- United States

- /

- Media

- /

- NasdaqGS:CHTR

Charter Communications Insiders Sell US$127m Of Stock, Possibly Signalling Caution

The fact that multiple Charter Communications, Inc. (NASDAQ:CHTR) insiders offloaded a considerable amount of shares over the past year could have raised some eyebrows amongst investors. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying versus knowing if they are selling, as the latter sends an ambiguous message. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

View our latest analysis for Charter Communications

Charter Communications Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the insider, Thomas Rutledge, sold US$99m worth of shares at a price of US$420 per share. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The good news is that this large sale was at well above current price of US$290. So it is hard to draw any strong conclusion from it.

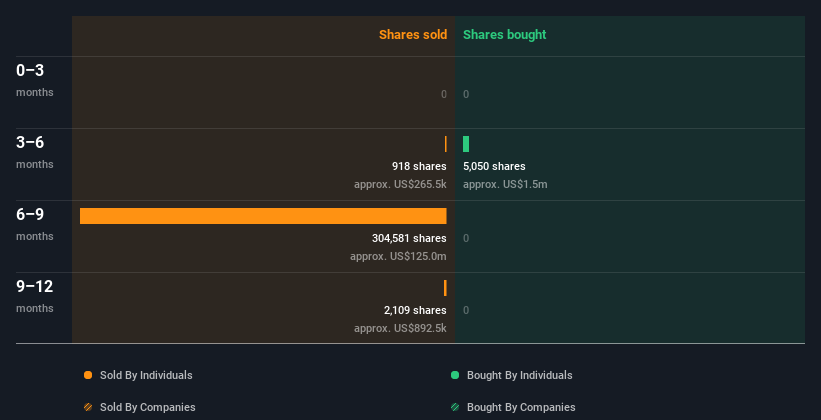

In total, Charter Communications insiders sold more than they bought over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

I will like Charter Communications better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Does Charter Communications Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Charter Communications insiders own about US$172m worth of shares (which is 0.4% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Charter Communications Tell Us?

It doesn't really mean much that no insider has traded Charter Communications shares in the last quarter. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Charter Communications insider transactions don't fill us with confidence. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Charter Communications. To assist with this, we've discovered 1 warning sign that you should run your eye over to get a better picture of Charter Communications.

But note: Charter Communications may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHTR

Charter Communications

Operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States.

Undervalued with acceptable track record.