Key Takeaways

- Growth in AI-powered sales tools and automation drives higher upsell opportunities, deeper enterprise engagement, and expands the company's long-term addressable market.

- Margin improvements and strong cash flow support share repurchases, while upmarket expansion points to significant untapped growth potential.

- Ongoing downmarket weakness, regulatory headwinds, upmarket challenges, and integration risks threaten ZoomInfo's revenue growth, margins, and ability to meet long-term expansion targets.

Catalysts

About ZoomInfo Technologies- Provides go-to-market intelligence and engagement platform for sales, marketing, operations, and recruiting professionals in the United States and internationally.

- The rapid expansion of AI-powered applications and automation within the ZoomInfo platform (such as Copilot and GTM Studio) reflects broader enterprise demand for intelligent, data-driven sales tools-driving higher upsell/cross-sell opportunities and likely supporting acceleration in revenue growth and improved average contract values among enterprise customers.

- Widespread adoption of remote and hybrid work has made digital, data-enabled sales and marketing workflows essential; ZoomInfo's unified go-to-market intelligence platform positions it as a critical infrastructure provider for these organizations, increasing long-term customer stickiness, net retention, and the company's addressable market.

- Margin improvement is anticipated as ongoing automation in data collection, enrichment, and platform delivery reduces operational costs and enables scalable enterprise expansion-supporting higher operating and net income margins over time.

- Share repurchases at current valuation levels are expected to significantly boost adjusted net income per share as the outstanding share count declines; this is financially accretive given strong free cash flow generation and reported cash margins exceeding 40%.

- Upmarket momentum-with enterprise customer wins, expanding product use cases beyond prospecting, and low seat penetration in existing Fortune 1000 accounts-suggests a large, underpenetrated growth opportunity that can drive sustainable revenue acceleration and improved net dollar retention, especially if software sector retention continues to rebound.

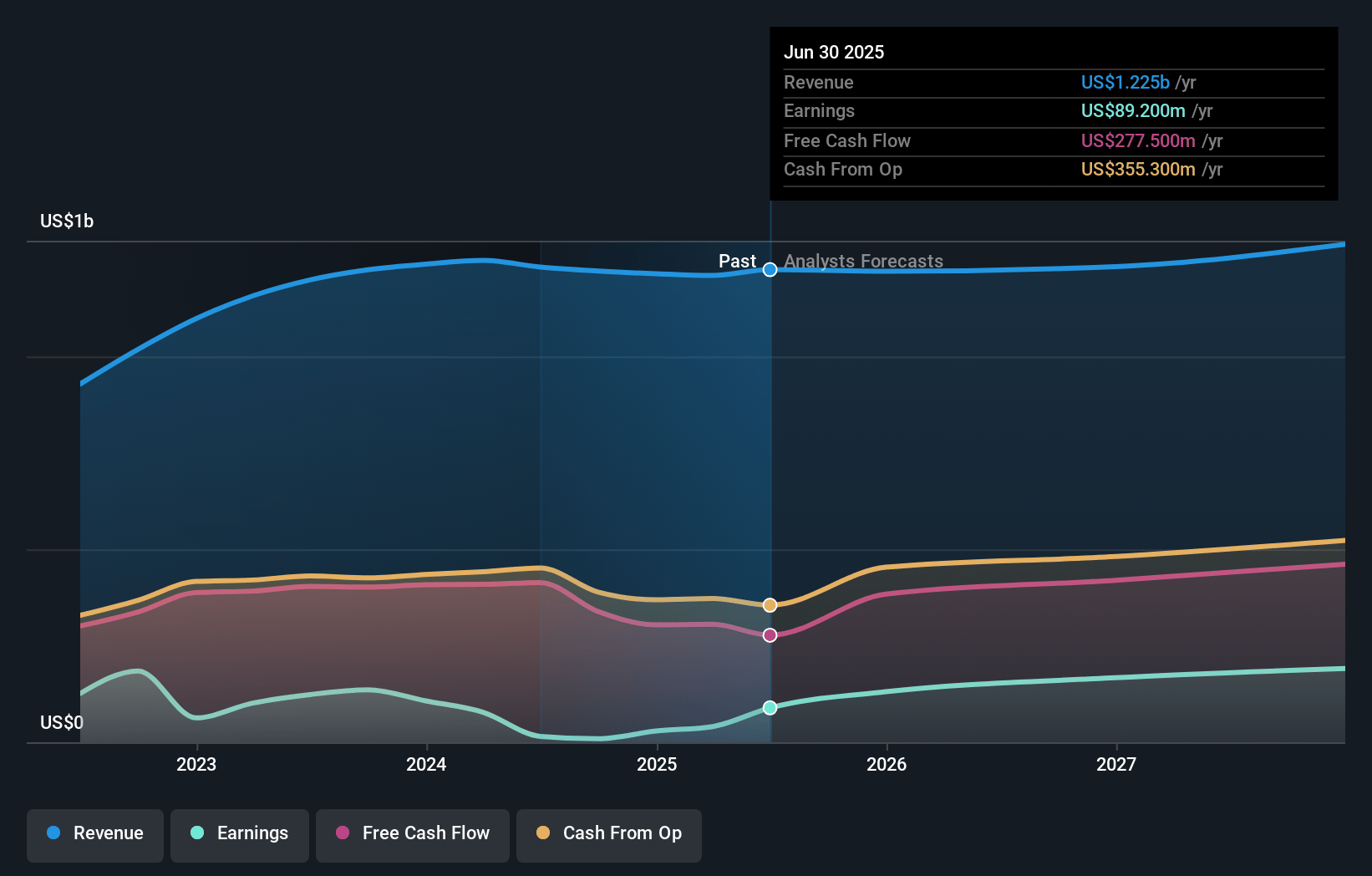

ZoomInfo Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ZoomInfo Technologies's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.4% today to 14.3% in 3 years time.

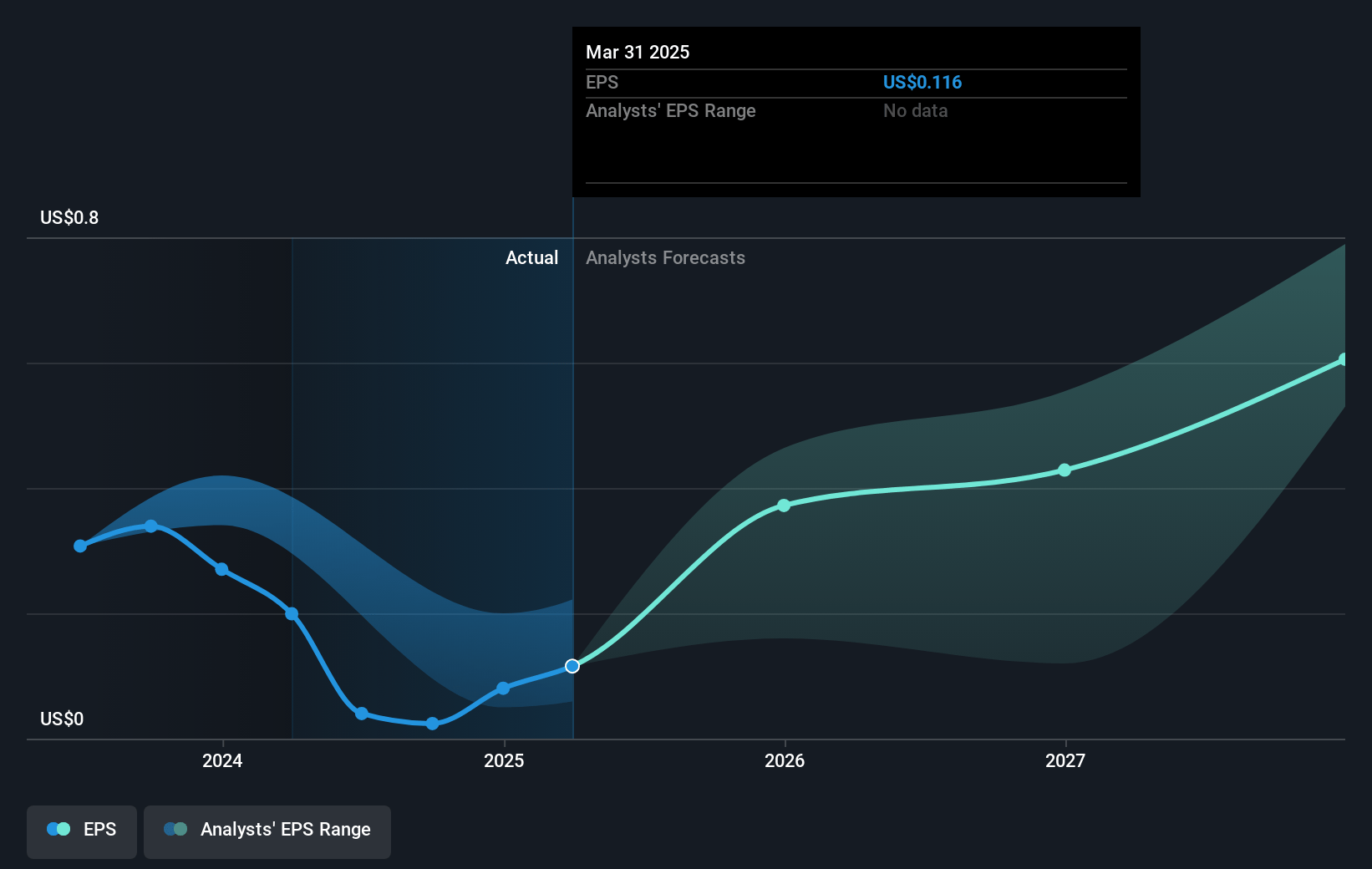

- Analysts expect earnings to reach $189.1 million (and earnings per share of $0.56) by about July 2028, up from $40.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $263.9 million in earnings, and the most bearish expecting $88.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.8x on those 2028 earnings, down from 84.2x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 17.0x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.59%, as per the Simply Wall St company report.

ZoomInfo Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued and accelerating contraction of the downmarket/SMB segment, which still represents nearly 30% of ZoomInfo's ARR, could persist for years; even after rightsizing, this loss of revenue base creates a headwind for total topline growth and puts pressure on achieving long-term revenue expansion targets.

- Sluggish net revenue retention (NRR) at 87%-well below the benchmark for best-in-class SaaS peers-remains heavily impaired in the downmarket and requires ongoing upmarket mix-shift just to stabilize; this signals persistent customer churn and downgrade risk, which could cap both revenue growth and net margins over time.

- Intensifying regulatory scrutiny around data privacy, security, and governance (especially as ZoomInfo leans into more AI-driven offerings and larger enterprise deals) poses long-term risks of increased compliance costs, margin drag, and potential constraints on core data acquisition-directly impacting gross margin and operating income.

- The shift upmarket brings longer sales cycles, higher customer acquisition costs, and increased deal complexity. If upmarket wins or expansions slow, or expected seat growth from enterprise users underperforms, revenue growth may fall short while expenses remain elevated, compressing earnings.

- Reliance on ongoing M&A and integration of acquired products (e.g., RingLead, Chorus, set sale) creates persistent execution risk. Failure to realize expected synergies, or value-destructive acquisitions, could hamper product cohesion, customer satisfaction, and cash flow, stalling both top-line and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.075 for ZoomInfo Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $189.1 million, and it would be trading on a PE ratio of 19.8x, assuming you use a discount rate of 8.6%.

- Given the current share price of $10.45, the analyst price target of $11.08 is 5.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives