- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BMBL

Bumble (BMBL) Revenue Projected to Decline 5.2% Yearly, Turnaround Hopes Center on Profit Growth

Reviewed by Simply Wall St

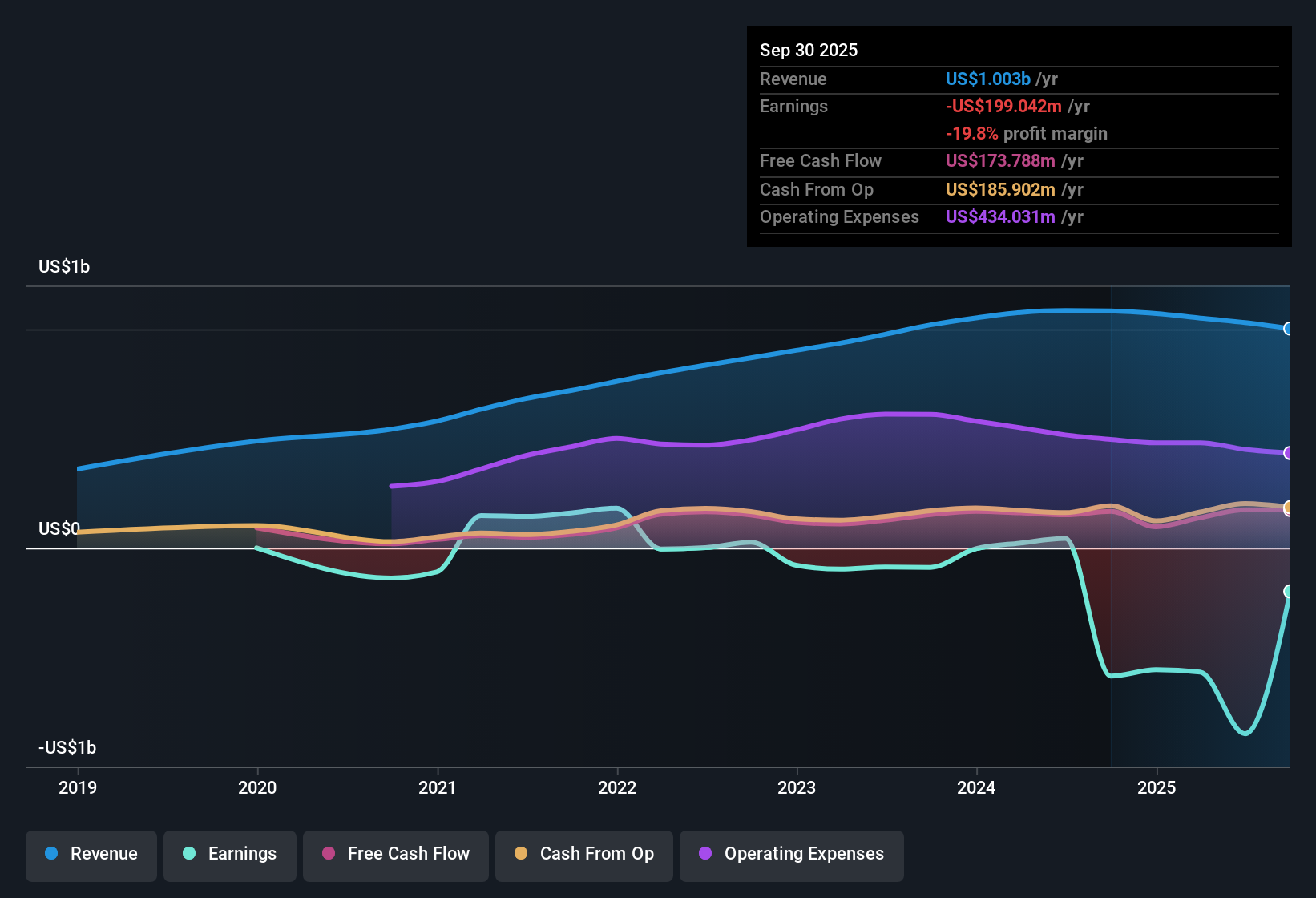

Bumble (BMBL) faces a mixed outlook this earnings season, with revenue forecast to decline by 5.2% per year over the next three years and net losses growing at an annual rate of 61.9% over the past five years. Despite the current losses, earnings are expected to surge by 101.57% annually, with profitability anticipated within the next three years. Investors may view Bumble's below-average Price-to-Sales Ratio and trading price, along with minor risks and a limited risk profile, as potential signs of value and a turnaround on the horizon.

See our full analysis for Bumble.Next, we will see how these headline numbers stack up against the broader community narrative and whether they shift the story in a new direction.

See what the community is saying about Bumble

Margins Expected to Climb from -82.5% to 15.5%

- Analysts project profit margins to move from -82.5% today to a positive 15.5% three years out, reflecting a major improvement even as revenue falls 3.9% annually in their base case.

- Analysts' consensus view sees Bumble's investments in trust and safety features, including AI-driven moderation and ID verification, as central to driving user retention and eventually boosting profit margins.

- By focusing on higher engagement and healthier ecosystem metrics, consensus argues that margin expansion will be achieved through operational efficiency, even with near-term revenue declines.

- However, consensus cautions that these improvements require ongoing product investment, which may weigh on net margins before the anticipated turnaround is realized.

Paying User Decline Offsets Premium Feature Upside

- Monthly paying users are forecast to drop by 100,000 to 120,000 in the coming quarters due to ecosystem health initiatives, and ARPPU (average revenue per paying user) is down 8% for Bumble App and 12% for Badoo App, driven by shifts in geographic mix.

- Analysts' consensus view suggests management’s pivot away from rapid user growth toward a healthier user base could pressure short-term revenue and margin expansion, but should enhance conversion quality and monetization over time.

- Consensus notes that sunsetting non-core apps and prioritizing user trust may cause a $12 million revenue headwind, but argues this could support sustainable earnings if free-to-paid conversion rates improve as intended.

- At the same time, ongoing declines in ARPPU and user numbers remain a headwind for any near-term bullish case, challenging those seeking a quick rebound in top-line momentum.

Share Price Trades Well Below DCF Fair Value

- With a current share price of $4.24, Bumble trades at a sizable discount to its DCF fair value of $13.45, as well as below its own sector and peer group averages, highlighting a valuation gap that may attract turnaround investors.

- Analysts' consensus view points out that the analyst price target of $6.10 is just slightly above current pricing, with consensus seeing the stock as largely fairly valued unless profit growth and margin expansion arrive faster than forecast.

- Consensus highlights that while Bumble’s price-to-sales and PE multiples are lower than industry averages, only sustained improvement in profitability and user metrics will close the gap to both fair value and price targets.

- With share count expected to decline by nearly 4% annually, upside for existing shareholders could be supported, but further downside risk exists if revenue continues to disappoint over multiple quarters.

If you want to see how all of these narrative threads come together, check out the full community consensus story on the company’s turnaround case. 📊 Read the full Bumble Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bumble on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the numbers? Share your perspective and shape your own data-driven narrative in under three minutes. Do it your way

A great starting point for your Bumble research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Bumble’s stalled revenue, shrinking user numbers, and inconsistent earnings point to a lack of stable growth as well as limited near-term momentum.

If you’re seeking steadier results, use stable growth stocks screener (2078 results) to find companies that consistently deliver reliable revenue and earnings gains across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bumble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BMBL

Bumble

Provides online dating and social networking applications in North America, Europe, internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives