- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GTM

Why Did ZoomInfo (GTM) Rise After Strong Q2 Results and an Upbeat Outlook?

Reviewed by Simply Wall St

- ZoomInfo Technologies reported second quarter 2025 results, announcing US$306.7 million in revenue and a shift from a net loss to net income year-over-year, while also raising its full-year revenue guidance and confirming Michael Graham O’Brien as permanent Chief Financial Officer.

- The company expanded API access across all Copilot plans and highlighted advances in AI-driven data innovation, strengthening its position in upmarket segments and with enterprise customers.

- We'll examine how ZoomInfo's raised full-year guidance influences its investment narrative and underpins future outlook assumptions.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ZoomInfo Technologies Investment Narrative Recap

To be a ZoomInfo Technologies shareholder today, you need to believe in its ability to accelerate sustainable growth by deepening its position with enterprise customers, leveraging AI-powered data offerings, and efficiently shifting upmarket. The latest results, returning to profitability and raising full-year revenue guidance, support the core catalyst of upmarket expansion but do not meaningfully change the high-stakes risk: persistent downmarket contraction and potential ongoing net revenue retention challenges.

Among recent announcements, ZoomInfo’s move to bring API access to all Copilot plans stands out. This opens up its data layer to more partner applications and customers, directly supporting its upmarket momentum and enhancing potential for larger enterprise deals, key to driving revenue expansion as the company navigates pressure from shrinking SMB revenue.

In contrast, investors should not overlook the ongoing risk posed by continued downmarket weakness and slow net revenue retention, especially since it still accounts for a sizeable share of ZoomInfo’s base...

Read the full narrative on ZoomInfo Technologies (it's free!)

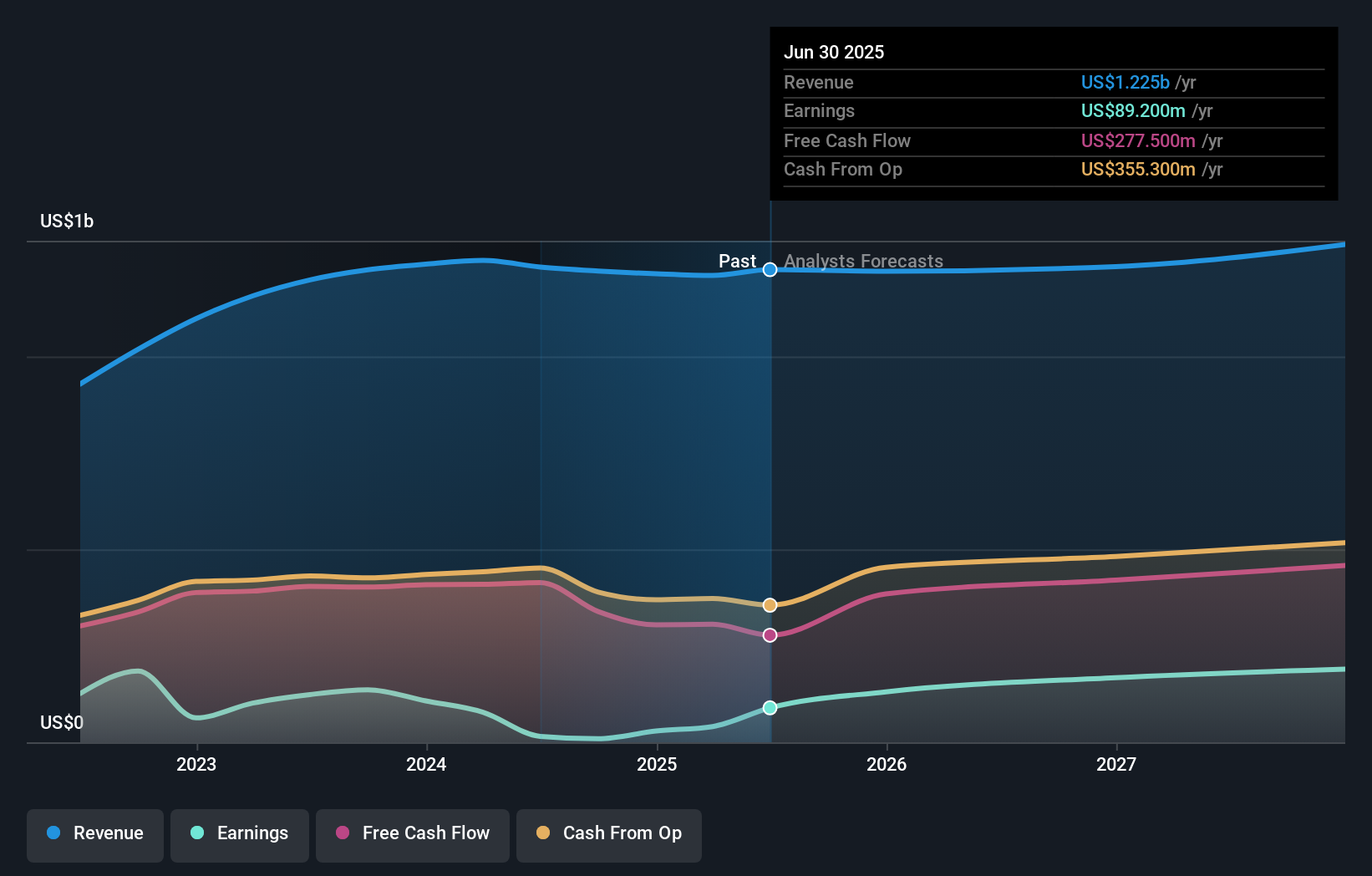

ZoomInfo Technologies is projected to reach $1.3 billion in revenue and $189.1 million in earnings by 2028. This requires 3.0% annual revenue growth and an earnings increase of $148.3 million from the current earnings of $40.8 million.

Uncover how ZoomInfo Technologies' forecasts yield a $11.08 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members published two fair value estimates for ZoomInfo ranging from US$12.43 to US$20.48 per share. While the business focuses on upmarket growth and enterprise clients, this wide range reflects sharply different views on the company’s long term resilience and potential.

Explore 2 other fair value estimates on ZoomInfo Technologies - why the stock might be worth as much as 92% more than the current price!

Build Your Own ZoomInfo Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ZoomInfo Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free ZoomInfo Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ZoomInfo Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZoomInfo Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTM

ZoomInfo Technologies

Provides go-to-market intelligence and engagement platform for sales, marketing, operations, and recruiting professionals in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives