- United States

- /

- Entertainment

- /

- NasdaqGS:BATR.K

Revenues Not Telling The Story For Atlanta Braves Holdings, Inc. (NASDAQ:BATR.K)

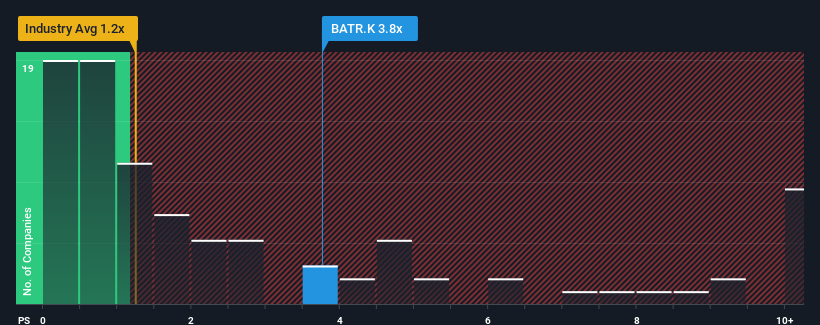

Atlanta Braves Holdings, Inc.'s (NASDAQ:BATR.K) price-to-sales (or "P/S") ratio of 3.8x may look like a poor investment opportunity when you consider close to half the companies in the Entertainment industry in the United States have P/S ratios below 1.2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Atlanta Braves Holdings

How Atlanta Braves Holdings Has Been Performing

Recent revenue growth for Atlanta Braves Holdings has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Atlanta Braves Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Atlanta Braves Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 8.9% gain to the company's revenues. Pleasingly, revenue has also lifted 260% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 6.4% per annum during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 9.9% per year, which is noticeably more attractive.

In light of this, it's alarming that Atlanta Braves Holdings' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see Atlanta Braves Holdings trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about these 2 warning signs we've spotted with Atlanta Braves Holdings.

If these risks are making you reconsider your opinion on Atlanta Braves Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BATR.K

Atlanta Braves Holdings

Through its subsidiary, Braves Holdings, LLC, owns and operates the Atlanta Braves Major League Baseball Club in the United States.

Imperfect balance sheet with minimal risk.

Market Insights

Community Narratives