- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Comcast (NasdaqGS:CMCSA) Celebrates Miami Art With Innovative Smartphone Sculptures Initiative

Reviewed by Simply Wall St

Comcast (NasdaqGS:CMCSA) recently initiated an artistic collaboration in Miami-Dade County, partnering with local artists to celebrate the role of mobile technology in business. This announcement coincides with a series of expansions in network services across various U.S. regions and the introduction of advanced cybersecurity solutions by the company's DataBee unit. Amidst these developments, Comcast's share price remained mostly flat over the past month, in alignment with broader market trends marked by cautious optimism surrounding U.S.-China trade talks. These events likely reinforced positive investor sentiment without significantly altering the company's share price trajectory.

Comcast's artistic collaboration in Miami-Dade County highlights its efforts to engage with new audiences and underscore the significance of mobile technology in business. While this initiative could enhance brand recognition and customer engagement, its immediate impact on revenue and earnings forecasts is limited. The strategic expansions in network services and cybersecurity solutions are more likely to influence long-term financial performance, supporting incremental revenue growth and potentially stabilizing earnings amidst competitive pressures.

Over a longer timeframe, Comcast's total shareholder return, incorporating both share price and dividends, saw a 0.98% decline over five years, indicating a challenging period for long-term investors. Relative to the industry, Comcast underperformed the U.S. media industry with a steeper decline relative to its return of 1.9% over the past year. This context highlights the ongoing challenges within the sector despite the company's proactive measures.

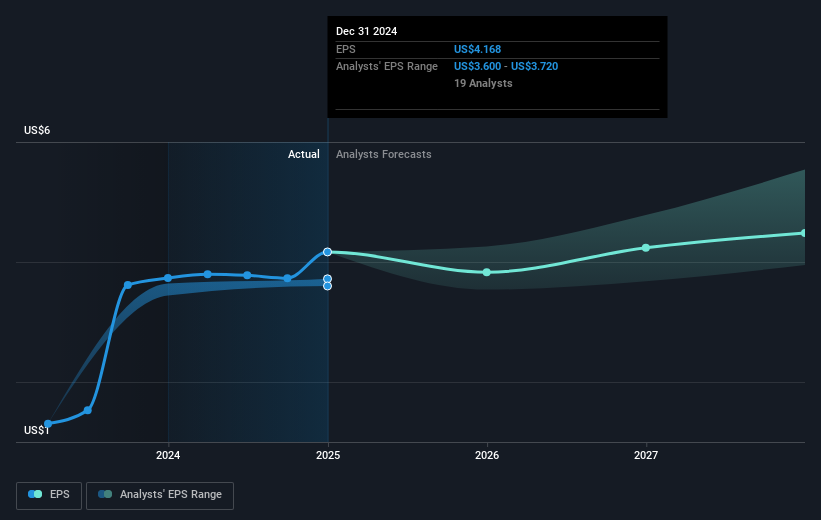

The recent price stability of Comcast shares, against the backdrop of cautious optimism in market trends, reflects mixed investor sentiment. The current share price of US$34.49 indicates a marginal discount compared to the consensus analyst price target of US$40.17, suggesting potential for upward movement if future earnings align with analyst expectations. However, the variance between bullish and bearish analyst perspectives underscores the uncertainty in projected future performance and valuation.

Review our growth performance report to gain insights into Comcast's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives