- United States

- /

- Media

- /

- NasdaqGS:CRTO

Criteo (CRTO) Margin Surge Reinforces Bullish Value Narrative Despite Forecast Earnings Decline

Reviewed by Simply Wall St

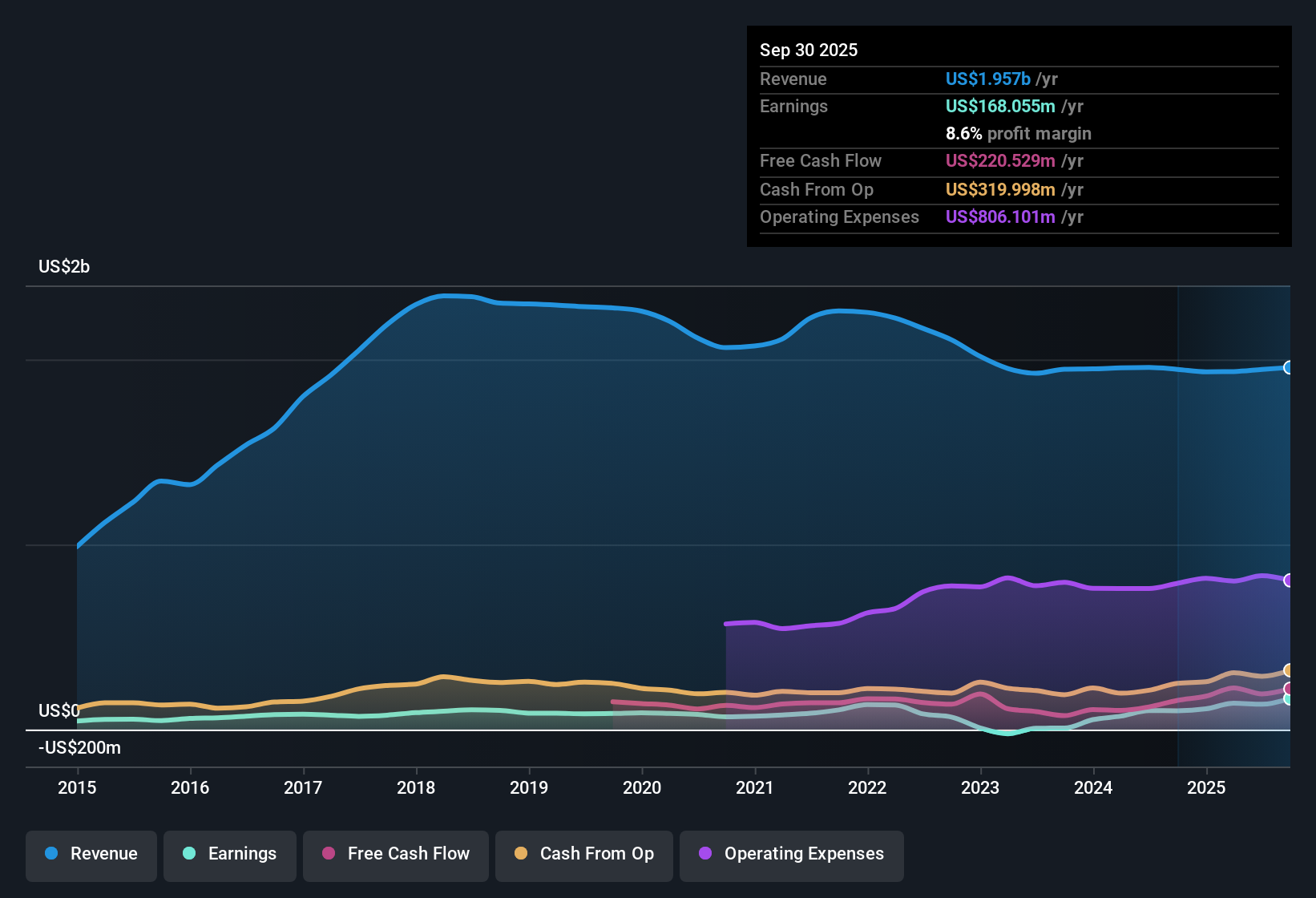

Criteo (CRTO) delivered improved profitability this quarter, with net profit margins climbing to 8.6% from 5.2% a year earlier. The company's EPS surged 65.6% year-over-year, far outpacing its five-year average annual earnings growth rate of 10%. Despite this strong historic growth, forecasts call for earnings to decline by 3.3% per year and revenue to drop by 16.1% per year over the next three years. This suggests investors face both an attractive valuation and real operational challenges ahead.

See our full analysis for Criteo.The real test is how these numbers stack up against the widely followed market narratives. Some views will get reinforced, while others may be challenged.

See what the community is saying about Criteo

Profit Margins Projected to Climb

- Analysts forecast profit margins rising from 7.0% today to 14.4% in three years, more than doubling efficiency even as overall revenue is expected to decline.

- According to the analysts' consensus view, Criteo’s push deeper into AI-driven ad targeting and Retail Media segments is seen as a way to offset shrinking revenues,

- Disciplined capital allocation and a strong, privacy-compliant data set are expected to enable margin expansion, strengthening shareholder returns despite top-line pressure.

- Market-wide demand for cross-channel, first-party data-driven advertising supports this path, provided product rollouts continue at scale and client budgets move to higher-margin segments.

- Consensus narrative cheered the margin forecast, but the durability of these improvements will depend on successfully scaling new product lines and partnerships, as heavy competition and operational costs could still weigh on future results.

- Don’t miss how analysts weigh these risks and opportunities in the deep dive. See how their forecast stacks up and where expectations might shift. 📊 Read the full Criteo Consensus Narrative.

Share Count Expected to Shrink

- Analysts expect Criteo’s number of shares outstanding to drop by 5.17% each year over the next three years, driven by ongoing buybacks and strong cash generation.

- Analysts' consensus view points out that this buyback program could give EPS a lift even if total earnings stagnate,

- Accelerating buybacks and a debt-free balance sheet provide room for shareholder returns that soften the sting of stagnant or falling revenues.

- Yet, this leverage rests on continued strong cash generation; if revenue erosion is sharper than forecast, repurchases may slow or pause.

Massive Valuation Gap Versus DCF Fair Value

- Criteo’s recent share price of $21.90 is far below its DCF fair value estimate of $126.24, reflecting a steep 83% discount and a Price-to-Earnings Ratio (P/E) of just 6.8x versus a 19.1x sector average.

- Analysts' consensus view notes that the current valuation heavily rewards patient investors who believe in margin expansion and a return to growth,

- Bulls highlight the combination of consistent historical earnings growth and a deep value discount as reasons to add at current levels.

- Cautious investors, however, focus on competitive and operational risks that could keep the stock “cheap” well past the next three years, especially if revenue bounce-backs fail to materialize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Criteo on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures above? Share your perspective and shape a new narrative in just a few minutes. Do it your way

A great starting point for your Criteo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Criteo’s declining revenue projections and dependence on buybacks highlight uncertainty around long-term earnings growth and business resilience.

If you want steadier performance, try stable growth stocks screener (2115 results) to discover companies delivering consistent revenue and earnings expansion across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRTO

Criteo

A technology company, provides marketing and monetization services and infrastructure on the open internet in North and South America, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives