- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Alphabet (NasdaqGS:GOOGL) Faces Shareholder Vote On Human Rights Due Diligence Report

Reviewed by Simply Wall St

Alphabet (NasdaqGS:GOOGL) saw its share price rise by 3% over the last month. Several factors may have influenced this move. The company's announcement of significant increases in both dividend and share buyback plans on April 23 likely improved investor sentiment. The subsequent release of strong earnings results on April 24, showing robust increases in sales and net income, would have further boosted confidence. Additionally, the resolution of a new U.S.-U.K. trade deal provided a lift to broader market sentiment, aligning with Alphabet's rise. A proposal for a human rights impact report filed on May 7 might have had a more neutral to negative influence, adding a layer of scrutiny to its operations. Overall, these elements collectively contributed to Alphabet's share price performance, reflecting broader market trends.

Buy, Hold or Sell Alphabet? View our complete analysis and fair value estimate and you decide.

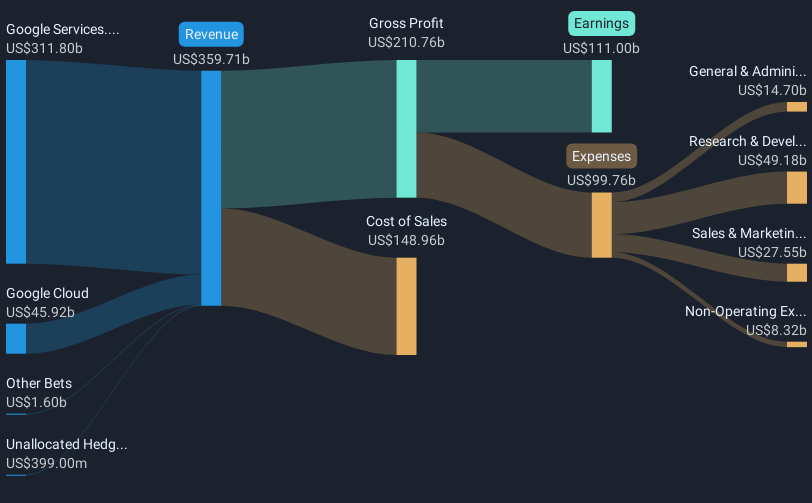

The recent changes in Alphabet’s dividend and share buyback plans, coupled with robust earnings results and the advantageous U.S.-U.K. trade deal, reinforce the company's drive towards scalable growth. Over the past five years, Alphabet’s total return, including share price appreciation and dividends, reached 125.62%. This long-term gain significantly outpaces its recent 3% share price rise, indicating consistent value creation over a prolonged period. However, over the past year, Alphabet's performance did not keep pace with the US Interactive Media and Services industry return of 1%.

The company's strategic emphasis on AI, highlighted by the release of the Gemini 2.5 model and AI infrastructure improvements, suggests potential revenue boosts, particularly from Google Cloud and innovative advertising solutions. Analysts estimate a 10.4% annual revenue growth over the next three years. As Alphabet continues to develop its AI capabilities, such initiatives are expected to bolster its market positioning, potentially lifting earnings forecasts like the projected rise to US$140.1 billion by April 2028.

In light of these developments, Alphabet's current share price of US$160.16 shows a substantial discount to the consensus analyst price target of US$202.12. This represents a 20.8% potential upside, reflecting positive sentiment based on future earnings growth, despite varying analyst opinions. Investors should weigh these aspects in context of their investment strategies and risk tolerance.

Our expertly prepared valuation report Alphabet implies its share price may be lower than expected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Alphabet, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives