- United States

- /

- Entertainment

- /

- NasdaqGS:EA

Is EA's (EA) Franchise Release Strategy Reinventing Player Engagement and Long-Term Live Services Growth?

Reviewed by Simply Wall St

- Electronic Arts recently rolled out a wave of significant product updates, launching the early access version of its free-to-play, cross-platform title skate., debuting the anticipated soundtrack and preorders for EA SPORTS FC 26, and releasing EA SPORTS NHL 26 for next-generation consoles.

- This rapid succession of major franchise releases and innovative features showcases EA's approach to broadening its audience engagement and reinforcing its presence across multiple gaming communities simultaneously.

- We'll explore how the simultaneous launch of multiple flagship titles could influence EA's longer-term focus on player engagement and live services growth.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

Electronic Arts Investment Narrative Recap

To be a shareholder in Electronic Arts, you need to believe in the company's ability to consistently drive player engagement and revenue through a broad slate of high-profile gaming franchises and live service models. While the recent rapid release of new titles like skate., EA SPORTS NHL 26, and EA SPORTS FC 26 underlines this approach, there is no immediate evidence that these launches materially change the biggest catalysts or short-term risks, namely, ongoing declines in net bookings and challenges within live services.

The early access launch of skate., a free-to-play and fully cross-platform title, is particularly interesting given its alignment with EA's push to expand its live services. It showcases the company's method of fostering continuous player interaction and ongoing content updates, both of which support the critical catalyst of growing user engagement and potential live services revenue.

However, it’s important for investors to keep in mind that, despite EA’s release momentum, the potential impact from underperformance of key franchises in live services could mean ...

Read the full narrative on Electronic Arts (it's free!)

Electronic Arts' narrative projects $8.7 billion revenue and $1.6 billion earnings by 2028. This requires 5.1% yearly revenue growth and a $0.6 billion earnings increase from $1.0 billion currently.

Uncover how Electronic Arts' forecasts yield a $175.53 fair value, in line with its current price.

Exploring Other Perspectives

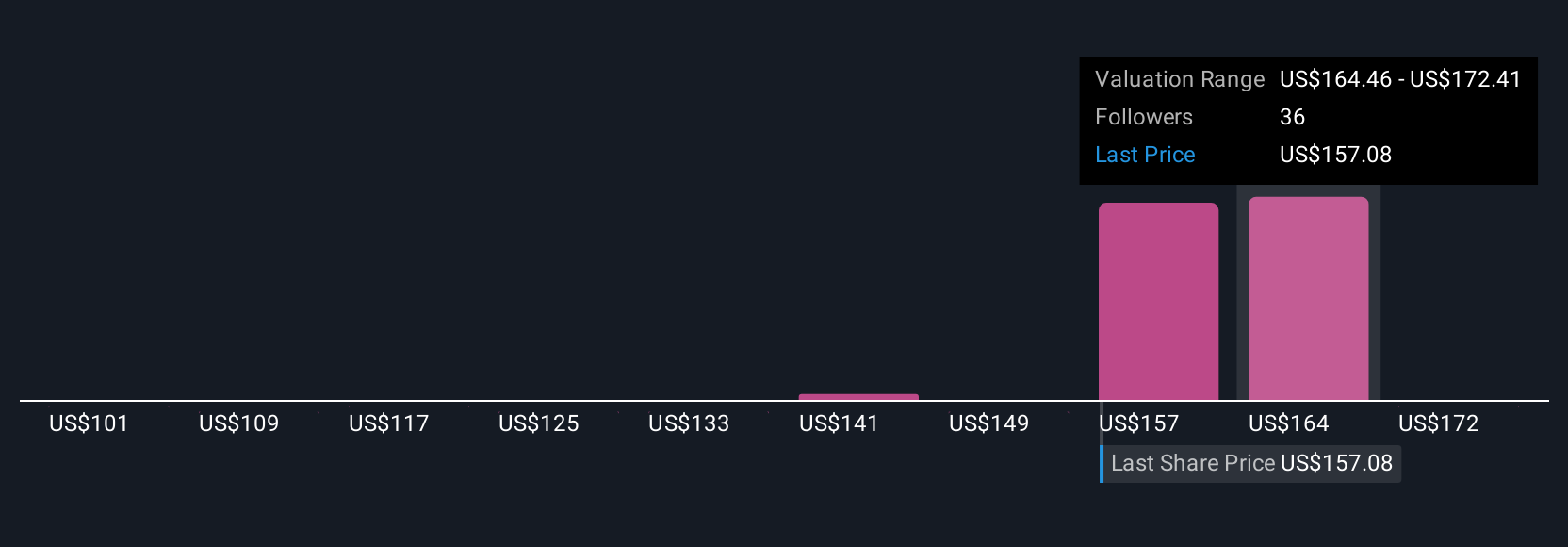

Seven fair value estimates from the Simply Wall St Community for EA stock range from US$120.39 to US$180.36. With live services revenue forming a substantial part of earnings, these opinions reflect how widely expectations differ on EA’s ability to maintain engagement and growth.

Explore 7 other fair value estimates on Electronic Arts - why the stock might be worth as much as $180.36!

Build Your Own Electronic Arts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Electronic Arts research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Electronic Arts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Electronic Arts' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electronic Arts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EA

Electronic Arts

Develops, markets, publishes, and delivers games, content, and services for game consoles, PCs, and mobile phones worldwide.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives