- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:CARG

CarGurus (CARG): Evaluating Valuation as Shares Stabilize After Recent Swings

Reviewed by Kshitija Bhandaru

See our latest analysis for CarGurus.

CarGurus is holding steady after a choppy stretch, with its latest share price at $33.99. The stock's shorter-term momentum has faded recently, but its 1-year total shareholder return of 9.2% and a massive 140% gain over three years hint at solid long-term value appreciation.

If you’re weighing what other opportunities might be gaining traction, this could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares settling after recent swings and trading at a notable discount to analyst targets, the question emerges: Is CarGurus a hidden bargain in plain sight, or has the market already baked in its growth potential?

Most Popular Narrative: 12.1% Undervalued

CarGurus closed at $33.99, while the narrative’s fair value stands meaningfully higher. This points to a notable gap and hints at deeper growth assumptions supporting current sentiment among the most followed market watchers.

Momentum in international markets (Canada and UK), evidenced by strong dealer additions, product adoption, and exclusive partnerships, expands CarGurus' total addressable market and provides a long runway for revenue and earnings growth outside North America, supporting long-term scalability.

Curious what makes this narrative so bullish? Analysts see a sharp acceleration in profit margins and major future earnings—numbers few investors are predicting. Want to discover what projections justify this bold upside? Dive into the full narrative to see which surprising figures the consensus is betting on.

Result: Fair Value of $38.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, surging competition from digital auto platforms and challenges related to scaling internationally could threaten CarGurus' growth and put pressure on future profit margins.

Find out about the key risks to this CarGurus narrative.

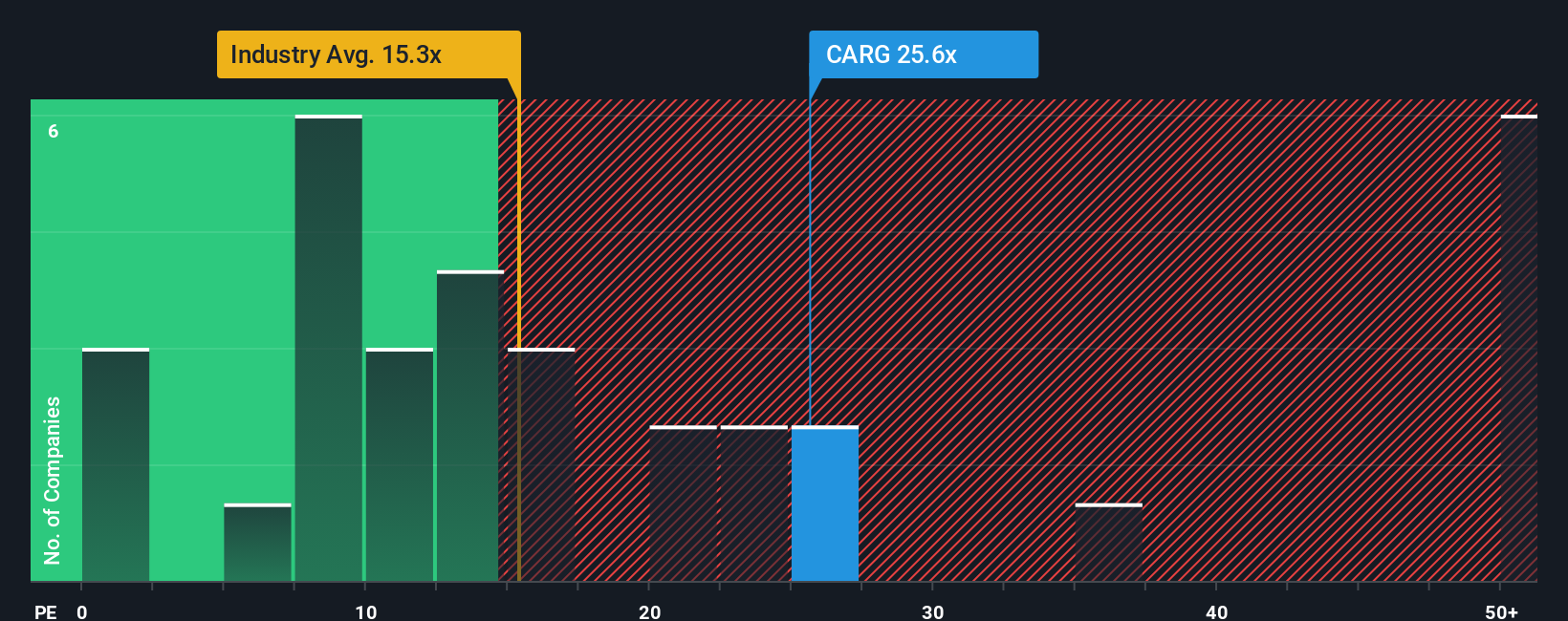

Another View: Price-to-Earnings Paints a Different Picture

Looking through the lens of pricing, CarGurus trades at a price-to-earnings ratio of 26x. This figure is notably higher than both peer averages (15.4x) and the broader industry (15.3x). Even compared to a fair ratio of 23.5x, the stock appears expensive. This suggests the market may be pricing in more growth or simply exposing investors to greater valuation risk. Is the premium justified, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CarGurus Narrative

If you see the story differently or prefer hands-on research, you can explore the numbers yourself and build a custom view in just minutes. Do it your way

A great starting point for your CarGurus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't sit on the sidelines and miss your next opportunity. Boost your portfolio with uniquely positioned stocks backed by actionable data and fresh themes.

- Unlock attractive yields and steady income potential by checking out these 18 dividend stocks with yields > 3% offering reliable dividends above 3%.

- Ride the wave of disruptive innovation by scanning these 25 AI penny stocks that are driving advances in artificial intelligence and automation.

- Supercharge your search for deep value with these 891 undervalued stocks based on cash flows that look underpriced based on their future cash flows and market fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CARG

CarGurus

Operates an online automotive platform for buying and selling vehicles in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion