- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

How Gradient Ventures Spin Out Impacts Google’s Current Share Valuation in 2025

Reviewed by Bailey Pemberton

If you are wondering what to do with Alphabet shares right now, you are not alone. Whether you are dazzled by Google’s dominance, curious about recent shake-ups, or just trying to keep up with the constant stream of headlines, deciding when to buy or hold can feel like its own full-time job.

Let’s look at how the journey has unfolded lately. Alphabet’s stock climbed an impressive 6.4% over the last month, fueling investor enthusiasm after a slower week that saw a slight dip of 0.5%. Over the year-to-date period, shares are up a remarkable 29.5%. Anyone who has held on for the past five years is sitting on gains north of 227%. That is serious long-term momentum, powered by innovation and some bold strategic moves.

The news cycle fuels plenty of discussion. Alphabet has been busy, spinning out its AI-focused Gradient Ventures to better compete in the booming artificial intelligence market and making headlines with plans to sell or spin off its Verily health business. At the same time, the company faces challenges, from workforce reductions in its Cloud division to legal wrangling over gambling apps and YouTube’s pricey settlements. These events can shake up risk perceptions and often lead to the price swings we have seen recently.

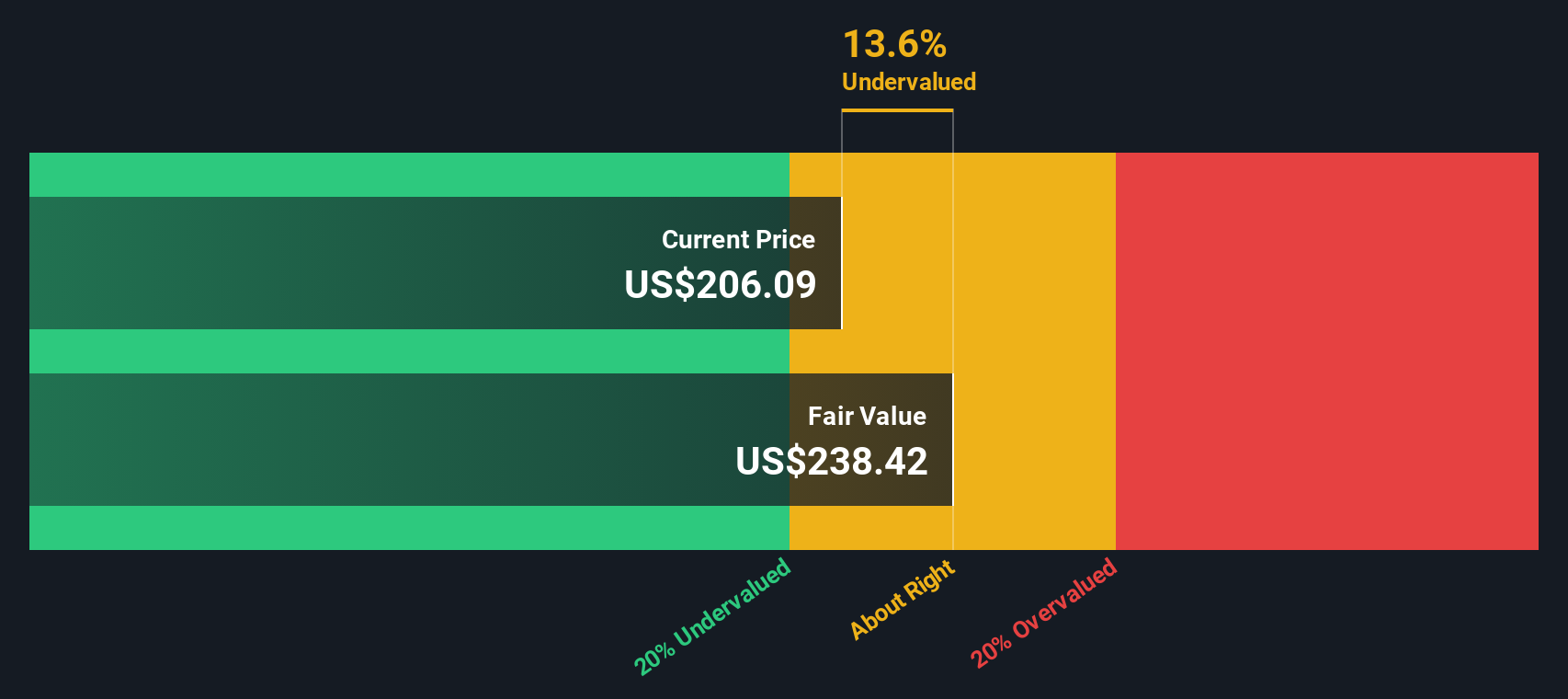

But does all this activity mean the stock is undervalued, or are the best days already priced in? According to our valuation framework, Alphabet scores a 1 out of 6, meaning it is only undervalued in one of six key checks. Still, traditional metrics only go so far. Next, we will break down these valuation approaches, and later, discuss an even more insightful way to evaluate where Alphabet stands.

Alphabet scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Alphabet Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future free cash flows and discounting them back to today's value. This approach aims to capture the intrinsic worth of Alphabet based solely on its ability to generate cash over time.

Currently, Alphabet produces an impressive $81.4 billion in Free Cash Flow (FCF). Analysts forecast steady FCF growth, projecting the company to generate $140.1 billion by the end of 2029. While analyst estimates are available for the next five years, longer-term projections, reaching up to 2035, are extrapolated using Simply Wall St's methodology. This suggests Alphabet’s cash generation will continue expanding in the years ahead.

Based on the DCF model, the fair value of Alphabet’s shares comes to $245.12. Compared to the current price, this suggests Alphabet is 0.1% overvalued, essentially trading right around its intrinsic worth according to these far-reaching cash flow projections.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Alphabet's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Alphabet Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for established, profitable companies like Alphabet, as it compares the current share price to the company’s earnings per share. A higher PE suggests the market expects faster growth or is willing to pay a premium for perceived quality. In contrast, a lower PE can indicate either lower growth expectations or higher risk.

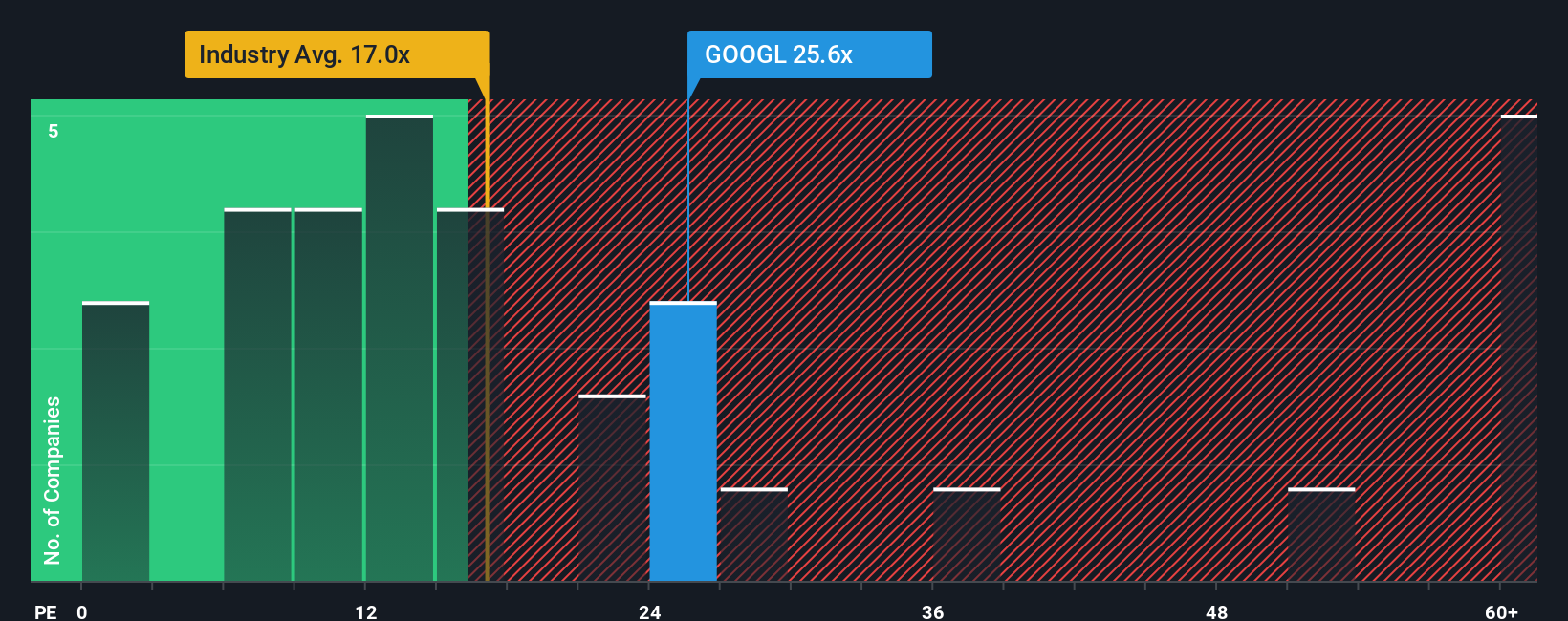

Alphabet currently trades at a PE ratio of 25.7x. For context, the average PE ratio across its "Interactive Media and Services" industry is 17.0x, and the average among peers sits at 16.1x. On the surface, this might make Alphabet appear more expensive than its competitors. However, headline comparisons like these can be misleading, as they do not factor in a company’s unique combination of growth prospects, margins, scale, and risk profile.

That is where Simply Wall St’s Fair Ratio comes in. This proprietary metric estimates what Alphabet’s PE should be, based on key company-specific attributes like earnings growth, market cap, profit margins, and risk factors. For Alphabet, the Fair Ratio is calculated to be 40.8x, which is substantially higher than both its present multiple and those of its industry peers. This suggests that Alphabet’s shares are actually valued about right relative to the exceptional strengths and outlook embedded in its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alphabet Narrative

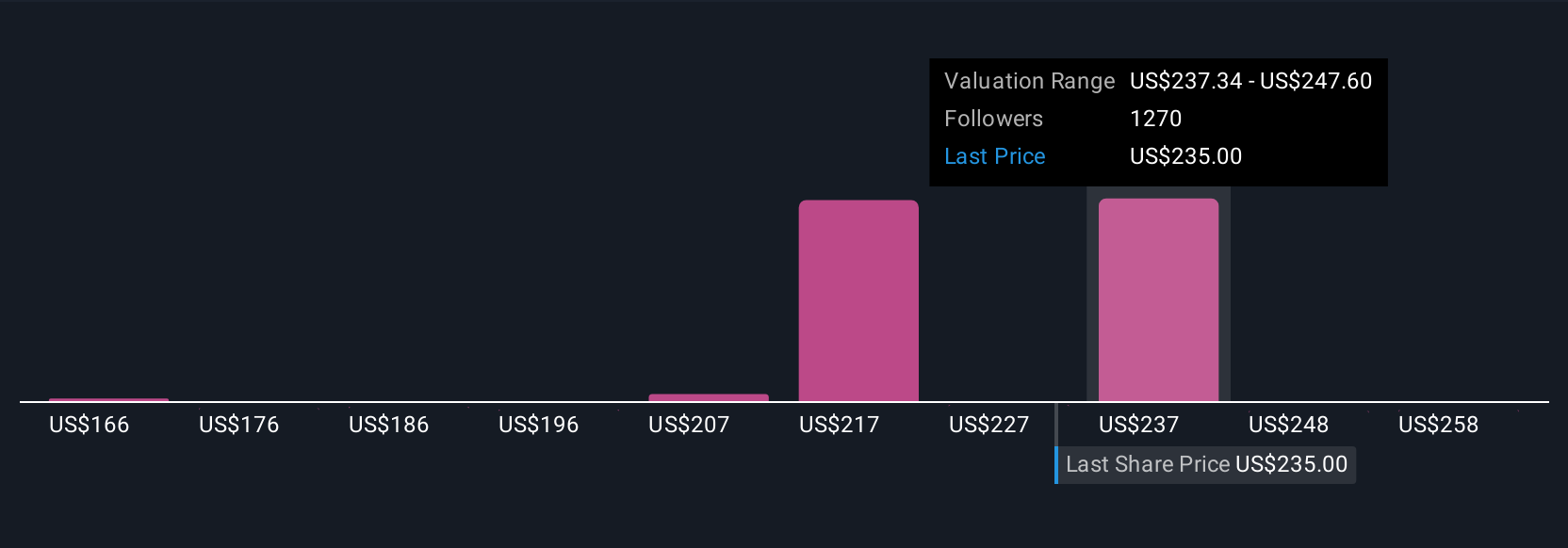

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a story you create that ties your beliefs about a company’s future, such as its revenue growth, profit margins, or risks, to a financial forecast and an estimated fair value. Rather than just relying on static ratios or models, Narratives let you articulate why you think Alphabet’s prospects are strong or weak, linking the company’s evolving story directly to numbers that matter.

Narratives make investment decision-making dynamic and accessible for everyone. On Simply Wall St’s Community page, where millions of investors share insights, you can explore, create, and update your own Narrative for Alphabet in just a few minutes. By comparing your Narrative’s fair value to Alphabet’s current price, you can quickly see if you believe it’s a buy, a hold, or a sell. Narratives are also designed to incorporate new data, such as market-moving news or fresh earnings reports, so they stay relevant with every update.

For example, recent Narratives for Alphabet range from a bullish case valuing shares at $268.59, supported by rapid AI adoption and double-digit growth forecasts, down to a more cautious view of $171.36, citing margin pressure and tougher competition. By exploring these perspectives, you can see how different assumptions lead to very different conclusions. This helps you anchor your decision to the story and numbers that fit your own view.

Do you think there's more to the story for Alphabet? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion