- United States

- /

- Entertainment

- /

- NasdaqCM:CURI

CuriosityStream Inc. (NASDAQ:CURI) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

Despite an already strong run, CuriosityStream Inc. (NASDAQ:CURI) shares have been powering on, with a gain of 28% in the last thirty days. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

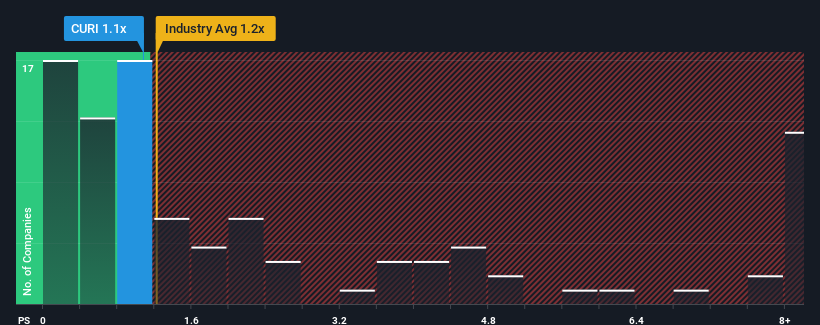

Although its price has surged higher, there still wouldn't be many who think CuriosityStream's price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S in the United States' Entertainment industry is similar at about 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for CuriosityStream

How CuriosityStream Has Been Performing

While the industry has experienced revenue growth lately, CuriosityStream's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on CuriosityStream will help you uncover what's on the horizon.How Is CuriosityStream's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like CuriosityStream's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 44% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% each year during the coming three years according to the two analysts following the company. That's shaping up to be similar to the 9.7% each year growth forecast for the broader industry.

With this information, we can see why CuriosityStream is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From CuriosityStream's P/S?

CuriosityStream's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at CuriosityStream's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

You should always think about risks. Case in point, we've spotted 3 warning signs for CuriosityStream you should be aware of, and 1 of them is concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CURI

CuriosityStream

A media and entertainment company, provides factual content through multiple channels.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives