- United States

- /

- Entertainment

- /

- NasdaqGM:GAIA

Further Upside For Gaia, Inc. (NASDAQ:GAIA) Shares Could Introduce Price Risks After 30% Bounce

Gaia, Inc. (NASDAQ:GAIA) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 79%.

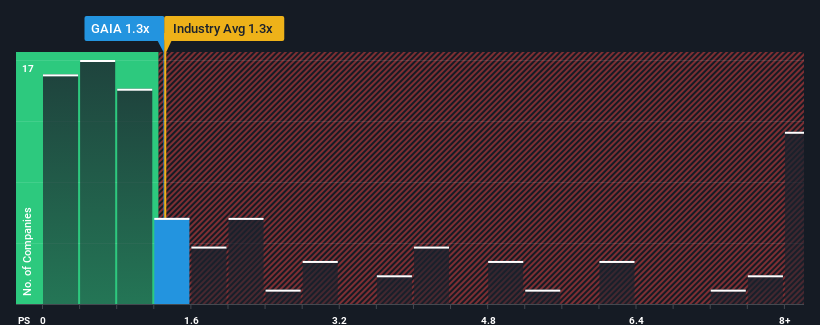

Although its price has surged higher, you could still be forgiven for feeling indifferent about Gaia's P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in the United States is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Gaia

What Does Gaia's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Gaia has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Gaia.Is There Some Revenue Growth Forecasted For Gaia?

In order to justify its P/S ratio, Gaia would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.3%. The solid recent performance means it was also able to grow revenue by 16% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 19% over the next year. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Gaia's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Gaia's P/S?

Its shares have lifted substantially and now Gaia's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Gaia's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Gaia, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Gaia, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:GAIA

Gaia

Operates a digital video subscription service and online community for underserved member base in the United States, Canada, Australia, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives