- United States

- /

- Entertainment

- /

- NasdaqGS:BATR.K

How Recent NBA Franchise Sales Could Impact Atlanta Braves Holdings Stock in 2025

Reviewed by Simply Wall St

Trying to decide what to do with Atlanta Braves Holdings stock? You are definitely not alone. Even the most seasoned investors are giving this one a hard look, especially as the backdrop for all sports ownership seems to be shifting. The stock has been anything but boring lately, with a recent dip of 0.8% over the past week and a larger drop of 8.4% over the last month. Zoom out just a little, and the picture brightens: the year-to-date return is still a positive 9.4%, and over the past three years, the stock has surged an impressive 53.7%. If you had the conviction to hang on for five years, you would be looking at a massive 98.5% return.

Those wild swings could be fueled in part by headline-grabbing moves around professional sports ownership, like the recent shakeups in the NBA where Tom Dundon is set to purchase the Trail Blazers and Cavaliers owner Dan Gilbert is exploring selling a stake in his team. All this action underscores how sports franchises can quickly shift in perceived value and risk profile. Atlanta Braves Holdings is no exception.

But what about the valuation? Here is where things get interesting. Atlanta Braves Holdings currently scores a 0 in the valuation department, meaning the company is not considered undervalued in any of the six classic checks analysts look at. That does not necessarily mean it is overpriced, but it definitely sets the tone for the deeper analysis to come. Next, we will walk through the different methods used to assess what this stock is really worth. To get there, though, you will want to see how these checks compare to an even smarter way to value a company, which we will reveal at the end of this article.

Atlanta Braves Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Atlanta Braves Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value in today's dollars. This helps investors get a sense of what the business is truly worth, based on how much cash it is expected to generate down the line.

For Atlanta Braves Holdings, analysts are projecting a remarkable turnaround. The company’s latest twelve months Free Cash Flow sits at minus $24 million, but projections show rapid growth over the next decade. Analyst forecasts expect Free Cash Flow to reach $26 million by 2028, with further estimates by Simply Wall St suggesting steady increases to $77 million in 2035. These projections are made using a two-stage Free Cash Flow to Equity model, factoring in both analyst views for the first five years and longer-term trends beyond that.

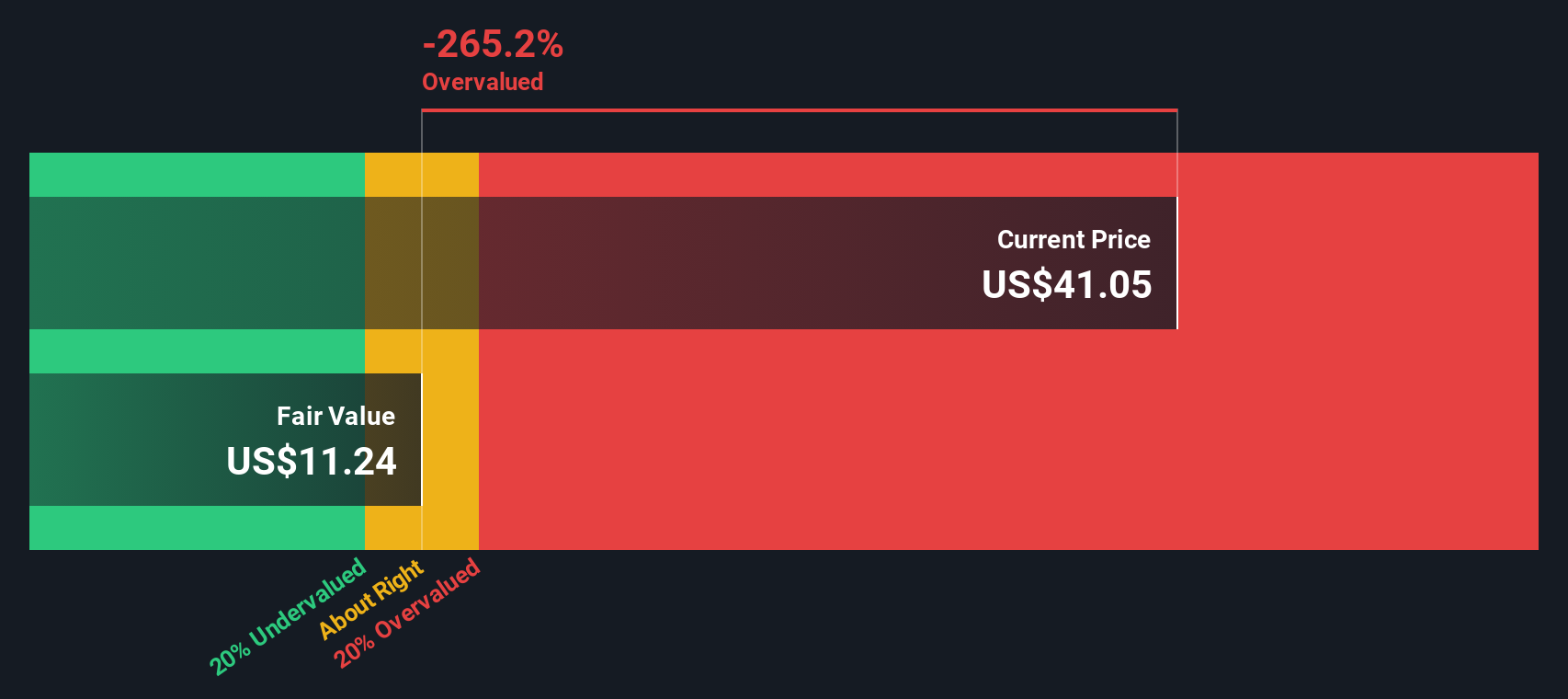

After discounting these future cash flows back to today, the resulting intrinsic value estimate is $11.14 per share. However, compared to the current share price, the DCF suggests the stock is around 270.0% overvalued. This indicates a significant disconnect between the market price and underlying cash flow expectations.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Atlanta Braves Holdings.

Approach 2: Atlanta Braves Holdings Price vs Sales

For companies like Atlanta Braves Holdings that are not yet profitable, the Price-to-Sales (P/S) ratio is a solid go-to for valuation. The P/S ratio gives investors a way to compare how much they're paying for each dollar of the company's sales. While earnings-based metrics don't work as well for unprofitable businesses, revenue performance is still a powerful lens, especially in industries such as entertainment where growth can come in waves and profits often lag behind sales momentum.

It's also important to remember that growth expectations and risk play a big role in what a fair multiple should be. Fast-growing companies or those perceived as less risky generally command higher multiples, while slow-growing or riskier businesses trade at a discount.

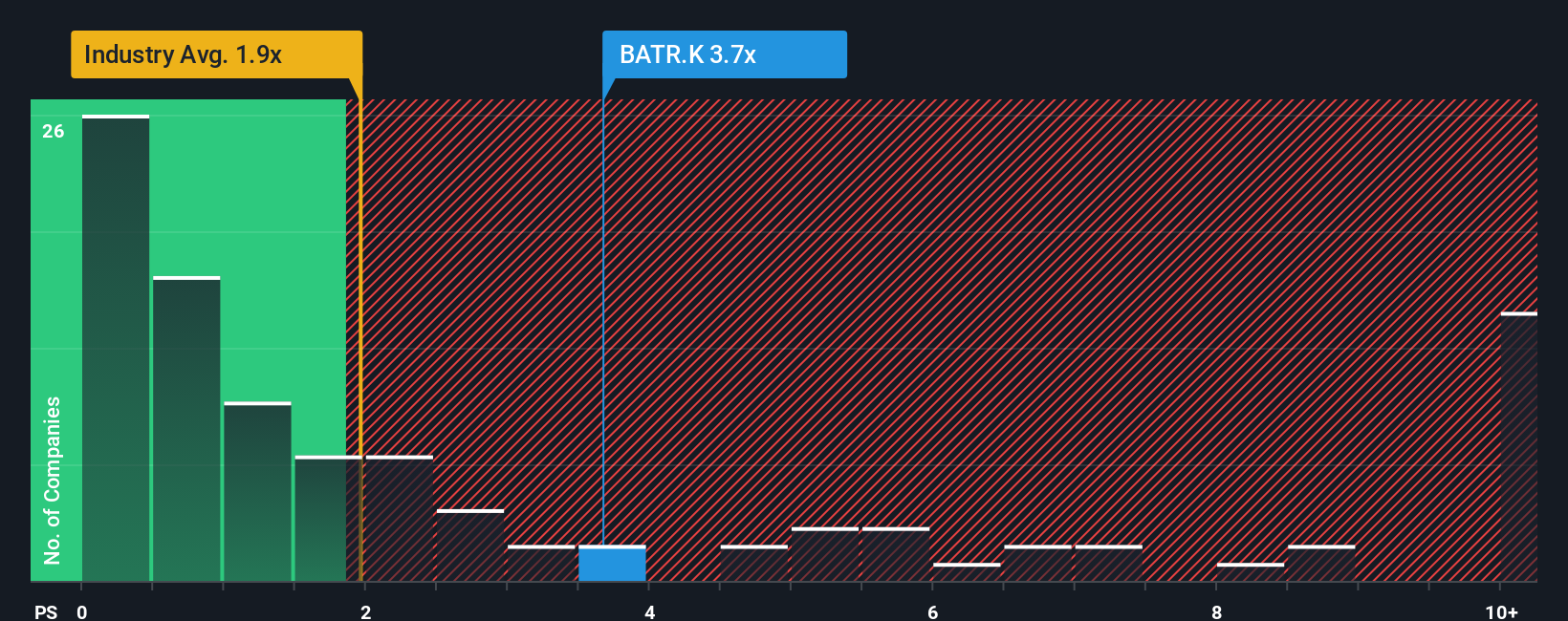

Atlanta Braves Holdings currently trades at a P/S ratio of 3.68x. That's considerably higher than the Entertainment industry average of 1.84x and above peer companies, which have an average of 1.26x. On the surface, this suggests the market is pricing in stronger future growth or a premium brand value.

This is where Simply Wall St's Fair Ratio comes into play. The Fair Ratio customizes what a reasonable multiple would be by factoring in Atlanta Braves Holdings' specific growth outlook, profit margins, size, risk, and its place within the industry. The Fair Ratio sits at 1.04x, which is far below the company's current P/S. This approach offers an advantage over standard peer or industry comparisons because it tailors the “fair value” to the company's real prospects rather than using a one-size-fits-all benchmark.

With the actual P/S ratio at 3.68x compared to a Fair Ratio of only 1.04x, Atlanta Braves Holdings appears meaningfully overvalued by this measure.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Atlanta Braves Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative allows you to link your perspective on a company to a set of financial forecasts, such as fair value, estimates of future revenue, earnings, and margins, which combines the "story" behind the business with the hard numbers investors rely on.

Narratives make this process approachable for everyone. They are an easy-to-use tool available on Simply Wall St's Community page, where millions of investors share their views. By connecting your personal outlook and assumptions to a real-time financial forecast, you can see how your story translates into a fair value that can be compared to the current share price. This can help you decide if you think the stock is a buy or a sell.

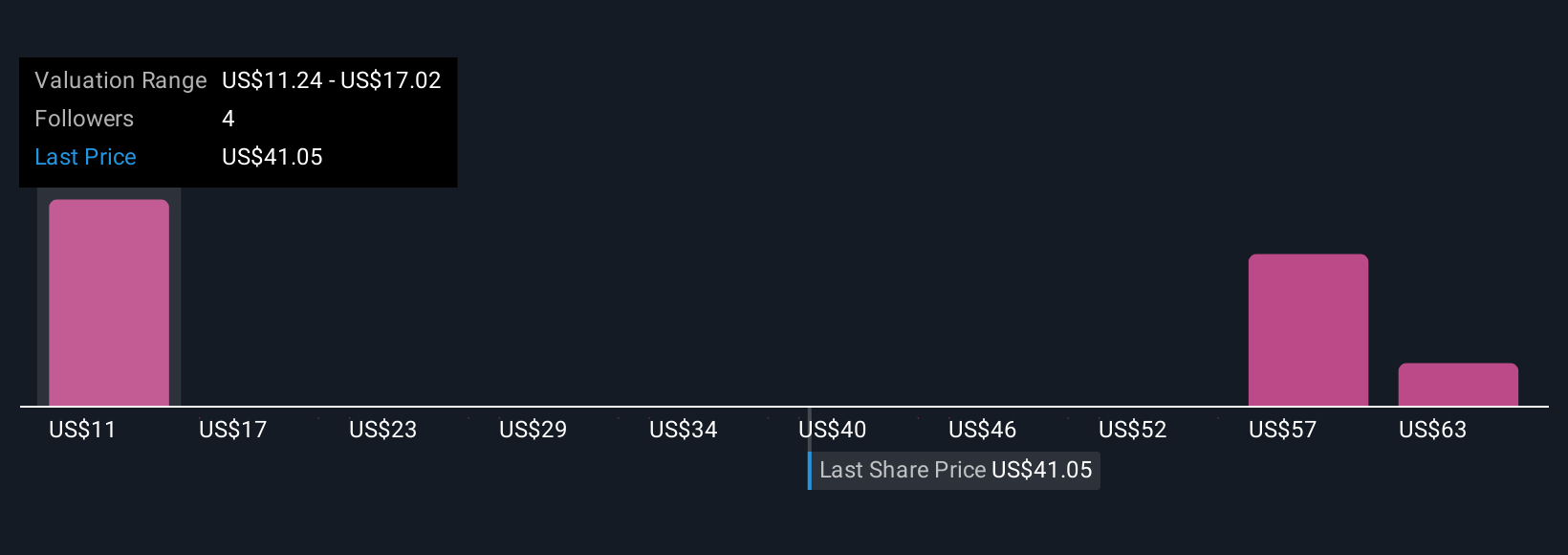

Best of all, Narratives update automatically in response to news and earnings, so your valuation stays relevant as the facts change. For example, one Narrative for Atlanta Braves Holdings might center on confidence in media rights and real estate developments leading to a bullish fair value of $69. Another, focused on fan volatility and rising costs, might drive a more cautious estimate of $45. This demonstrates how different assumptions can directly inform your investment decision.

Do you think there's more to the story for Atlanta Braves Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BATR.K

Atlanta Braves Holdings

Through its subsidiary, Braves Holdings, LLC, owns and operates the Atlanta Braves Major League Baseball Club in the United States.

Imperfect balance sheet with minimal risk.

Market Insights

Community Narratives