- United States

- /

- Entertainment

- /

- NasdaqGM:GRVY

Gravity (NASDAQ:GRVY) Might Become A Compounding Machine

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Ergo, when we looked at the ROCE trends at Gravity (NASDAQ:GRVY), we liked what we saw.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Gravity, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.25 = ₩76b ÷ (₩398b - ₩89b) (Based on the trailing twelve months to September 2022).

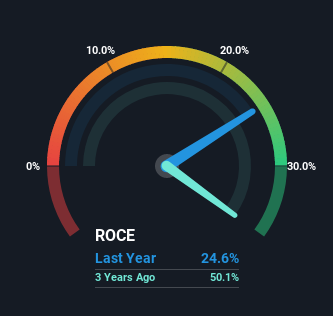

Therefore, Gravity has an ROCE of 25%. That's a fantastic return and not only that, it outpaces the average of 8.4% earned by companies in a similar industry.

View our latest analysis for Gravity

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Gravity has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

In terms of Gravity's history of ROCE, it's quite impressive. The company has employed 580% more capital in the last five years, and the returns on that capital have remained stable at 25%. Now considering ROCE is an attractive 25%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns. If Gravity can keep this up, we'd be very optimistic about its future.

On a side note, Gravity has done well to reduce current liabilities to 22% of total assets over the last five years. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

The Bottom Line

Gravity has demonstrated its proficiency by generating high returns on increasing amounts of capital employed, which we're thrilled about. However, over the last five years, the stock has only delivered a 12% return to shareholders who held over that period. So because of the trends we're seeing, we'd recommend looking further into this stock to see if it has the makings of a multi-bagger.

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation on our platform that is definitely worth checking out.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:GRVY

Gravity

Develops and publishes online and mobile games worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

What IREN's decision to buy over 50,000 NVIDIA GPUs could mean for its future

AI short positioning & India emerging market opportunties

Cheniere Energy (LNG) — The Toll Road That Geopolitics Just Made More Valuable

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026