- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Evaluating Baidu’s Value After 52% Rally and AI Development News in 2025

Reviewed by Bailey Pemberton

- Ever wondered if Baidu is truly a bargain, especially with so much buzz around tech stocks right now?

- Baidu's share price is up 3.9% this week and has soared 52.3% year-to-date, signaling renewed optimism and possible shifts in how investors view its future growth risks.

- News around Baidu's accelerating AI development and expansion into new business areas has fueled speculation about its long-term prospects. Recent headlines highlight its leadership in generative AI services and partnerships with global tech giants, adding context to the stock's momentum.

- When it comes to valuation, Baidu currently scores 3 out of 6 on our value checklist. See the full breakdown here. Let's unpack how we get to this number using different valuation methods. Stick around, because we'll close out with a smarter way to get a true read on value.

Approach 1: Baidu Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today to account for the time value of money. This approach is designed to capture the true economic potential of a business beyond what the current share price suggests.

For Baidu, the latest reported Free Cash Flow (FCF) is negative, at approximately CN¥10.4 billion. However, analysts currently forecast a recovery, with FCF projected to reach about CN¥22.7 billion by 2026. It is important to note that while analyst estimates only go out a few years, Simply Wall St's model extends these projections up to 10 years using trend-based extrapolation. By 2035, the forecasted FCF stands at roughly CN¥22.1 billion.

Based on these projections, the DCF analysis estimates Baidu’s fair intrinsic value at CN¥111.27 per share. However, when compared to the current share price, this suggests the stock is about 13.2% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baidu may be overvalued by 13.2%. Discover 872 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Baidu Price vs Earnings

For profitable companies like Baidu, the Price-to-Earnings (PE) ratio is a popular valuation metric because it helps investors quickly assess how much they are paying for each unit of earnings. A lower PE can indicate a bargain, but what is “normal” depends on how fast the company is expected to grow and how much risk is involved. Higher growth and lower perceived risk generally justify a higher PE ratio.

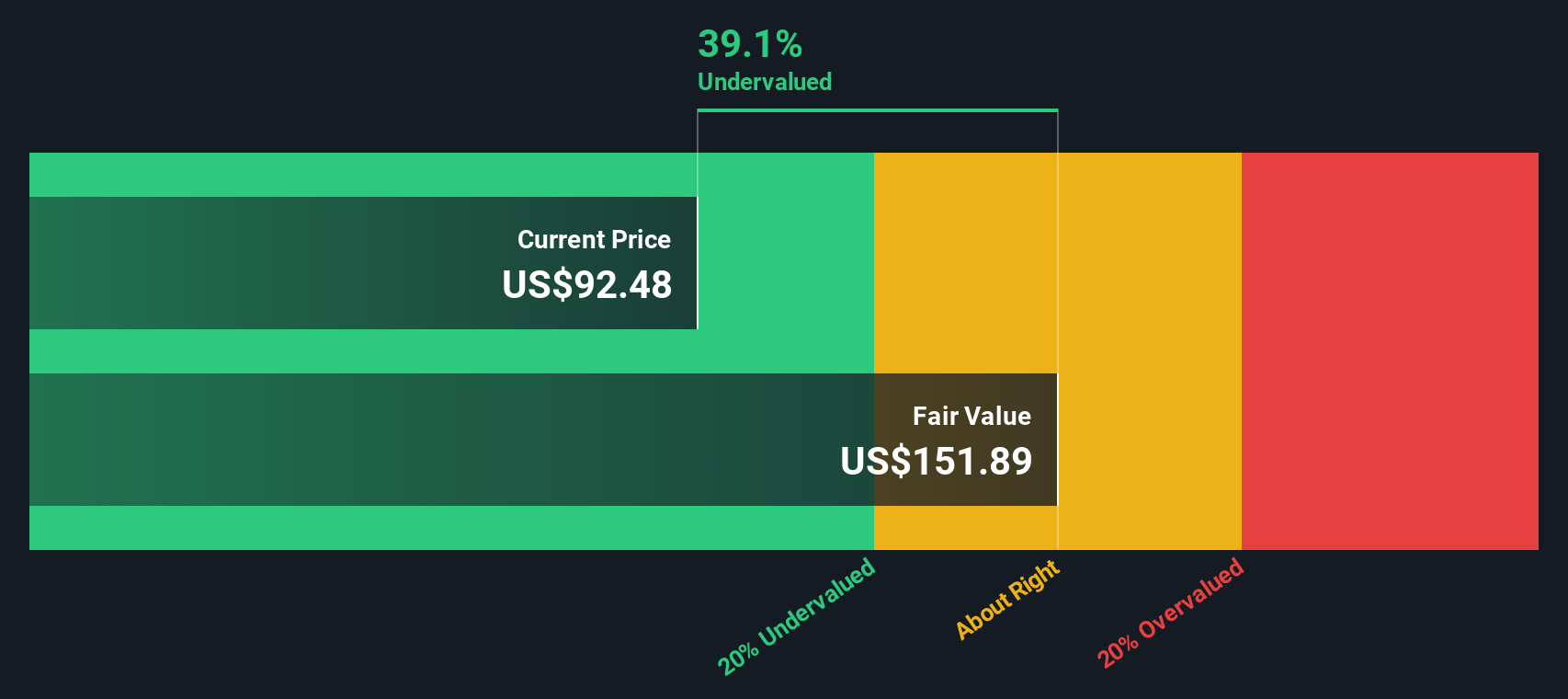

Baidu’s current PE ratio stands at 11.3x. This is noticeably lower than both the Interactive Media and Services industry average of 17.0x and the peer average of 42.3x. At first glance, this could suggest Baidu is undervalued compared to its sector and competitors.

However, Simply Wall St’s proprietary “Fair Ratio” goes a step further, blending in factors like Baidu’s earnings growth outlook, profit margins, market capitalization, risk profile, and position within the industry to calculate a tailored valuation benchmark. In Baidu’s case, the Fair Ratio sits at 18.7x, indicating what investors should reasonably pay for its earnings given current conditions. This approach is more nuanced than simply comparing with peers or industry averages, since it accounts for what actually makes Baidu unique in its operating environment.

Comparing the actual PE (11.3x) to the Fair Ratio (18.7x) reveals Baidu is currently trading well below its bespoke fair value multiple, pointing toward a potentially attractive buying opportunity for investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baidu Narrative

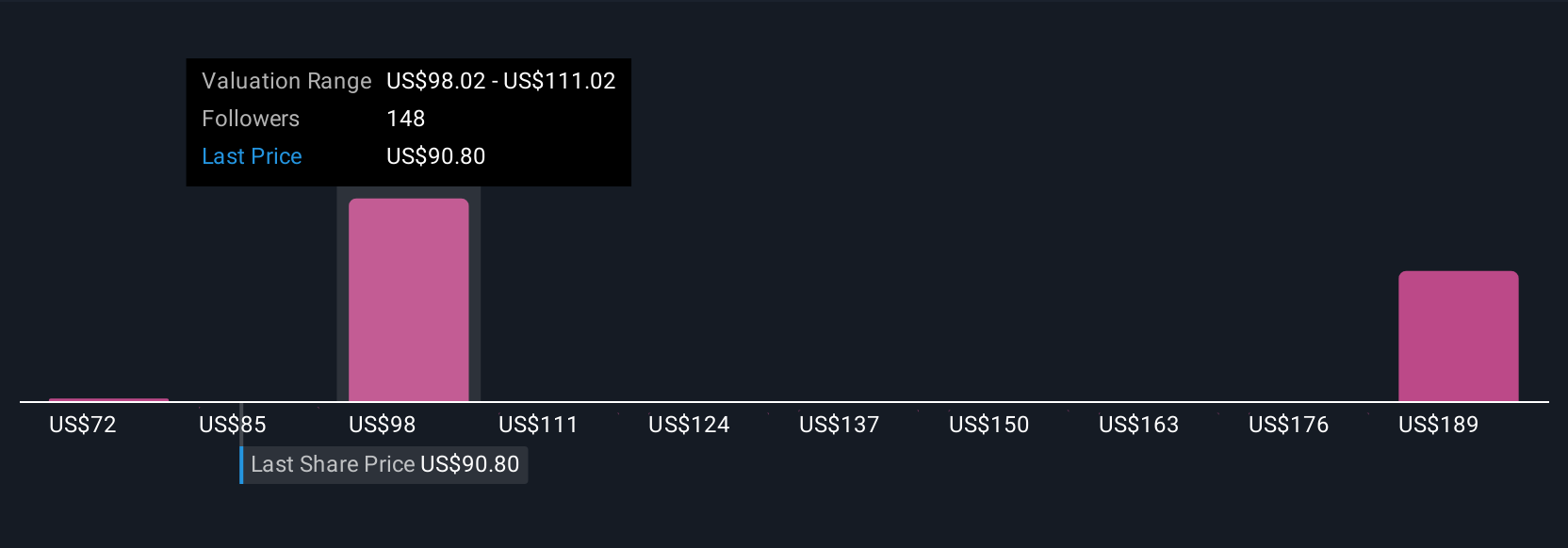

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized perspective on a company; it connects the story you believe about Baidu’s future (like how its AI will transform advertising or how regulatory risks could limit growth) directly to your financial forecasts for the business, including revenue, earnings, and profit margins, ultimately linking those assumptions to a fair value for the stock.

Narratives are easy to create and explore on Simply Wall St's Community page, so millions of investors can set out their own view on Baidu and see how it stacks up against the market. By comparing each Narrative’s fair value to Baidu’s actual share price, you can decide for yourself whether it’s time to buy, sell, or wait. These Narratives also update dynamically as news or financial results come in, so your valuation always reflects the latest context.

For example, one investor using the highest analyst estimate might argue that Baidu’s AI chip breakthroughs and global robotaxi launches will drive earnings up to CN¥27.0 billion, justifying a price target of $145.76. Meanwhile, a more cautious Narrative could point to ongoing ad revenue challenges and expect earnings to slow to CN¥16.6 billion, supporting a price closer to $71.14. With Narratives, you can anchor your investment decisions to the story and numbers you believe in.

Do you think there's more to the story for Baidu? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives