- United States

- /

- Media

- /

- NasdaqGS:CHTR

How Investors Are Reacting To Charter Communications (CHTR) Federal Securities Lawsuit and Management Accountability Concerns

Reviewed by Simply Wall St

- In August 2025, BFA announced that a lawsuit was filed against Charter Communications, Inc. and certain senior executives for alleged violations of federal securities laws, with investors given until October 14, 2025, to seek lead plaintiff status in the case now pending in the U.S. District Court for the Southern District of New York.

- This legal development brings potential reputational and regulatory risks to the company at a time when market focus is on its operational efficiency and growth initiatives.

- We'll examine how a federal securities lawsuit raises questions about risk and management accountability in Charter's current investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Charter Communications Investment Narrative Recap

To be a Charter Communications shareholder today is to believe in the company’s ability to drive operational efficiencies and expand its Spectrum Mobile and broadband offerings, even as ongoing subscriber losses and elevated debt remain key risks. The recent filing of a federal securities lawsuit introduces new uncertainties, but does not appear to materially impact the short-term focus on shifting customer trends and market share retention, the primary catalyst and risk in Charter’s investment story at this stage.

Alongside this legal update, Charter completed fixed-income offerings totaling nearly US$2 billion in August 2025, demonstrating ongoing access to capital markets. While this move helps fund operational and network initiatives, it further raises Charter’s debt load, which now stands out as a central concern amid regulatory and competitive pressures, potentially impacting its flexibility to counteract slowing subscriber growth.

In contrast, investors should be aware that Charter’s substantial debt load and how it may influence financial decisions in the quarters ahead...

Read the full narrative on Charter Communications (it's free!)

Charter Communications is forecast to have $56.8 billion in revenue and $6.1 billion in earnings by 2028. This outlook is based on an expected annual revenue decline of 0.9% and an increase in earnings of $0.8 billion from the current $5.3 billion.

Uncover how Charter Communications' forecasts yield a $395.75 fair value, a 49% upside to its current price.

Exploring Other Perspectives

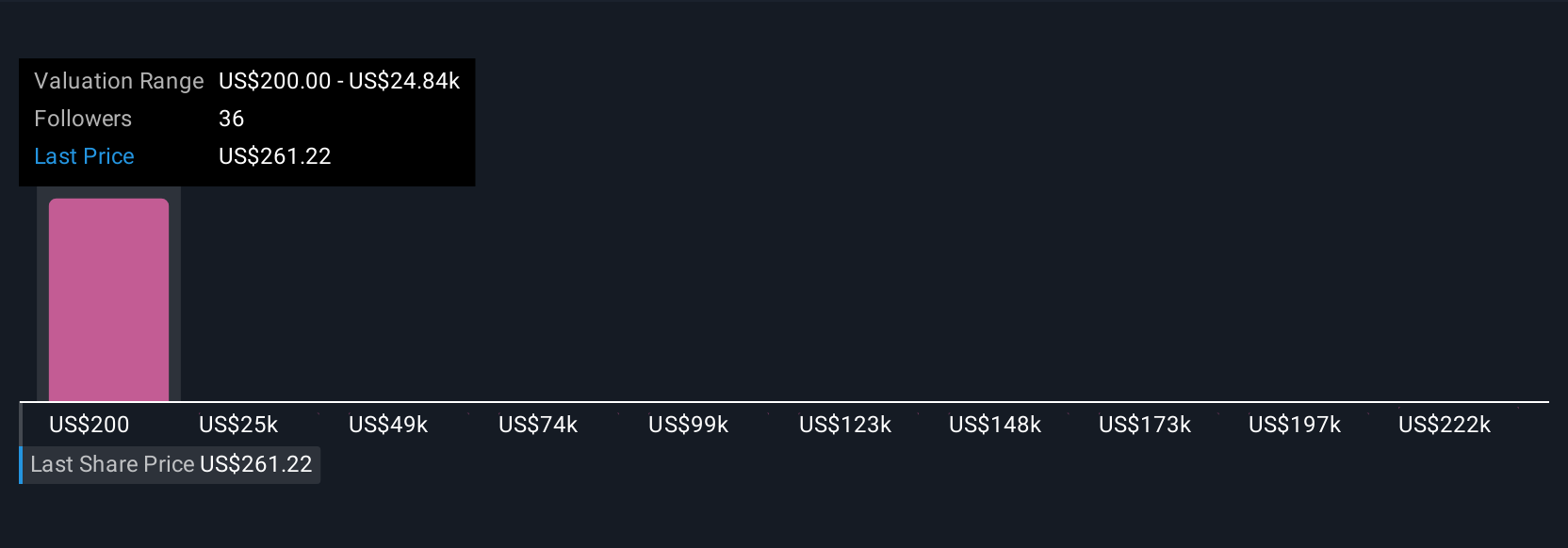

Six members of the Simply Wall St Community produced fair value estimates for Charter ranging from US$200 to US$246,622.39. As debt continues to grow, understanding the full range of market opinions can add important context to the company’s future financial decisions.

Explore 6 other fair value estimates on Charter Communications - why the stock might be worth 25% less than the current price!

Build Your Own Charter Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charter Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charter Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charter Communications' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHTR

Charter Communications

Operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives