- United States

- /

- Media

- /

- NasdaqGS:CHTR

Charter Communications’ (CHTR) AI Partnership With AWS Could Be a Game Changer for Innovation

Reviewed by Sasha Jovanovic

- Charter Communications recently announced a partnership with Amazon Web Services to accelerate the use of generative AI in software development and operations, including the adoption of Amazon Q Developer and GitLab Duo tools.

- This move aims to enhance software efficiency and customer experiences for Spectrum Internet, TV, and Mobile services, highlighting Charter’s increased focus on technological innovation amid market pressures.

- We'll look at how Charter's adoption of AI-driven software development could influence its investment narrative and operational outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Charter Communications Investment Narrative Recap

To be a shareholder in Charter Communications, you generally need to believe the company can leverage investments in technology and improved customer experiences to offset intensifying competition and broadband subscriber pressures. Charter’s recent AWS partnership, centered on generative AI integration, has the potential to improve operational efficiency and service quality, but given ongoing subscriber losses and slower growth, the direct impact on the core broadband business remains limited in the short term.

Among Charter’s recent service launches, the November expansion of 4K content availability on the Spectrum TV App stands out for its relevance to customer retention and enhanced user experiences. Broader access to high-quality viewing on popular devices aligns with efforts to boost engagement as Charter navigates market challenges and seeks to balance catalysts like feature upgrades against customer growth risks.

In contrast, investors should be aware that if low-income subscriber retention weakens further as affordability programs wind down…

Read the full narrative on Charter Communications (it's free!)

Charter Communications’ outlook anticipates $56.8 billion in revenue and $6.0 billion in earnings by 2028. This assumes a 0.9% annual revenue decline and a $0.7 billion increase in earnings from $5.3 billion today.

Uncover how Charter Communications' forecasts yield a $314.94 fair value, a 57% upside to its current price.

Exploring Other Perspectives

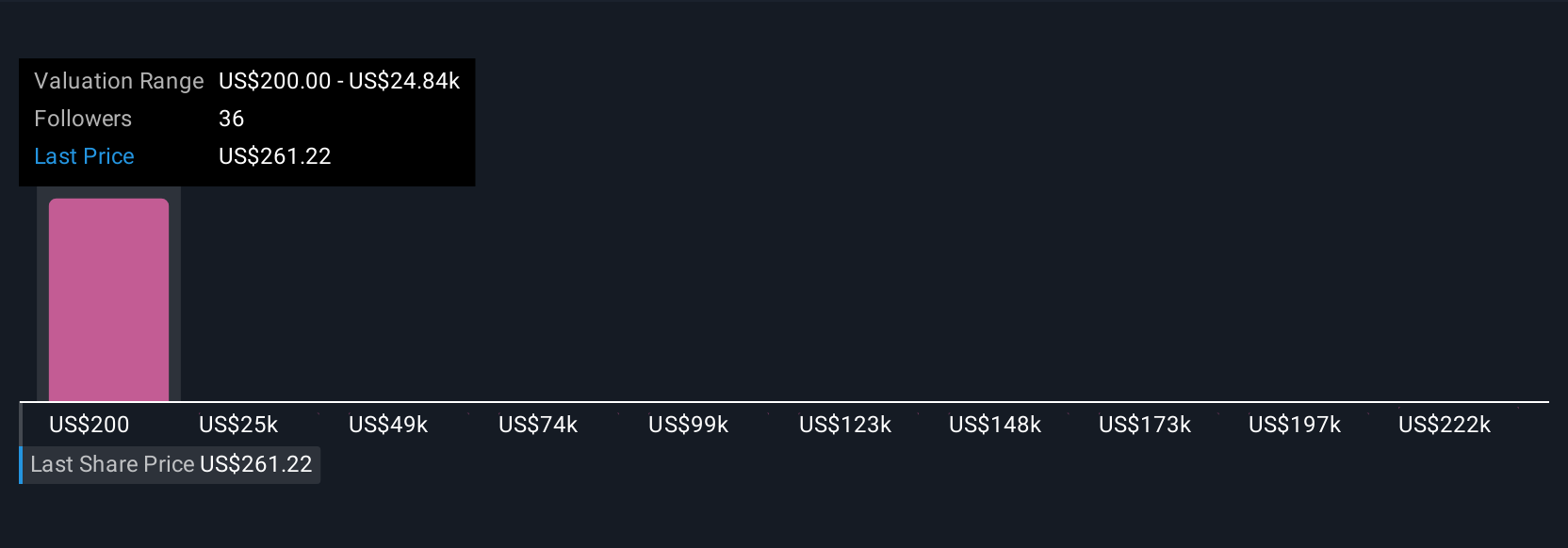

Five fair value estimates from the Simply Wall St Community for Charter range from US$223 to US$821, showing wide divergence. As you consider these views, remember continued subscriber losses may weigh on Charter’s growth outlook, explore several alternative perspectives to inform your own assessment.

Explore 5 other fair value estimates on Charter Communications - why the stock might be worth over 4x more than the current price!

Build Your Own Charter Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charter Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charter Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charter Communications' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHTR

Charter Communications

Operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026