- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Alphabet (NasdaqGS:GOOGL) Partners With Illinois To Tackle Maternal Health Crisis Using AI

Reviewed by Simply Wall St

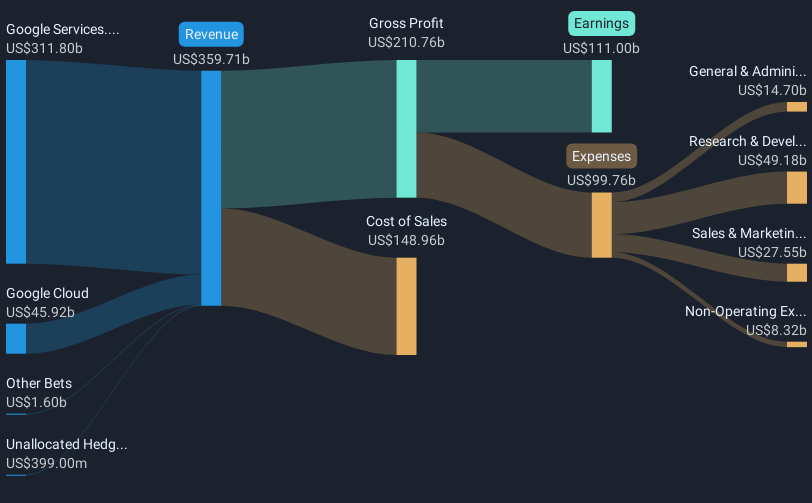

Alphabet (NasdaqGS:GOOGL) recently partnered with Drive Health and the State of Illinois to launch the "Healthy Baby" program, aiming to improve maternal health in rural areas. While the company's stock rose 1.52% over the last month, the market trends, including the tech sector's broader positive momentum, likely influenced this uptick. Alphabet's moves, including the partnership and solid earnings reported for Q1 2025, may have aligned well with market optimism driven by easing tariffs between the U.S. and China. Furthermore, Alphabet's expanded buyback plan and dividend announcements could have strengthened investor confidence.

Buy, Hold or Sell Alphabet? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent partnership between Alphabet and Drive Health, alongside the State of Illinois, aims to improve maternal health in rural areas and underscores Alphabet's commitment to community development. This initiative may not have an immediate financial impact, but it highlights potential long-term goodwill and aligns with broader healthcare goals, subtly bolstering Alphabet's brand image. Over a five-year span, Alphabet's total shareholder returns, including share price appreciation and dividends, have surged by a substantial 133.25% as of 14 May 2025, indicating robust long-term performance. However, in the past year, the company's performance didn't match the broader U.S. market's 11.5% return. This highlights the challenges in maintaining market-leading growth amidst varying sector dynamics.

The Healthy Baby program, along with Alphabet's AI and cloud initiatives, may contribute to future revenue and earnings growth. Analysts foresee expanded capabilities in Google's Cloud and AI services enhancing operational efficiency and potentially increasing revenue growth, despite existing challenges in advertising sectors. Given a current share price of US$163.23, Alphabet is trading 19.1% below the consensus analyst price target of US$201.75. This potential price movement reflects positive market sentiment towards Alphabet's strategic initiatives and buyback programs. Although the share price movement aligns with recent financial announcements, future revenue and earnings forecasts remain contingent on ongoing industry trends and Alphabet’s ability to mitigate profitability pressures from fixed expenses and depreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives