- United States

- /

- Entertainment

- /

- NasdaqGS:ATVI

Activision Blizzard's (NASDAQ:ATVI) Price Implies Some Positive Expected Value From M&A

- Microsoft's offer supported the ATVI price from collapsing

- FTC entered the second phase of its investigation

- At the current price level, there is a positive expected value from the deal

Activision Blizzard, Inc. ( NASDAQ: ATVI ) made the headlines in January when it announced the largest M&A deal of the year. While the broad market experienced a correction, the magnetic pull of Microsoft's US$95 per share offer kept the stock from falling.

Since then, the company reported few unimpressive earnings results, but the only thing that could endanger its position is the M&A deal falling through.

See our latest analysis for Activision Blizzard

Second quarter 2022 results

- EPS: US$0.36 (down from US$1.13 in 2Q 2021).

- Revenue: US$1.64b (down 28% from 2Q 2021).

- Net income: US$280.0m (down 68% from 2Q 2021).

- Profit margin: 17% (down from 38% in 2Q 2021). The decrease in margin was driven by lower revenue.

Revenue exceeded analyst estimates by 4.1%. Earnings per share (EPS) missed analyst estimates by 30%.

Over the next year, revenue is forecast to grow 14%, compared to a 31% growth forecast for the industry in the US. Over the last 3 years, on average, earnings per share have increased by 15% per year, whereas the company’s share price has risen by 19% per year.

What Are the Upside and Downside?

Currently, the stock is trading around U$80, implying almost 20% upside potential at the takeover price of 95.

Meanwhile, the downside is a matter of speculation, although, if we look at the previous lows from December at US$56, that would imply a downside of about 30%. However, if the deal collapses, it is likely that the price could move lower than that.

But what are the odds of the Federal Trade Commission (FTC) making such a move? That is the 69 billion dollar question, but we can at least play with some math.

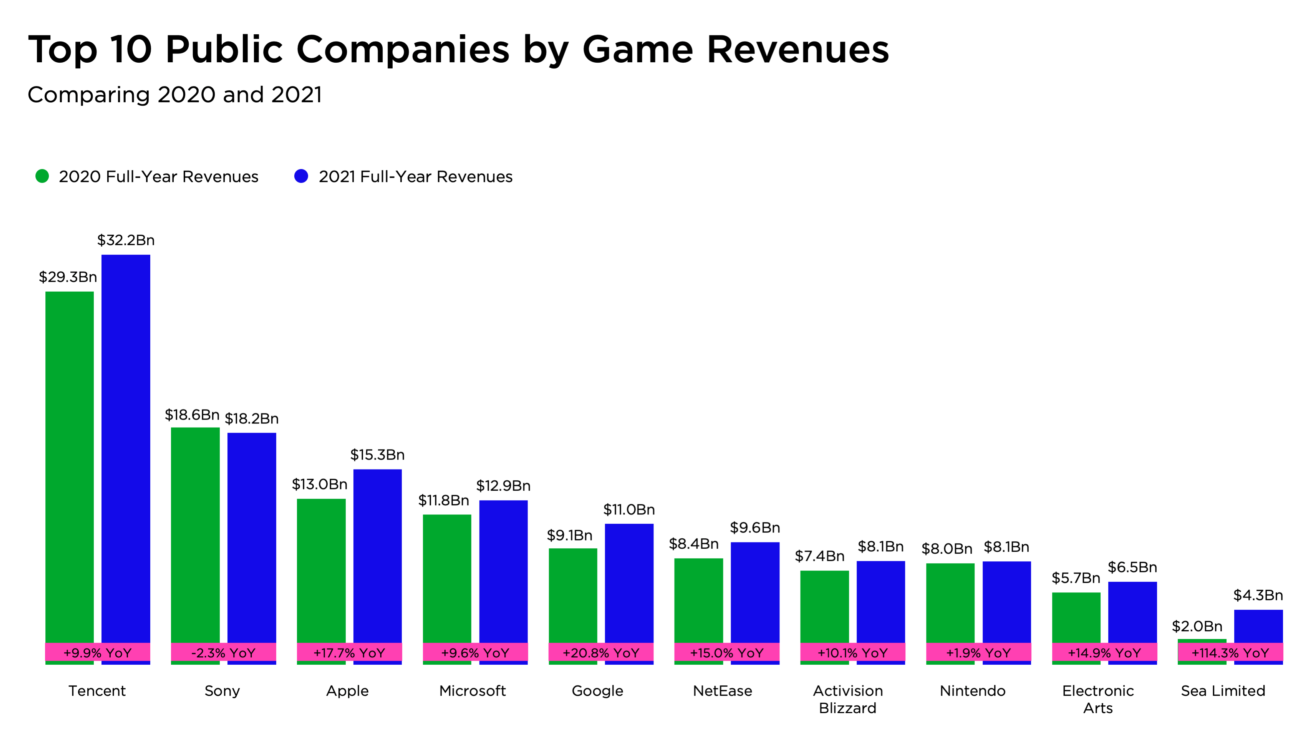

Wedbush Securities analyst Michael Pachter places the odds of the FTC lawsuit at 10% and argues that even if the lawsuit happened, the odds of winning the case would be nonexistent because Microsoft actually wouldn't have the controlling market share in the industry. It would still be well behind its main competitors like Tencent and Sony.

Of course, FTC is not the only regulator looking into the case, but it is the most important one. Yet, even if FTC gives the green light, other regulators like the UK's Competition and Markets Authority (CMA) might stop the merger globally.

Here's some speculative math given the odds and the expected value.

- Assuming a 30% chance of the deal falling through and a 70% chance of success.

- Given the previous estimate of 20% upside and 30% downside, we calculate as follows

0.7 x 20 – 0.3 x 30 = 14 – 9 = 5% positive expected value.

A deal of this size is unprecedented in the gaming industry, thus, the regulators might drag it out well into 2023. Since FTC is already in the second phase of its review, it might finish ahead of the rest. When that happens, the M&A arbitrage investment opportunity could close fast.

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NASDAQ every day. If you want to find the calculation for other stocks, just search here .

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:ATVI

Activision Blizzard

Activision Blizzard, Inc., together with its subsidiaries, develops and publishes interactive entertainment content and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives