- United States

- /

- Media

- /

- NasdaqGM:CDLX

Revenues Tell The Story For Cardlytics, Inc. (NASDAQ:CDLX) As Its Stock Soars 64%

Cardlytics, Inc. (NASDAQ:CDLX) shares have continued their recent momentum with a 64% gain in the last month alone. But the last month did very little to improve the 69% share price decline over the last year.

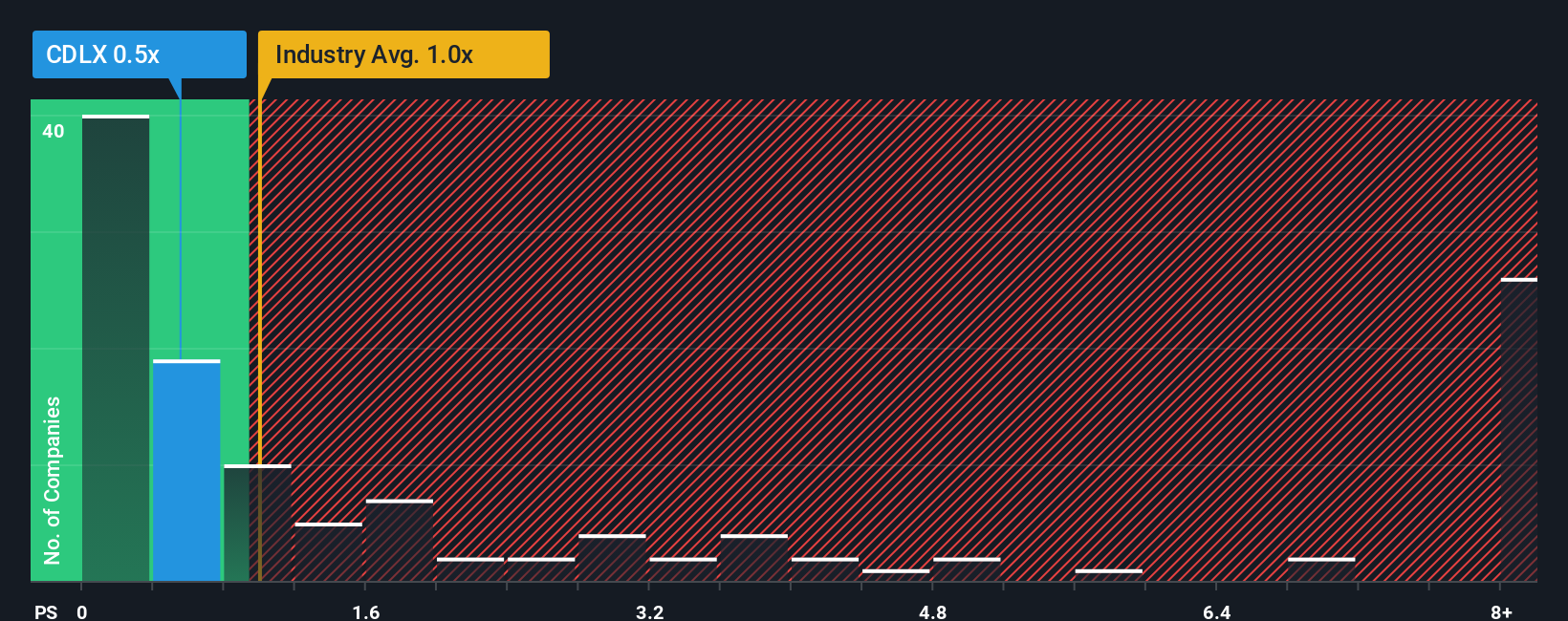

Even after such a large jump in price, there still wouldn't be many who think Cardlytics' price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in the United States' Media industry is similar at about 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Cardlytics

What Does Cardlytics' Recent Performance Look Like?

Cardlytics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Cardlytics will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Cardlytics?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Cardlytics' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. This means it has also seen a slide in revenue over the longer-term as revenue is down 3.3% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 0.7% during the coming year according to the six analysts following the company. With the industry predicted to deliver 1.4% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Cardlytics' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Cardlytics' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Cardlytics' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Media industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Cardlytics (1 is concerning) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CDLX

Cardlytics

Operates an advertising platform in the United States and the United Kingdom.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives