- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BZ

Revenues Tell The Story For Kanzhun Limited (NASDAQ:BZ) As Its Stock Soars 27%

Kanzhun Limited (NASDAQ:BZ) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 30%.

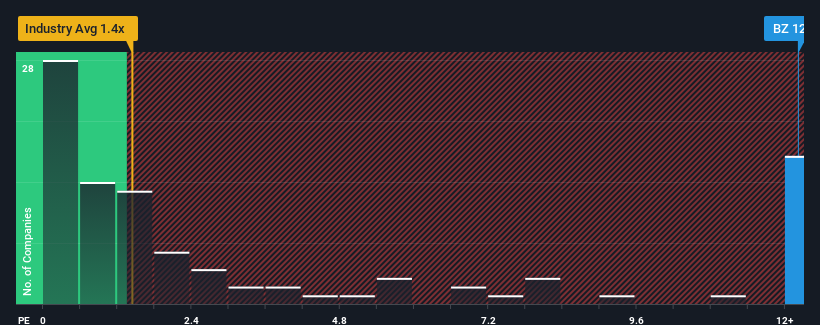

Following the firm bounce in price, when almost half of the companies in the United States' Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Kanzhun as a stock not worth researching with its 12.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Kanzhun

How Kanzhun Has Been Performing

Recent times have been advantageous for Kanzhun as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Kanzhun will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Kanzhun's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 206% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 25% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 12% per annum, which is noticeably less attractive.

With this information, we can see why Kanzhun is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Kanzhun's P/S?

The strong share price surge has lead to Kanzhun's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Kanzhun maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Interactive Media and Services industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Kanzhun that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kanzhun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BZ

Kanzhun

Provides online recruitment services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives