- United States

- /

- Entertainment

- /

- NasdaqGS:EA

Is There an Opportunity in EA Stock After Its 15% Rally in 2025?

Reviewed by Bailey Pemberton

If you’re trying to figure out whether to buy, hold, or sell Electronic Arts right now, you’re not alone. The stock has been drawing attention lately, not just from gamers and industry insiders, but from investors eyeing its performance on Wall Street. Over the past month, EA’s stock price soared by 15.4%, and it now sits just over $200 per share. That’s not a fluke. In fact, EA has delivered gains of 37.3% so far this year and a striking 63.0% return over the past three years.

Part of the recent momentum can be traced to shifting market sentiment around major entertainment and technology firms. As the gaming landscape rapidly evolves with new content and platforms, investors are re-evaluating the risk and growth prospects of top publishers. EA sits at a crossroads, poised to benefit from both emerging trends and the company’s established franchises.

But before you make your next move, it’s crucial to consider valuation. Is EA’s price justified by fundamentals, or are we looking at a case of hype outpacing value? Based on six classic valuation checks, EA currently scores a 0, meaning, by those measures, it isn’t undervalued on any front. Of course, that’s only part of the story. In this article, I’ll dig into what those metrics reveal, and even better, I’ll share a more insightful approach to understanding EA’s true worth before you make any decisions.

Electronic Arts scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Electronic Arts Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Electronic Arts, the model uses a 2 Stage Free Cash Flow to Equity approach, forecasting both near-term analyst estimates and longer-term extrapolations.

Currently, EA generates free cash flow of $1.76 billion. Analyst forecasts expect this to grow, with projections reaching $2.61 billion by the fiscal year ending March 2030. While the first five years are grounded in analyst research, further cash flow growth is extrapolated by Simply Wall St to stretch out the company’s likely long-term performance.

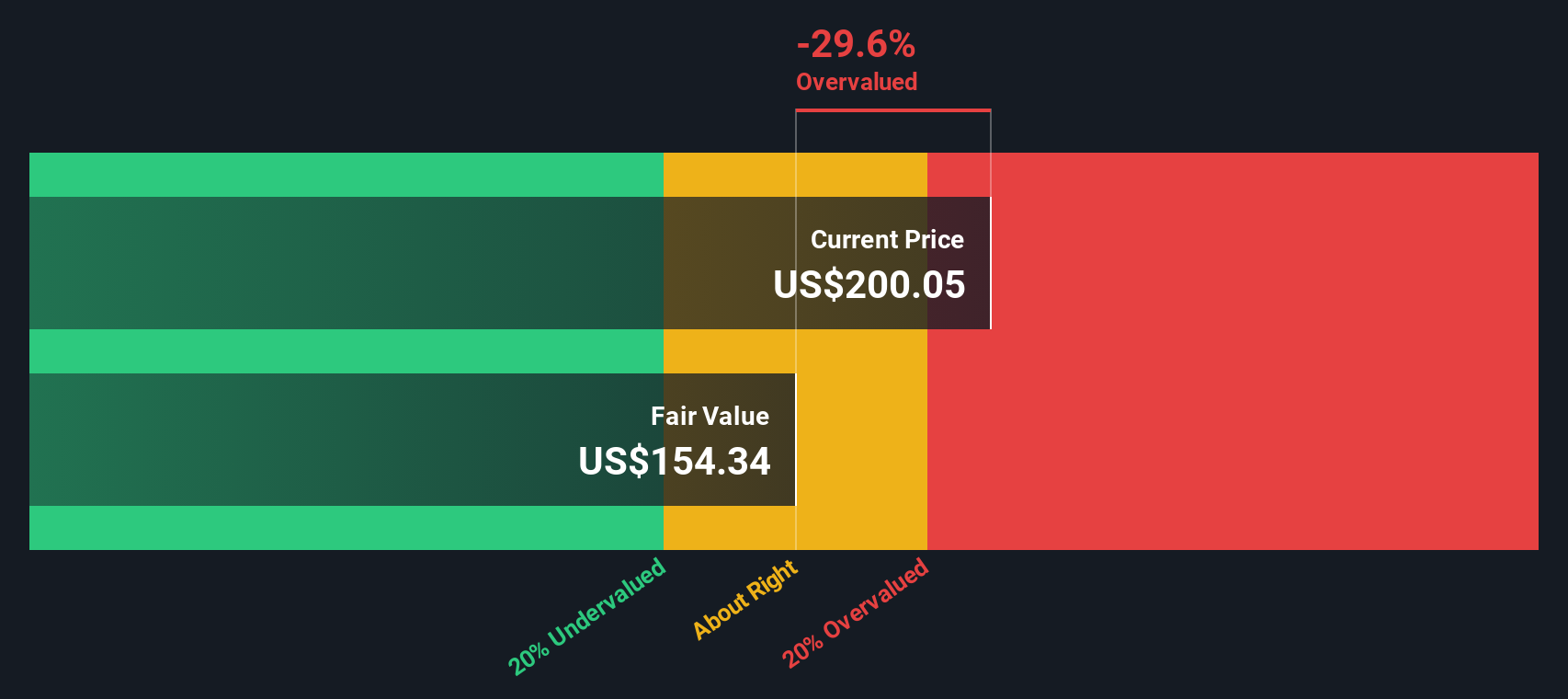

The resulting intrinsic value calculated by the DCF model is $154.40 per share. With the current share price trading just above $200, this implies the stock is trading at a 29.7% premium to its projected fair value. In other words, on a cash flow basis alone, EA appears overvalued relative to its underlying fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Electronic Arts may be overvalued by 29.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Electronic Arts Price vs Earnings (PE)

When analyzing profitable companies like Electronic Arts, the price-to-earnings (PE) ratio is often the go-to valuation metric. This is because it directly compares a company's share price to its earnings, offering a snapshot of how the market values those profits. However, the "right" PE ratio is not the same for every company. Expectations of higher earnings growth, better margins, or greater stability can all justify a higher multiple, while risks or slower growth tend to depress it.

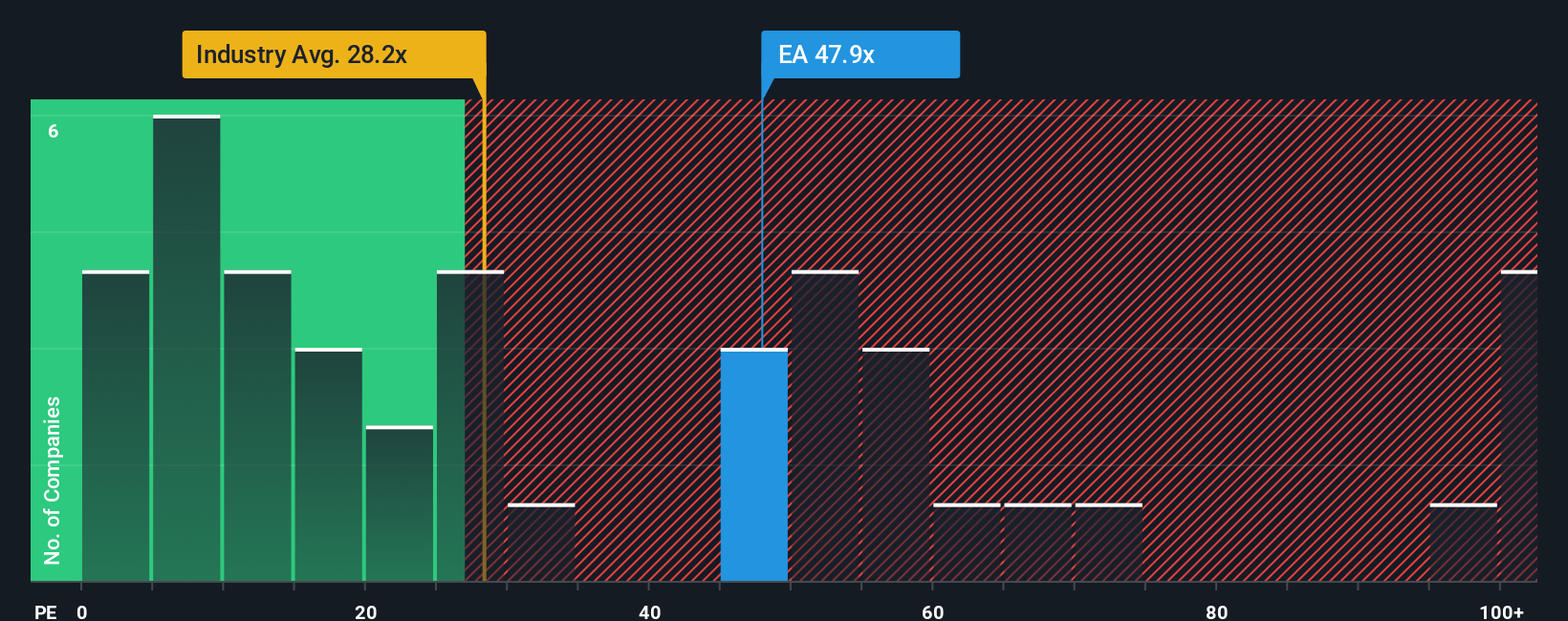

Electronic Arts currently trades at a PE ratio of 47.9x. This is well above the Entertainment industry average of 24.7x and its peers, which average 43.0x. At first glance, this might make EA appear overvalued compared to its sector. But raw comparisons do not tell the whole story.

That is where the Simply Wall St Fair Ratio comes in. This proprietary benchmark considers not just industry and peer averages, but also EA's own growth potential, profit margins, scale, and risk profile. For EA, the Fair Ratio stands at 26.4x, representing what would be an appropriate multiple if all these factors are considered. Because this model goes deeper than surface-level comparisons, it provides investors with a more balanced view of whether the current price is justified.

Comparing the Fair Ratio of 26.4x to EA’s actual PE of 47.9x, the stock looks significantly overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Electronic Arts Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about Electronic Arts, describing how you see its future, the assumptions you make about its revenue, earnings, and margins, and what you think a fair value is. Narratives connect the company’s big picture to a detailed financial forecast and then link that to what you believe the shares are really worth.

On Simply Wall St’s Community page, millions of investors use Narratives to express their views, test ideas, and make decisions with confidence. Narratives take the guesswork out of investing by letting you see, in real time, whether your fair value estimate suggests EA is a buy, sell, or hold compared to the current price. They also update automatically when the latest news or results come in.

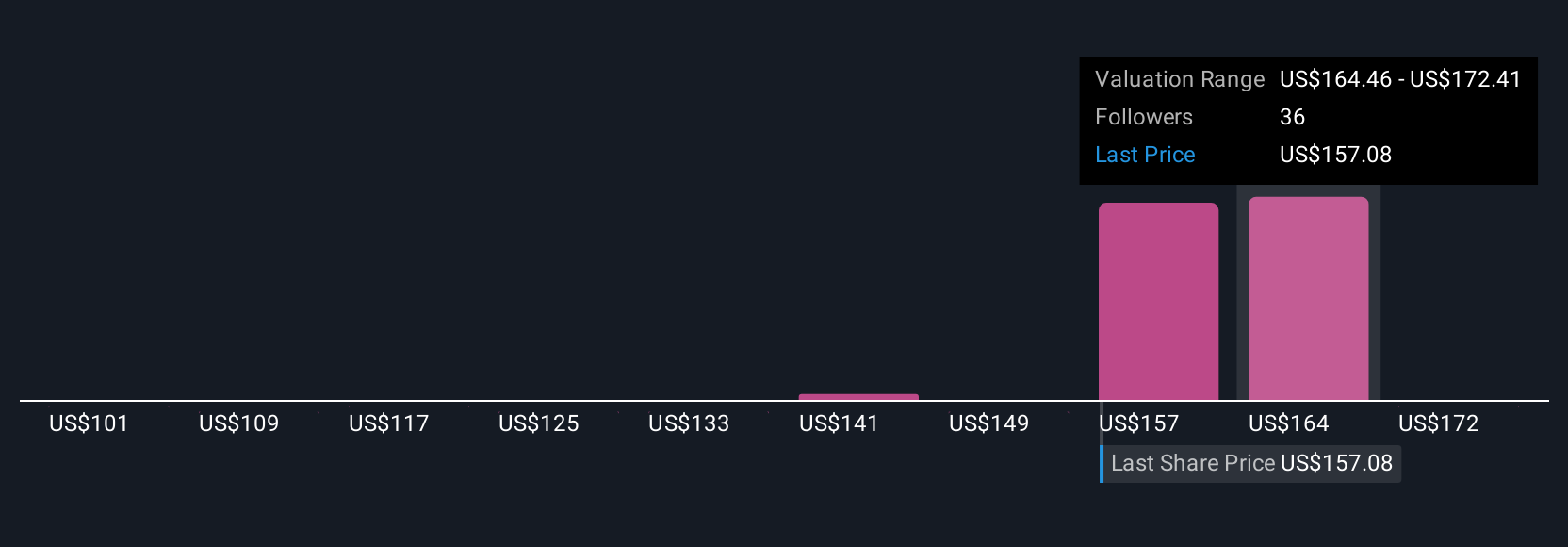

For example, some investors have set their EA Narrative fair value as high as $210, believing in unstoppable live services growth and blockbuster new releases. Others are more cautious, valuing EA as low as $148 due to risks from underperforming franchises and industry headwinds. With Narratives, you can see both perspectives and quickly sense-check which matches your own view.

Do you think there's more to the story for Electronic Arts? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electronic Arts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EA

Electronic Arts

Develops, markets, publishes, and delivers games, content, and services for game consoles, PCs, and mobile phones worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026