- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Has Comcast’s Valuation Shifted After YouTube TV Blackout Warning?

Reviewed by Bailey Pemberton

If you are staring at Comcast’s stock chart and wondering if this is the time to buy, hold, or move on, you are definitely not alone. Comcast shares have been on something of a mixed ride lately. Over just the last week, they inched up by 0.4%. Zoom out and the story gets murkier; the stock is down 6.2% over the past month and has dropped 15.2% year to date. That slide bumps up to a 21.2% decline over the past year. Still, if you take an even longer view, Comcast is up 18.8% over three years, though the five-year performance shows a drop of nearly 20%. So, what gives?

Some of these moves tie directly to recent headlines. There’s been news of possible programming blackouts for YouTube TV customers and job cuts aimed at streamlining Comcast’s biggest business unit. The landscape keeps shifting, with carriage disputes and changes in advertising inventory, such as the 2026 Super Bowl ad sellout, sparking fresh conversations around Comcast’s risks and opportunities. Investors are likely weighing all this recent action and trying to gauge whether negative sentiment has pushed the stock into truly undervalued territory.

On that front, here is where things start to look interesting. Comcast has a value score of 6 out of 6 based on key valuation checks, suggesting the company is undervalued across every single lens that is typically used to size up a stock. But what are those methods, and what do they really say? Let’s walk through each of those valuation approaches. Also, I will share a more holistic way to judge whether Comcast’s current price is a real opportunity.

Why Comcast is lagging behind its peersApproach 1: Comcast Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by forecasting a company's future cash flows and then discounting those projections back to their present value. This approach helps investors estimate what a business is truly worth today based on its ability to generate cash in the future.

For Comcast, the current Free Cash Flow (FCF) sits at $15.8 billion. Analyst estimates extend for the next five years, showing steady increases. For example, FCF is projected to grow to $16.7 billion by 2029, with the next decade's trajectory extrapolated from these trends. These numbers, all measured in billions of dollars, signal a company generating significant cash, with Simply Wall St calculations used for years beyond detailed analyst forecasts.

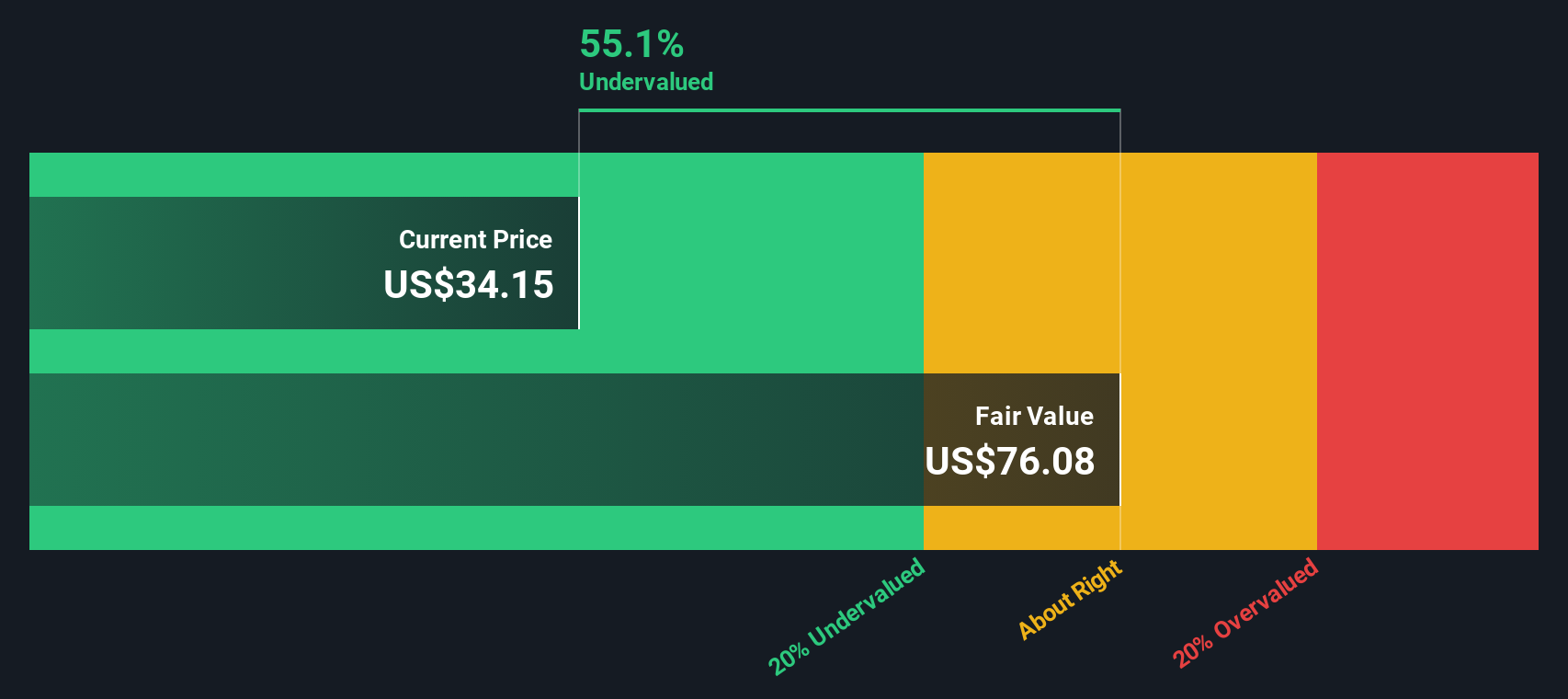

According to the DCF model, Comcast's intrinsic value comes out to $79.28 per share. This is about 60% higher than its current price, implying that the stock is significantly undervalued by this measure.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Comcast.

Approach 2: Comcast Price vs Earnings

The price-to-earnings (PE) ratio is a popular and reliable way to assess the value of profitable companies like Comcast. This metric looks at how much investors are willing to pay for each dollar of current earnings, making it particularly relevant for firms generating consistent profits.

A “fair” PE ratio for any company depends on expectations for its future earnings growth and how much risk or uncertainty investors see in those future profits. Companies expected to grow faster, or considered less risky, typically earn a higher PE multiple, while slow-growth or more uncertain businesses trade at lower multiples.

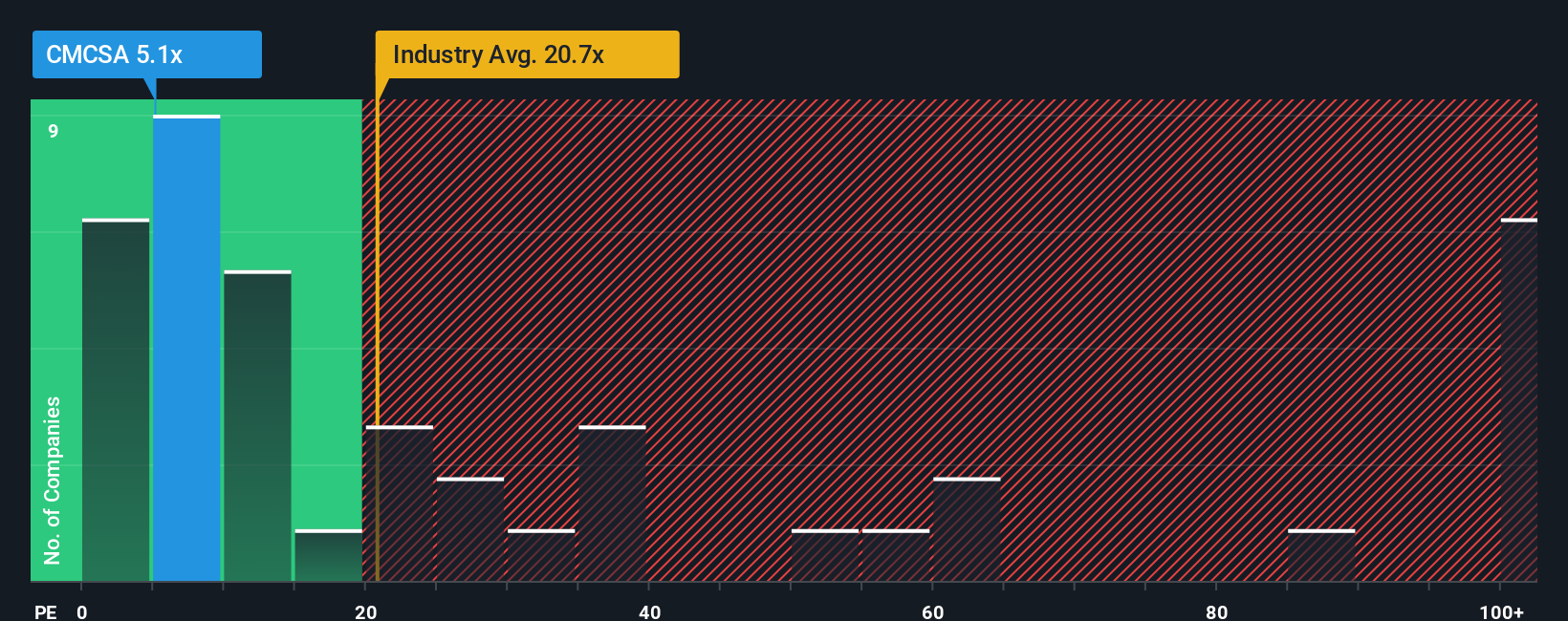

Right now, Comcast trades at just 5.1x earnings. For context, that is well below the Media industry’s average PE ratio of 20.4x, and much lower than the peer group average of 47.3x. But headline comparisons do not always tell the full story since not all media businesses are the same in terms of growth, profitability, or risk profile.

This is where Simply Wall St's "Fair Ratio" comes in. It custom-fits the PE benchmark to Comcast’s own circumstances by weighing expected earnings growth, profit margins, risk levels, its industry, and even its market size. In Comcast’s case, the calculated Fair Ratio is 17.6x, which is materially higher than its current 5.1x, suggesting that its shares may be trading below what the fundamentals warrant.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Comcast Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe best describes Comcast’s future: what drives its business, what challenges it faces, and how those factors might shape its revenue, profit margins, and valuation down the line.

Rather than just plugging numbers into formulas, Narratives connect your perspective with tangible forecasts and a fair value estimate. This creates a link from your story to a projection to a clear price target. Narratives are easy to use and available to everyone on Simply Wall St’s Community page, where millions of investors share their own outlooks.

This approach helps you decide when to buy or sell by letting you compare your Narrative’s Fair Value directly to today’s stock price. Narratives update automatically as new news or earnings are released, so your view stays current with events and market signals.

For Comcast, one investor’s Narrative might see next-gen broadband and streaming investments fueling a rebound to a $49.43 fair value, while another focuses on intense competition and narrowing profit margins, estimating fair value closer to $31.00. Narratives capture both perspectives and make it easy for you to build your own.

For Comcast, however, we'll make it really easy for you with previews of two leading Comcast Narratives:

- 🐂 Comcast Bull Case

Fair Value: $39.75

Current Price vs Fair Value: 20.2% undervalued

Expected Revenue Growth (next 3 years): 1.2%

- Broadband innovation, streaming expansion, and convergence are driving durable growth, higher margins, and retention across core businesses.

- Theme park expansion and favorable tax changes strengthen resilience, support capital returns, and enhance long-term cash flow visibility.

- Risks include competitive threats, rising costs, margin pressure, and slowdowns in media and broadband revenues. However, consensus sees the stock as undervalued relative to its fair value.

- 🐻 Comcast Bear Case

Fair Value: $31.00

Current Price vs Fair Value: 2.3% overvalued

Expected Revenue Growth (next 3 years): 0.1%

- Broadband and legacy media revenues face saturation and competition, leading to pressure on both growth and margins.

- Rising capital and programming costs, regulatory risks, and industry disruption threaten free cash flow and shareholder returns.

- Analysts with this viewpoint expect weak or declining revenues and earnings by 2028, seeing the stock as modestly overvalued at current market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success