- United States

- /

- Entertainment

- /

- NasdaqCM:BHAT

Take Care Before Jumping Onto Blue Hat Interactive Entertainment Technology (NASDAQ:BHAT) Even Though It's 49% Cheaper

Blue Hat Interactive Entertainment Technology (NASDAQ:BHAT) shareholders that were waiting for something to happen have been dealt a blow with a 49% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

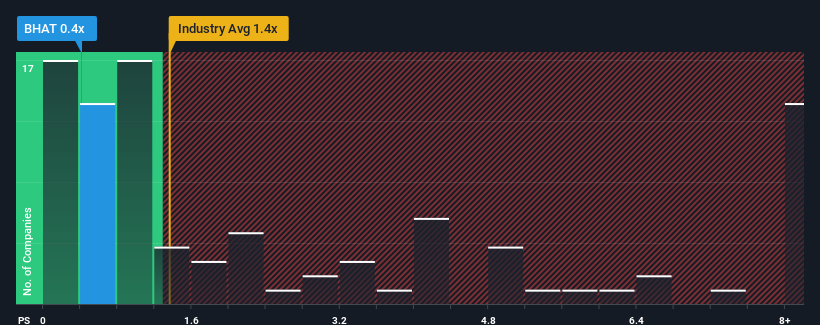

Since its price has dipped substantially, Blue Hat Interactive Entertainment Technology may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Entertainment industry in the United States have P/S ratios greater than 1.4x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Blue Hat Interactive Entertainment Technology

What Does Blue Hat Interactive Entertainment Technology's Recent Performance Look Like?

Recent times have been quite advantageous for Blue Hat Interactive Entertainment Technology as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Blue Hat Interactive Entertainment Technology will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Blue Hat Interactive Entertainment Technology would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an excellent 200% overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Blue Hat Interactive Entertainment Technology's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Blue Hat Interactive Entertainment Technology's P/S Mean For Investors?

Blue Hat Interactive Entertainment Technology's recently weak share price has pulled its P/S back below other Entertainment companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Blue Hat Interactive Entertainment Technology currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It is also worth noting that we have found 5 warning signs for Blue Hat Interactive Entertainment Technology (4 are significant!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Blue Hat Interactive Entertainment Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BHAT

Blue Hat Interactive Entertainment Technology

Engages in bulk commodity trading business in the People’s Republic of China.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026