- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:GIFT

Discovering Giftify And 2 Other US Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As U.S. markets show resilience with rising stocks and dipping yields, investors are increasingly exploring diverse opportunities to capitalize on potential growth. Penny stocks, a term that might seem outdated, continue to offer intriguing possibilities for those willing to look beyond the big names. These often smaller or newer companies can present a compelling mix of affordability and growth potential when backed by strong financials, making them an attractive option for discerning investors.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.88875 | $6.46M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $125.23M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.94 | $89.18M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.71 | $43.29M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $46.86M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.69 | $46.67M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.41 | $25.01M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8834 | $79.45M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.60 | $384.4M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Giftify (NasdaqCM:GIFT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Giftify, Inc. owns and operates a restaurant deal space in the United States with a market cap of $29.57 million.

Operations: The company generates revenue of $86.44 million from its direct marketing segment.

Market Cap: $29.57M

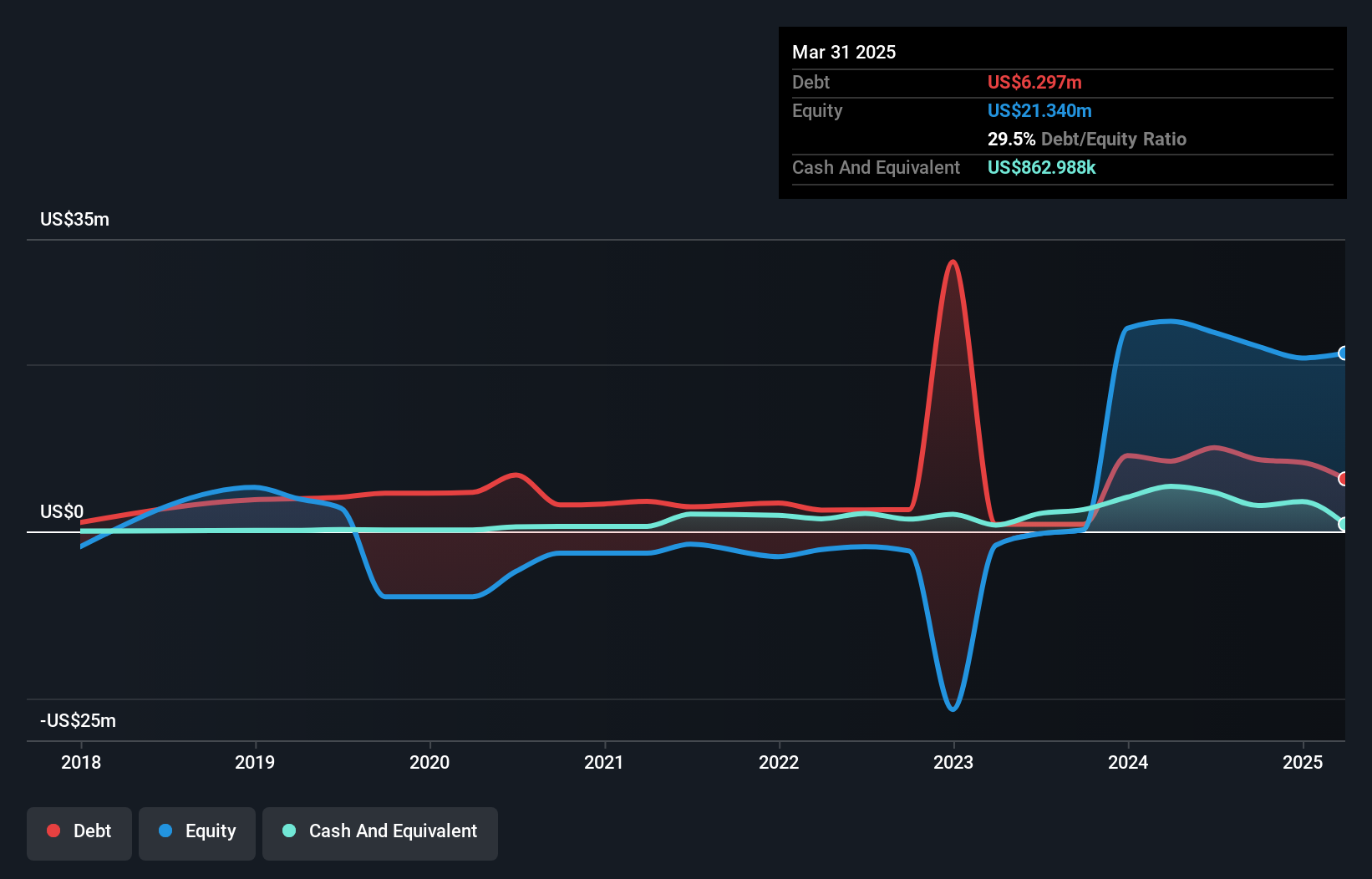

Giftify, Inc., with a market cap of US$29.57 million, operates in the restaurant deal space and is currently unprofitable. Despite generating US$86.44 million in revenue from its direct marketing segment, losses have increased over the past five years by 27.1% annually. The company's short-term assets do not cover its liabilities, but long-term liabilities are adequately managed with short-term assets exceeding them by US$4.4 million. Recent financial activities include a private placement raising US$2 million and a follow-on equity offering of US$0.6 million to bolster cash reserves amidst volatile share prices and ongoing strategic acquisition pursuits following its Nasdaq uplisting.

- Dive into the specifics of Giftify here with our thorough balance sheet health report.

- Examine Giftify's earnings growth report to understand how analysts expect it to perform.

CureVac (NasdaqGM:CVAC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CureVac N.V. is a biopharmaceutical company that develops transformative medicines using messenger ribonucleic acid (mRNA) technology, with a market cap of $803.04 million.

Operations: CureVac generates its revenue primarily from the discovery and development of biotechnological applications, amounting to €65.86 million.

Market Cap: $803.04M

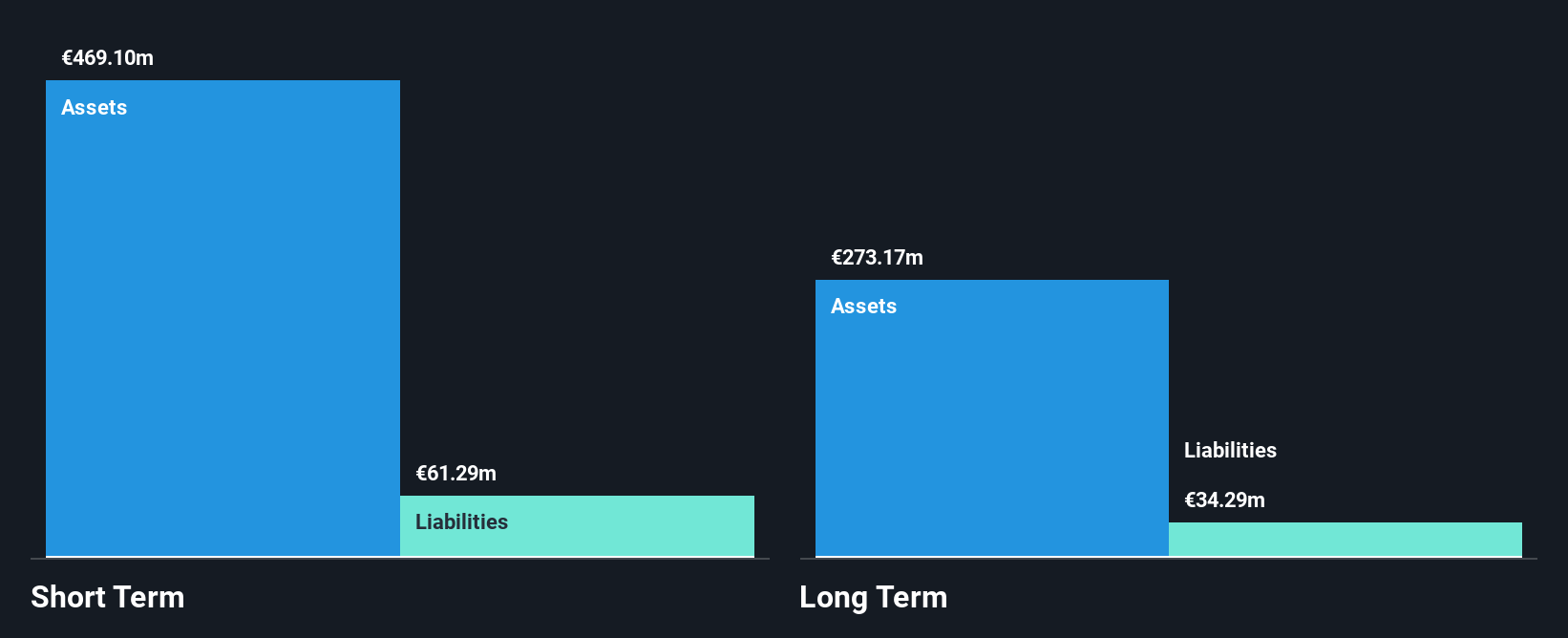

CureVac N.V., with a market cap of $803.04 million, is currently unprofitable and operates in the biopharmaceutical sector using mRNA technology. The company has a limited cash runway of less than one year, though it remains debt-free and has sufficient short-term assets (€251.6M) to cover both its short-term (€110M) and long-term liabilities (€70.3M). Despite trading significantly below its estimated fair value, CureVac's management team is relatively inexperienced with an average tenure of two years. Recent presentations at major healthcare conferences indicate ongoing efforts to engage with industry stakeholders amidst high share price volatility.

- Click here to discover the nuances of CureVac with our detailed analytical financial health report.

- Review our growth performance report to gain insights into CureVac's future.

BioLargo (OTCPK:BLGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BioLargo, Inc. invents, develops, and commercializes various platform technologies with a market cap of $81.29 million.

Operations: The company's revenue is derived from BLEST, contributing $3.09 million, and ONM Environmental, which accounts for $16.50 million.

Market Cap: $81.29M

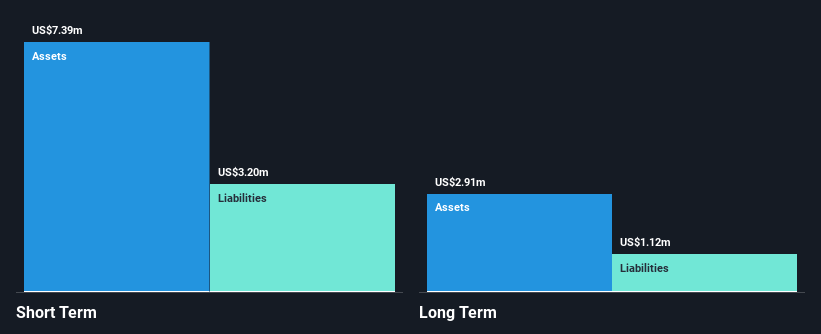

BioLargo, Inc., with a market cap of US$81.29 million, is unprofitable but has shown improvement by reducing losses over the past five years. The company reported third-quarter 2024 revenue of US$4.35 million, up from US$2.67 million a year ago, and reduced its net loss to US$0.537 million from US$1.2 million in the previous year. Its cash position exceeds total debt, providing financial stability despite high share price volatility over recent months. The seasoned management team and board bring extensive experience to the company as it continues to focus on growth within its platform technologies sector.

- Unlock comprehensive insights into our analysis of BioLargo stock in this financial health report.

- Explore BioLargo's analyst forecasts in our growth report.

Seize The Opportunity

- Access the full spectrum of 709 US Penny Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GIFT

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives