- United States

- /

- Media

- /

- NasdaqGS:FOXA

What Fox (FOXA)’s Exclusive Podcast Partnership Means for Its Digital Streaming Ambitions

Reviewed by Sasha Jovanovic

- In October 2025, Tubi Media Group announced a multi-year deal with Audiochuck for exclusive distribution and advertising rights to top podcasts, including a dedicated Crime Junkie FAST Channel for FOX platforms and expanded video podcast offerings.

- This partnership leverages the popularity of true crime audio content to help strengthen Fox’s streaming presence while highlighting continued investment in digital formats.

- We'll explore how expanding Tubi's exclusive podcast content could influence Fox's long-term growth prospects in digital media and streaming.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fox Investment Narrative Recap

Being a Fox shareholder means believing in the company's ability to adapt as audiences shift from traditional TV to digital platforms, particularly through initiatives like Tubi and FOX One. The recent Tubi–Audiochuck partnership adds attractive content for streaming, but its effect on Fox’s largest near-term catalyst, digital revenue growth, is likely incremental rather than transformative, while the primary risk remains a continued decline in linear TV advertising revenues.

Among Fox’s latest developments, the August 2025 launch of FOX One, an all-in-one streaming service, is most relevant as it directly addresses the trend toward cord-cutting and creates an ecosystem for new exclusive offerings like the Audiochuck podcasts. These moves align with the company's objective to scale its digital business alongside broadcast operations, aiming to strengthen long-term audience and advertiser appeal.

But despite efforts to grow its streaming footprint, investors need to be aware that linear TV ad revenue pressure could...

Read the full narrative on Fox (it's free!)

Fox's outlook anticipates $16.4 billion in revenue and $1.9 billion in earnings by 2028. This is based on a -0.3% annual revenue decline and a $0.4 billion decrease in earnings from today's $2.3 billion.

Uncover how Fox's forecasts yield a $70.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

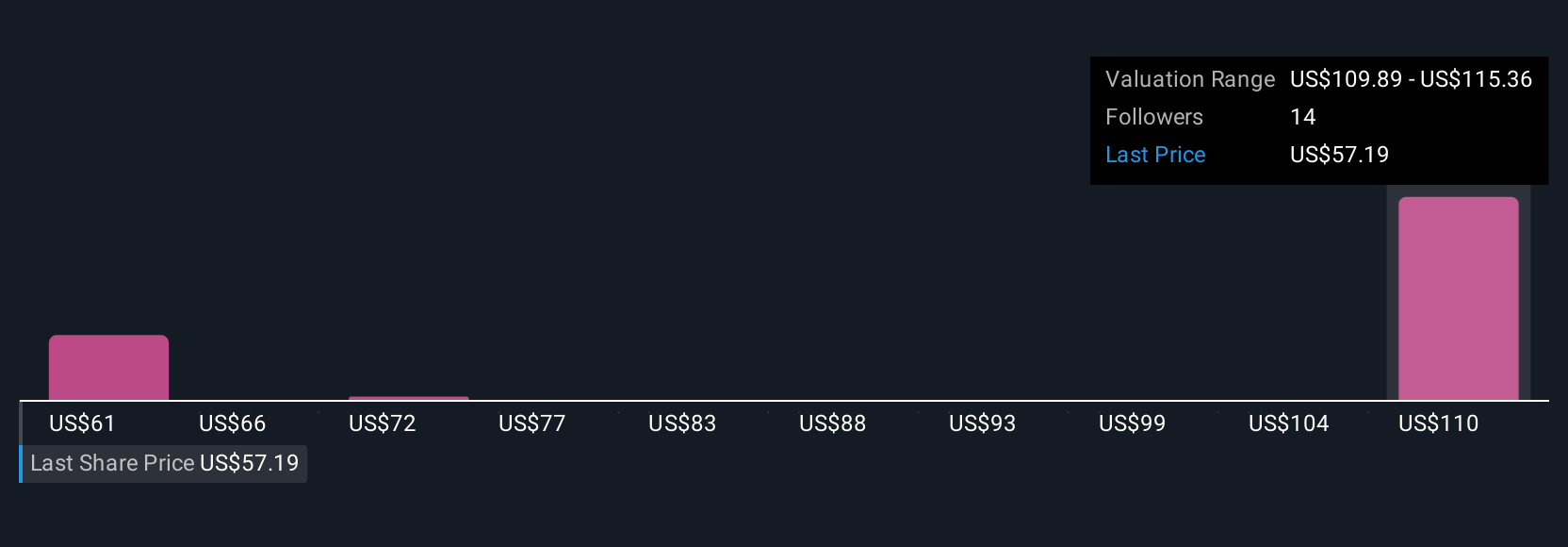

Three individual fair value estimates from the Simply Wall St Community for Fox range from US$70.50 to US$73.17. While opinions within the community differ, many recognize that slower digital scaling could weigh on future earnings, prompting a closer look at alternative views on Fox’s prospects.

Explore 3 other fair value estimates on Fox - why the stock might be worth as much as 10% more than the current price!

Build Your Own Fox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fox's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives