- United States

- /

- Media

- /

- NasdaqGS:CRTO

Why Criteo (CRTO) Is Up 11.4% After Announcing Redomiciliation and Direct Nasdaq Listing Plans

Reviewed by Sasha Jovanovic

- Criteo recently reported strong third quarter 2025 results, with increased revenue and net income, and announced plans to shift its legal domicile from France to Luxembourg while moving to a direct Nasdaq listing.

- This major restructuring aims to streamline Criteo's corporate structure, potentially improve liquidity, and broaden its shareholder base through index eligibility and fee elimination.

- We'll explore how Criteo's planned redomiciliation and direct listing could impact its investment narrative and future growth outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Criteo Investment Narrative Recap

The core investment case for Criteo centers on the company's ability to execute in AI-driven advertising and retail media, delivering growth through innovation while withstanding heavy competition from larger tech players. The recent legal restructuring announcement, moving domicile to Luxembourg and transitioning to a direct Nasdaq listing, is unlikely to materially affect the key catalyst: strengthening Criteo’s platform reach and product scale, though it could streamline operations and broaden the investor base near-term. The biggest ongoing risk remains Criteo’s need to sustain top-line growth and margin expansion as industry pressures persist.

Among the latest developments, the appointment of Edouard Dinichert as Chief Customer Officer stands out. His experience in leading revenue organizations at Amazon and TripleLift could provide valuable momentum for Criteo’s growth agenda, especially as the company prioritizes partnerships and scaling its Performance Media offerings, an area closely tied to the most important short-term catalysts for the business.

However, investors should also be aware that alongside legal and structural changes, ongoing uncertainties around commercializing AI...

Read the full narrative on Criteo (it's free!)

Criteo's outlook anticipates $1.0 billion in revenue and $147.8 million in earnings by 2028. This is based on a projected 19.2% annual revenue decline, and an $11.3 million increase in earnings from the current $136.5 million.

Uncover how Criteo's forecasts yield a $35.92 fair value, a 57% upside to its current price.

Exploring Other Perspectives

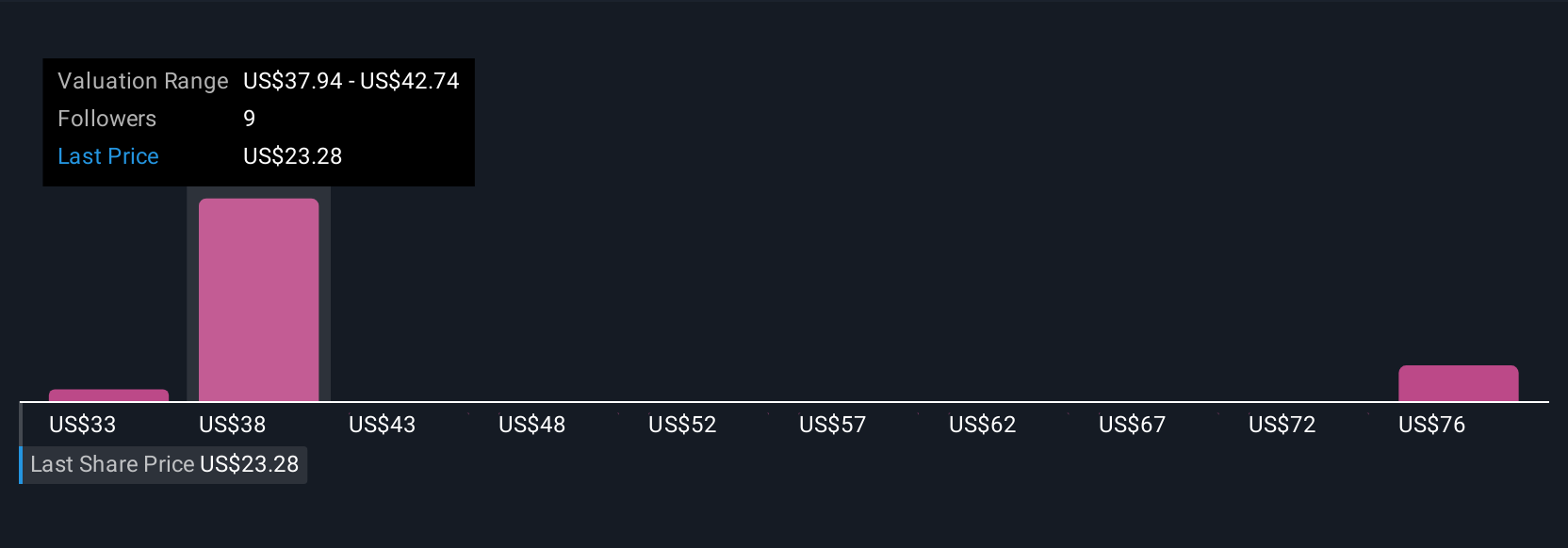

Simply Wall St Community members submitted four fair value estimates for Criteo, ranging from US$33.14 to US$125.78 per share. While consensus expects growth from AI-powered ad targeting to drive opportunity, opinions differ widely on future performance and potential risks.

Explore 4 other fair value estimates on Criteo - why the stock might be worth just $33.14!

Build Your Own Criteo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Criteo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Criteo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Criteo's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRTO

Criteo

A technology company, provides marketing and monetization services and infrastructure on the open internet in North and South America, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives