- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Alphabet (NasdaqGS:GOOGL) Strengthens Google Cloud Offerings With Virtusa Partnership

Reviewed by Simply Wall St

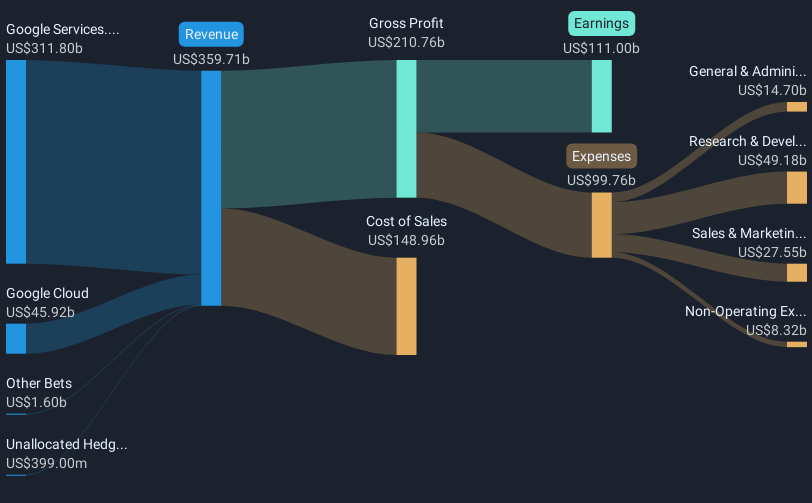

Virtusa Corporation recently partnered with Google Cloud to move to Google Workspace, a transition aimed at improving collaboration and security. Over the past month, Alphabet (NasdaqGS:GOOGL) shares rose 3%, a move in line with the broader market gains, driven by several key developments. Alphabet's strong earnings report showed a significant year-over-year increase in sales and net income, while also enhancing their buyback program. The partnership with Virtusa and other collaborations likely reinforced the market's positive sentiment towards the company, supporting its stock performance, although the broader bullish market trends also played a significant part.

Buy, Hold or Sell Alphabet? View our complete analysis and fair value estimate and you decide.

The recent partnership between Virtusa Corporation and Google Cloud, aimed at transitioning to Google Workspace, highlights Alphabet's continuous efforts to enhance its collaborative and secure infrastructure. This move could positively impact Alphabet's narrative of focusing on AI advancements and infrastructure improvements, potentially driving increased operational efficiency and supporting revenue and net margin growth. As Alphabet deepens its strategic partnerships, such efforts may play a crucial role in reinforcing its revenue streams, especially given the company’s focus on expanding AI Cloud and Waymo services.

Over the past five years, Alphabet has achieved a total shareholder return of 136.72%, showcasing significant long-term growth. However, in the past year, the company's performance lagged behind the US Market, which returned 9.5%, and the Interactive Media and Services industry, which returned 6.6%. Despite the recent market challenges, Alphabet's ongoing commitment to innovative solutions and potential future revenue diversification through personalized services indicates resilience.

The move to Google Workspace, coupled with the expected expansion of AI and subscription services, could bolster Alphabet's revenue and earnings forecasts. Analysts anticipate a revenue growth rate of 10.4% annually over the next three years, alongside earnings reaching $140.1 billion by 2028. Current market activity positions Alphabet's shares at approximately US$160.16, representing a 20.8% climb needed to reach the consensus price target of US$202.12. This potential uptick reflects market confidence in Alphabet's strategic direction, though individual assessments should consider both prevailing market dynamics and specific company performance indicators.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Alphabet, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives