- United States

- /

- Entertainment

- /

- NasdaqCM:DLPN

Bullish: Analysts Just Made An Incredible Upgrade To Their Dolphin Entertainment, Inc. (NASDAQ:DLPN) Forecasts

Celebrations may be in order for Dolphin Entertainment, Inc. (NASDAQ:DLPN) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects.

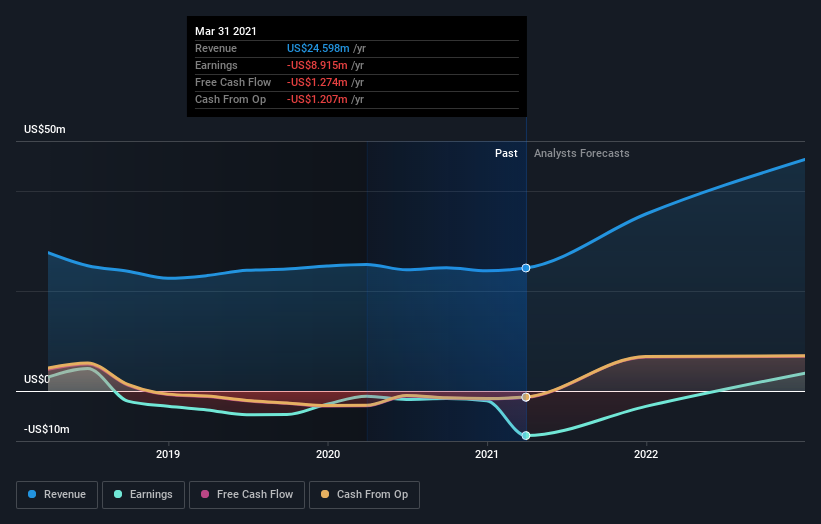

After this upgrade, Dolphin Entertainment's two analysts are now forecasting revenues of US$35m in 2021. This would be a major 44% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 72% to US$0.40. However, before this estimates update, the consensus had been expecting revenues of US$32m and US$0.85 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

See our latest analysis for Dolphin Entertainment

The consensus price target rose 7.1% to US$30.00, with the analysts encouraged by the higher revenue and lower forecast losses for this year.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting Dolphin Entertainment's growth to accelerate, with the forecast 107% annualised growth to the end of 2021 ranking favourably alongside historical growth of 22% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 17% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Dolphin Entertainment to grow faster than the wider industry.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for this year, reflecting increased optimism around Dolphin Entertainment's prospects. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Dolphin Entertainment could be worth investigating further.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have analyst estimates for Dolphin Entertainment going out as far as 2022, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Dolphin Entertainment or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:DLPN

Dolphin Entertainment

Operates as an entertainment marketing and production company in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives