- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Comcast (NasdaqGS:CMCSA) Expands Xfinity Multiview Enhancing March Hoops Viewing Experience

Reviewed by Simply Wall St

Comcast (NasdaqGS:CMCSA) has shown resilience amid a volatile market backdrop with a 1% share price increase over the past month. This growth aligns with key product developments, notably the expansion of Xfinity Multiview and upgraded internet speeds, which likely enhanced consumer engagement, especially during March Madness. Customers now enjoy increased interactivity through voice commands and access to comprehensive tournament coverage. Meanwhile, broader market trends showed significant challenges, with the Dow Jones, S&P 500, and Nasdaq Composite all experiencing declines due to economic uncertainties. Despite these hurdles, Comcast's investments in expanding digital infrastructure, such as in Phillipsburg and Northeastern Pennsylvania, likely contribute positively to the company’s long-term trajectory, balancing the immediate market pressures from tech sector struggles. Overall, Comcast’s focused enhancements in services and regional expansions appear well-timed, supporting its stock performance despite an unsettled broader market environment.

Dive into the specifics of Comcast here with our thorough balance sheet health report.

Find companies with promising cash flow potential yet trading below their fair value.

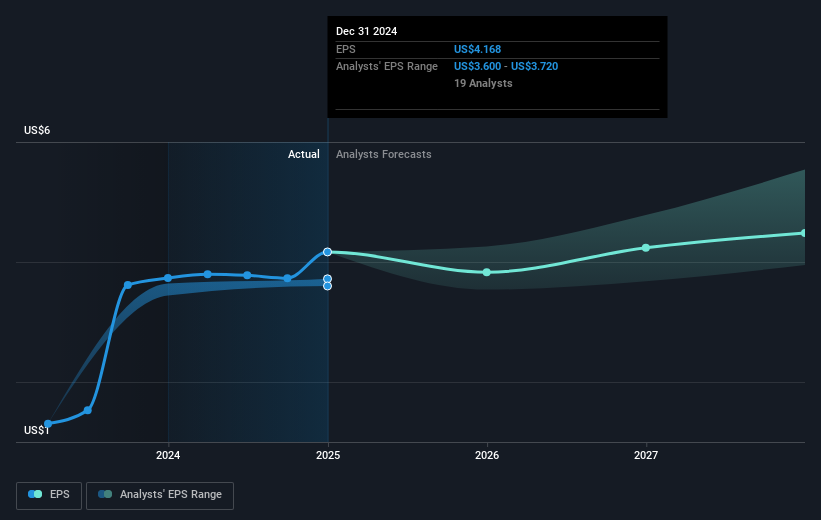

The last five years have seen Comcast (NasdaqGS:CMCSA) achieve a total shareholder return of 18.96%, amidst both challenges and expansions. A critical factor has been its consistent earnings growth, averaging 4% annually, underscoring steady financial stability. The company's aggressive share buyback policy, including the substantial repurchase of 49.51 million shares for US$2.05 billion at the end of 2024, further supported share value. Comcast's commitment to rewarding shareholders is also evident in its increased dividends, rising by US$0.08, reflecting a 6.5% enhancement.

Investment in infrastructure, such as expanding high-speed internet services to new areas like Hagerstown, MD, has bolstered regional connectivity and service offerings. Furthermore, Trian Fund Management's acquisition of a stake in Comcast in 2020 signaled confidence in the company's potential, fostering positive investor sentiment. Despite recent underperformance compared to the broader US market, Comcast's focused initiatives over five years demonstrate comprehensive efforts to enhance shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion