- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Is Google Still a Bargain After Waymo’s London Expansion News and a 7% Weekly Surge?

Reviewed by Bailey Pemberton

If you have been watching Alphabet's stock lately, you are not alone. It is the kind of company people talk about at dinner, and with good reason. Many investors are wondering whether now is the right time to hold, buy, or cash in on those hefty gains. The past year especially has been more than just solid, with Alphabet chalking up a 55.7% return over twelve months and an impressive 152.2% over three years. Year to date, it is up 33.7%, which certainly turns heads, and the last week alone brought a 7.1% jump. On a quieter note, gains over the past month have been milder, hovering around 1.5%.

Some of that recent excitement can be tied back to headlines, such as Google's driverless Waymo aiming for a new launch in London, moves to dodge a substantial EU fine through adjustments to search results, and bold expansion into Asia with a massive data center agreement. While not every bit of news moves the stock, this blend of innovation and regulatory challenge keeps Alphabet in the spotlight and perhaps resets how investors see both the risks and opportunities ahead.

Now, as impressive as these returns are, the best investors know that price history is only part of the story. Valuation matters too. Based on our latest analysis, Alphabet racks up a value score of 2 out of 6, meaning the company appears undervalued in just two of the key valuation checks we track. Still, interpreting that score and what it means for your decision goes deeper than simply ticking boxes. Next, we will walk through the popular valuation approaches and then tackle a smarter way to look at value that may change how you view Alphabet altogether.

Alphabet scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Alphabet Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental tool for valuing a business. It works by projecting a company's future cash flows and then discounting them back to their present value. This lets investors estimate the intrinsic worth of a company based on the money it is expected to generate in years ahead.

For Alphabet, the current Free Cash Flow stands at approximately $81.4 billion. Analysts have offered projections for the coming years, with an expected Free Cash Flow reaching around $140.7 billion by 2029, based on a combination of analyst estimates and longer-term extrapolations. These numbers highlight robust growth, even as the majority of future cash flow figures beyond 2029 are simply projected rather than directly estimated by analysts.

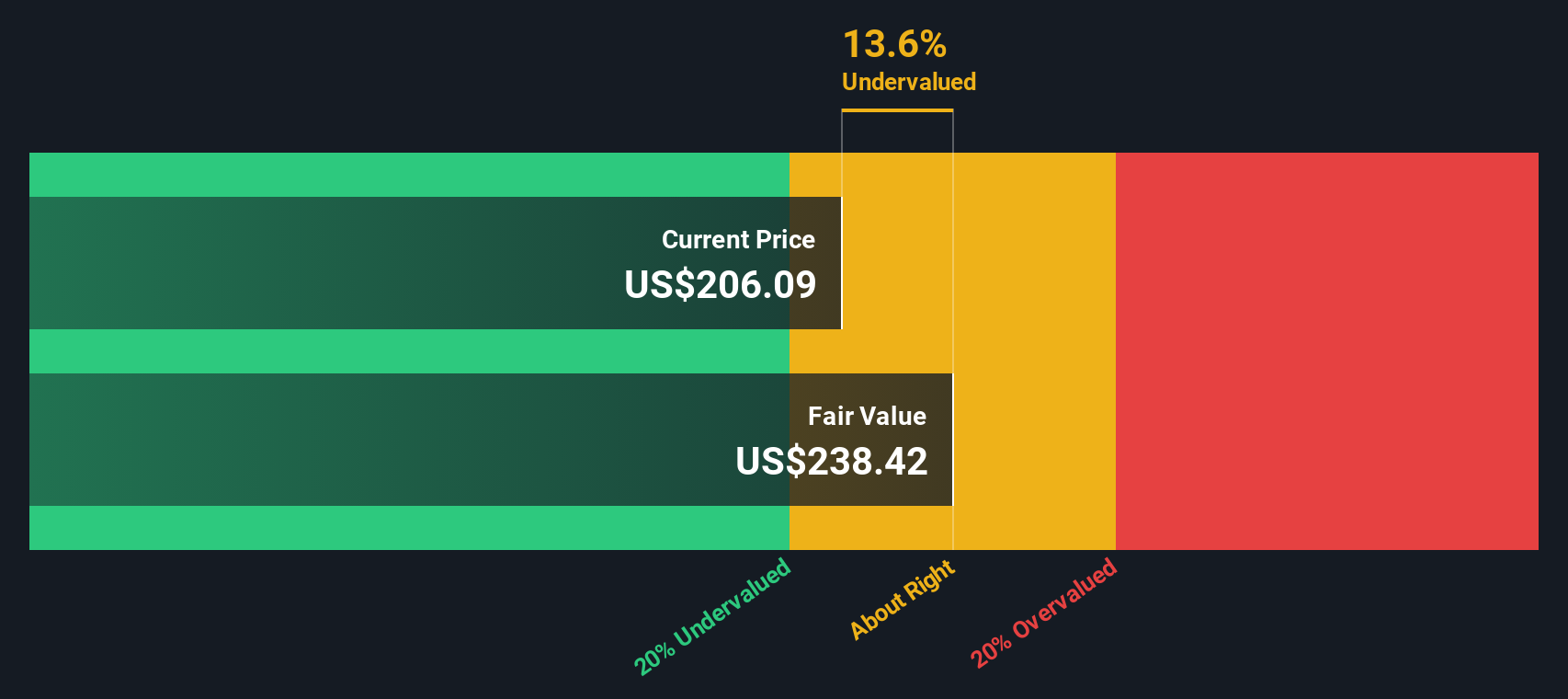

Bearing in mind these projections and using a 2 Stage Free Cash Flow to Equity model, the DCF estimates Alphabet's fair value at $246.31 per share. At the time of this analysis, the model suggests the stock trades at a 2.8% premium to this intrinsic value, implying a slight overvaluation but not significantly so.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Alphabet's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Alphabet Price vs Earnings

For companies like Alphabet that consistently generate strong profits, the Price-to-Earnings (PE) ratio is a widely used and trusted valuation metric. The PE ratio helps investors understand how much they are paying for each dollar of a company's earnings, making it especially relevant for mature businesses with robust profitability.

The right PE ratio for any stock depends on expected earnings growth, stability, and risk. Higher growth rates or lower risk profiles can justify a higher PE, while slower-growing or more volatile firms usually deserve a lower one.

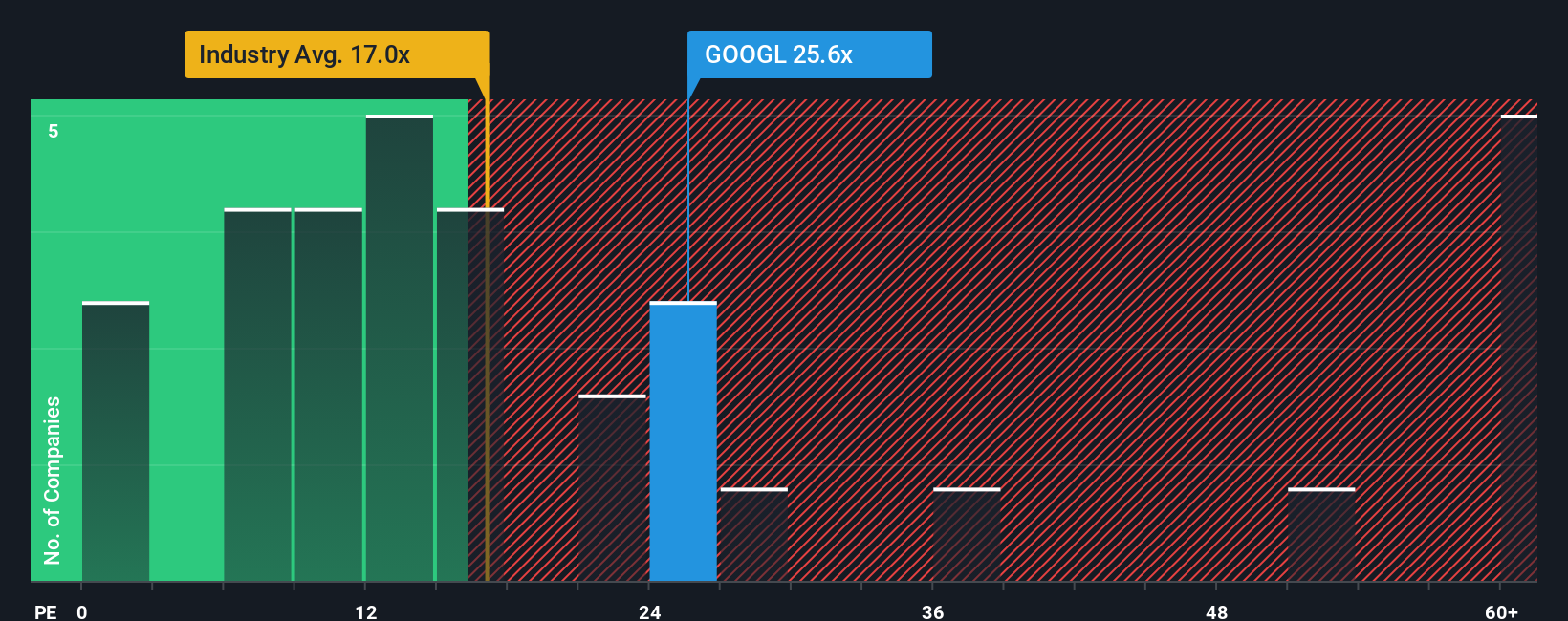

Alphabet currently trades at a PE ratio of 26.5x. To put this into context, this is well above the Interactive Media and Services industry average of 15.4x, but well below its peer average of 54.0x. While these comparisons are useful, they do not account for Alphabet's specific strengths and challenges.

That is where Simply Wall St's proprietary "Fair Ratio" comes in. This metric offers a tailored benchmark for Alphabet by analyzing factors like expected growth, profit margins, market cap, and risks, setting a fair PE ratio at 41.7x. Unlike a simple comparison with industry or peer averages, the Fair Ratio provides a more meaningful context for Alphabet’s valuation and future prospects.

Looking at the numbers, Alphabet's current PE of 26.5x is noticeably below its Fair Ratio of 41.7x. This suggests the stock may be trading at an attractive valuation for long-term investors, given its underlying strengths and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alphabet Narrative

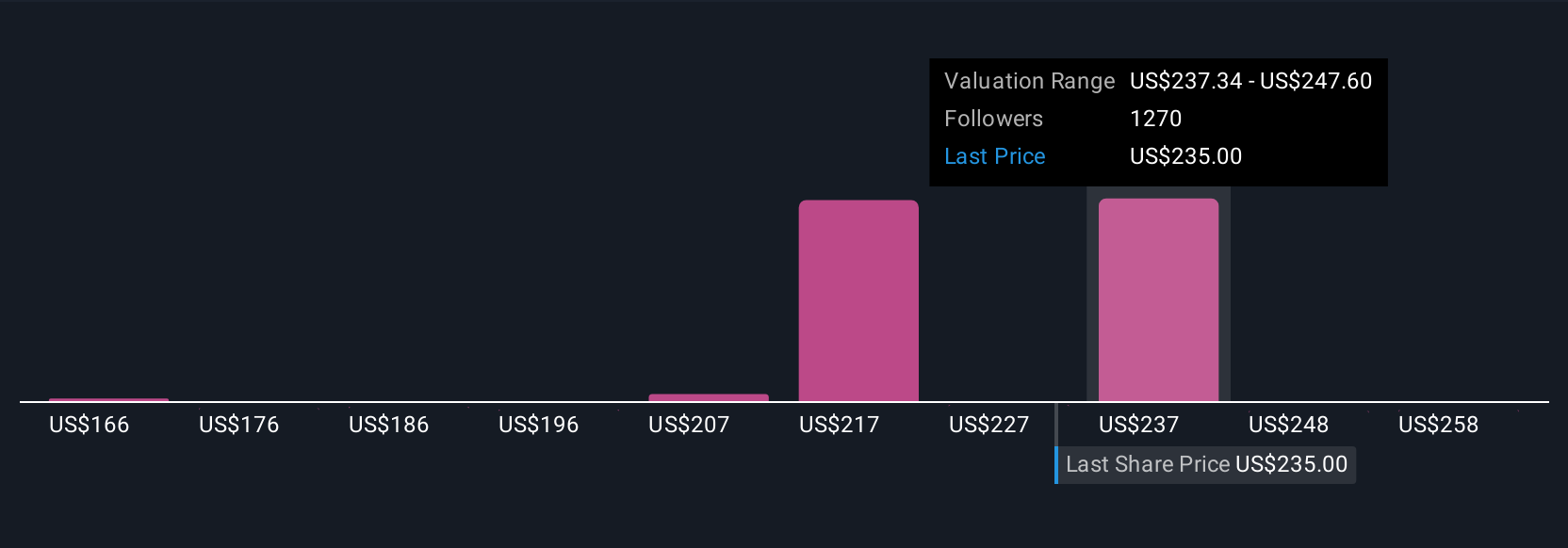

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story of how you see Alphabet’s future, combining your assumptions about fair value, expected revenue, profit margins, and risks, with your perspective on what will drive or hinder the company. By linking the company’s story to a financial forecast and a resulting fair value, Narratives empower you to move past the numbers and reflect your own convictions.

On Simply Wall St, Narratives are easy for anyone to use and are already shaping investment decisions for millions within the Community page. They help you decide whether to buy, sell, or hold by comparing your fair value to the latest share price. Because they are dynamically updated with each major news or earnings event, you always have context in real time.

For example, one investor expects strong AI and Cloud growth to push Alphabet’s fair value to $268.59, while another sees slower revenue expansion and assigns a fair value closer to $171.36. Your Narrative turns your outlook, whether bullish or cautious, into a clear, data-driven roadmap for action.

Do you think there's more to the story for Alphabet? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives