- United States

- /

- Entertainment

- /

- NasdaqCM:CPOP

The Market Doesn't Like What It Sees From Pop Culture Group Co., Ltd's (NASDAQ:CPOP) Revenues Yet As Shares Tumble 26%

Pop Culture Group Co., Ltd (NASDAQ:CPOP) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 76% loss during that time.

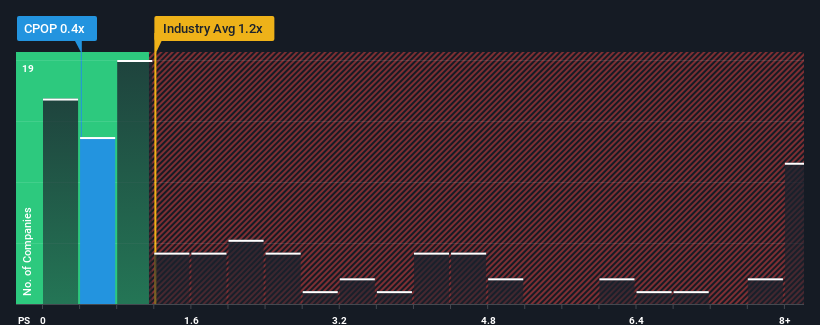

Since its price has dipped substantially, Pop Culture Group's price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Entertainment industry in the United States, where around half of the companies have P/S ratios above 1.2x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Pop Culture Group

How Has Pop Culture Group Performed Recently?

For example, consider that Pop Culture Group's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Pop Culture Group's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Pop Culture Group's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 43%. Regardless, revenue has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Pop Culture Group is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

Pop Culture Group's recently weak share price has pulled its P/S back below other Entertainment companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Pop Culture Group confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Pop Culture Group, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Pop Culture Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CPOP

Pop Culture Group

Provides living entertainment services and digital entertainment services to corporate clients in China.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026