- United States

- /

- Entertainment

- /

- NasdaqGS:EA

Is It Too Late To Consider EA After A 39.8% Year To Date Rally?

Reviewed by Bailey Pemberton

- Wondering if Electronic Arts at around $203 a share is still a good buy or if you have already missed the move? Let us break down whether the current price makes sense for long term investors.

- The stock has quietly climbed 0.9% over the last week, 1.6% over the past month, and is now up 39.8% year to date, adding to a 22.7% gain over the last year and 66.2% over three years.

- Behind these returns is a steady stream of big franchise updates, new content drops for live service titles, and continued momentum in major sports and core gaming IP that keep engagement high and recurring revenue flowing. Investors have been digesting this pipeline alongside broader optimism around the gaming sector. Together these factors help explain why sentiment on EA has stayed relatively constructive.

- Despite that, EA only scores a 1/6 valuation check score, suggesting it screens as undervalued on just one of our standard metrics. We will therefore dig into what different valuation methods say about the stock today and then finish by exploring a more nuanced way to judge whether EA is genuinely good value.

Electronic Arts scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Electronic Arts Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those back into current dollars using a required rate of return.

For Electronic Arts, the model starts from last twelve month free cash flow of roughly $1.67 billion and uses analyst forecasts for the next few years, with Simply Wall St extrapolating beyond that. By 2030, free cash flow is projected to reach about $2.54 billion, with further gradual increases over the following years as growth slows to more mature rates.

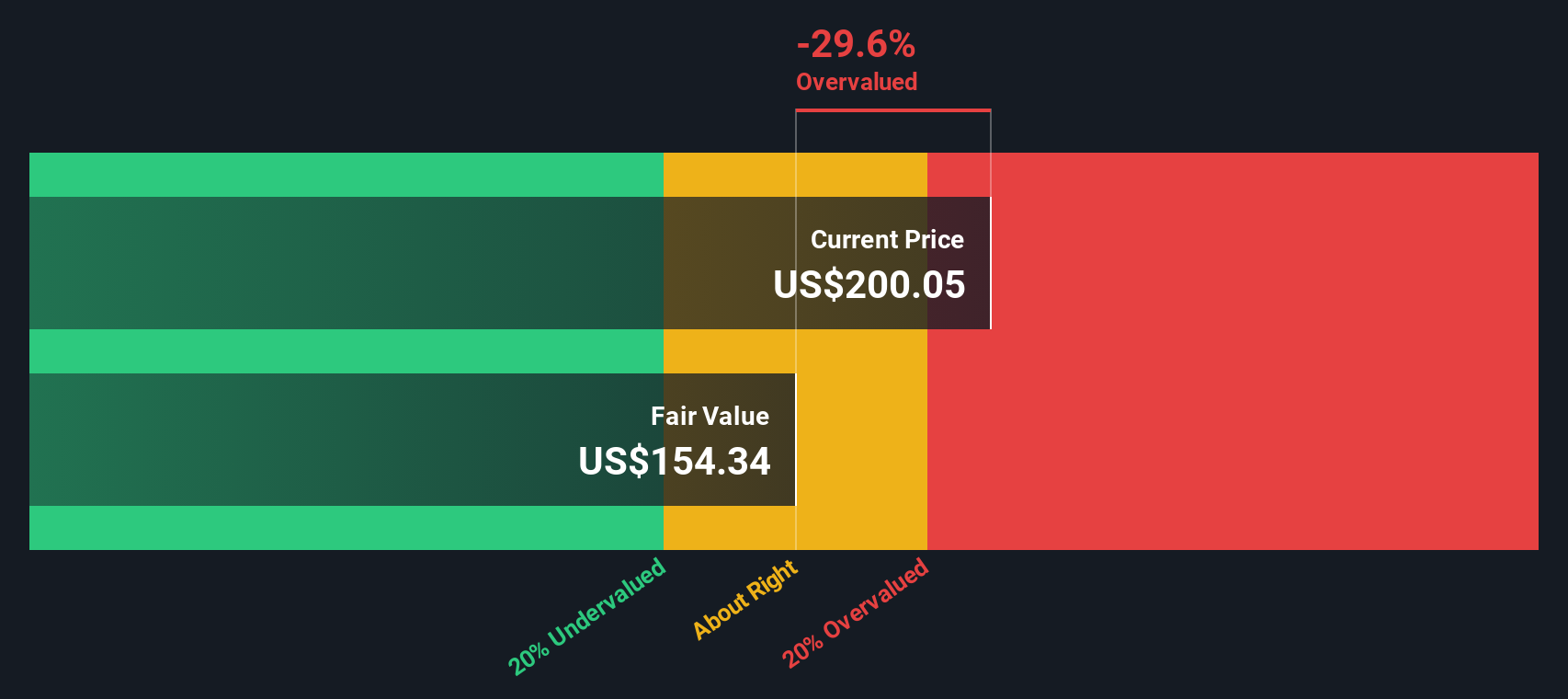

Adding up these discounted cash flows under a 2 Stage Free Cash Flow to Equity framework gives an estimated intrinsic value of about $150.66 per share. With the stock currently trading around $203, the DCF implies EA is roughly 35.4% overvalued on this cash flow based view.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Electronic Arts may be overvalued by 35.4%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Electronic Arts Price vs Earnings

For consistently profitable companies like Electronic Arts, the price to earnings, or PE, ratio is a useful yardstick because it directly links what investors are paying to the profits the business is generating today. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or more uncertainty usually call for a lower, more conservative multiple.

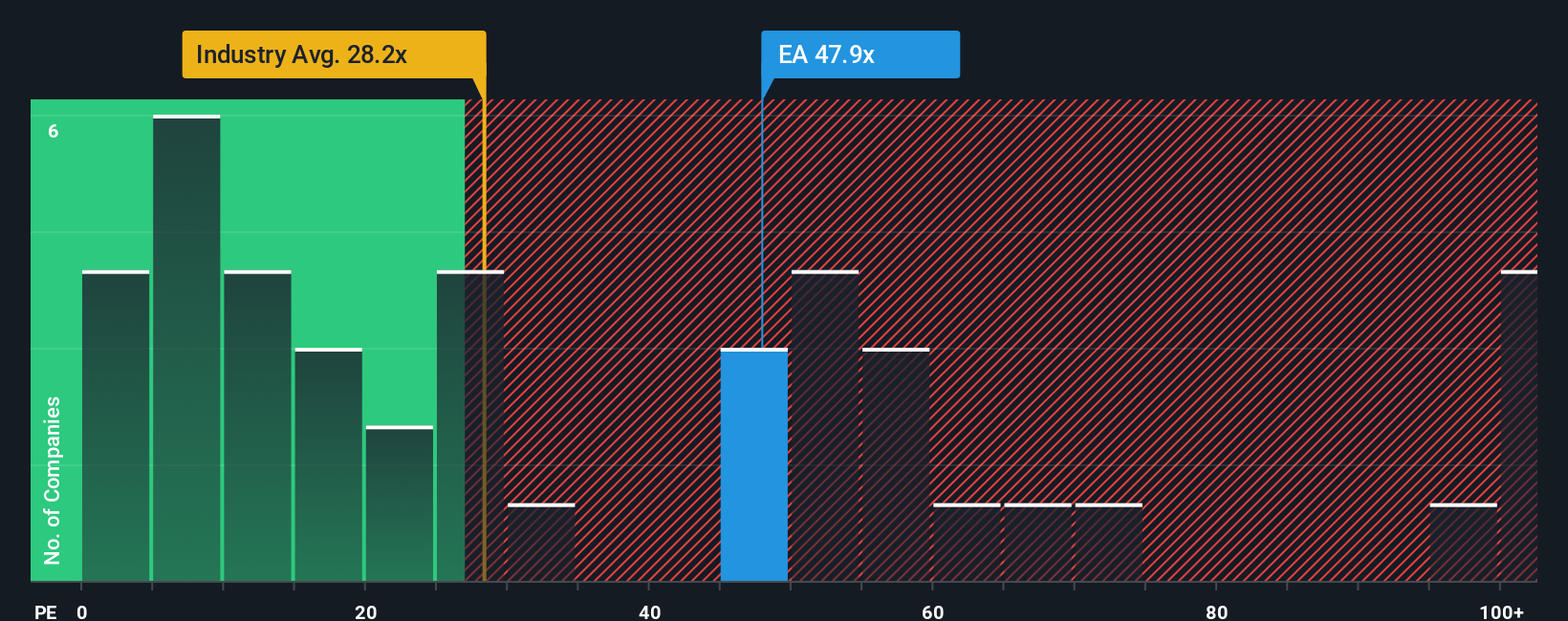

EA currently trades on a PE of about 57.5x, comfortably above both the broader Entertainment industry average of roughly 23.2x and the peer group average of around 67.6x. To go a step further than these blunt comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates the PE a company should trade on given its earnings growth outlook, profitability, industry, market cap and risk profile. For EA, that Fair Ratio is around 25.8x.

Because the Fair Ratio is tailored to EA’s fundamentals, it offers a more nuanced anchor than simply lining the stock up against peers that may have very different growth runways or risk levels. With the current 57.5x PE sitting well above the 25.8x Fair Ratio, this approach also suggests EA shares are pricing in quite optimistic expectations.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

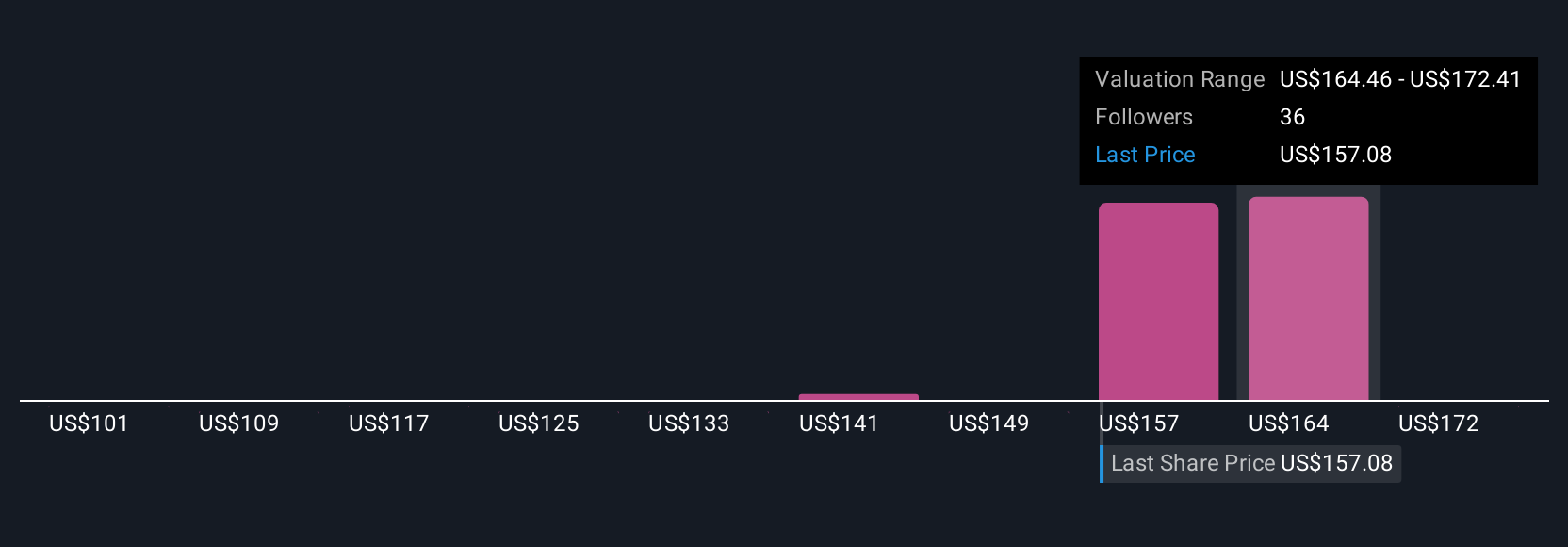

Upgrade Your Decision Making: Choose your Electronic Arts Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you write the story behind your numbers by linking your view of a company’s future revenue, earnings, and margins to a financial forecast and a fair value you can compare with today’s share price to decide whether to buy, hold, or sell. Each Narrative updates dynamically as new news, earnings or guidance emerge. For example, one EA investor might build a bullish Narrative that leans into growing live services, AI enabled efficiencies, stable margins near 19 percent and a fair value closer to the recent 210 dollar deal price. A more cautious investor could instead create a conservative Narrative that stresses risks from underperforming IPs, softer bookings, and macro headwinds, leading to slower growth assumptions, a lower future PE multiple and a fair value nearer 148 dollars. Both investors are using the same tool to turn their story into a clear, numbers backed valuation.

Do you think there's more to the story for Electronic Arts? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electronic Arts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EA

Electronic Arts

Develops, markets, publishes, and delivers games, content, and services for game consoles, PCs, and mobile phones worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026