few minutes. Do it your way.

A great starting point for your ZoomInfo Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by. Make your next move with confidence using screeners built to highlight unique potential. Check out these hand-picked options to strengthen your portfolio:

- Maximize your potential returns by reviewing these 3566 penny stocks with strong financials with robust financials and track records of outperforming the broader market.

- Capture future tech growth by targeting companies leading the charge in artificial intelligence through these 24 AI penny stocks.

- Supercharge your passive income by focusing on standout businesses offering above-average yields in these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZoomInfo Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTM

ZoomInfo Technologies

Provides go-to-market intelligence and engagement platform for sales, marketing, operations, and recruiting professionals in the United States and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives