- United States

- /

- IT

- /

- NasdaqCM:DTST

November 2024 Penny Stocks On US Exchanges To Consider

Reviewed by Simply Wall St

As the United States stock market reaches record highs following an election-fueled rally, investor optimism is palpable. Penny stocks, often seen as a relic of past trading days, continue to offer intriguing opportunities for those looking to explore smaller or newer companies with potential growth at lower price points. By focusing on penny stocks with strong balance sheets and solid fundamentals, investors can uncover hidden gems that might provide both stability and potential upside in today's vibrant market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7656 | $5.56M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $170.72M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $4.10 | $51.05M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.07B | ★★★★★★ |

| AsiaFIN Holdings (OTCPK:ASFH) | $0.97 | $79.11M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.44 | $128.99M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $88.26M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Puma Biotechnology (NasdaqGS:PBYI) | $2.88 | $141.25M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

Click here to see the full list of 740 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Data Storage (NasdaqCM:DTST)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Data Storage Corporation offers data management and cloud solutions both in the United States and internationally, with a market cap of $28.54 million.

Operations: The company's revenue is primarily generated from its Cloudfirst Technologies segment, contributing $13.83 million, followed by Nexxis Inc with $1.14 million.

Market Cap: $28.54M

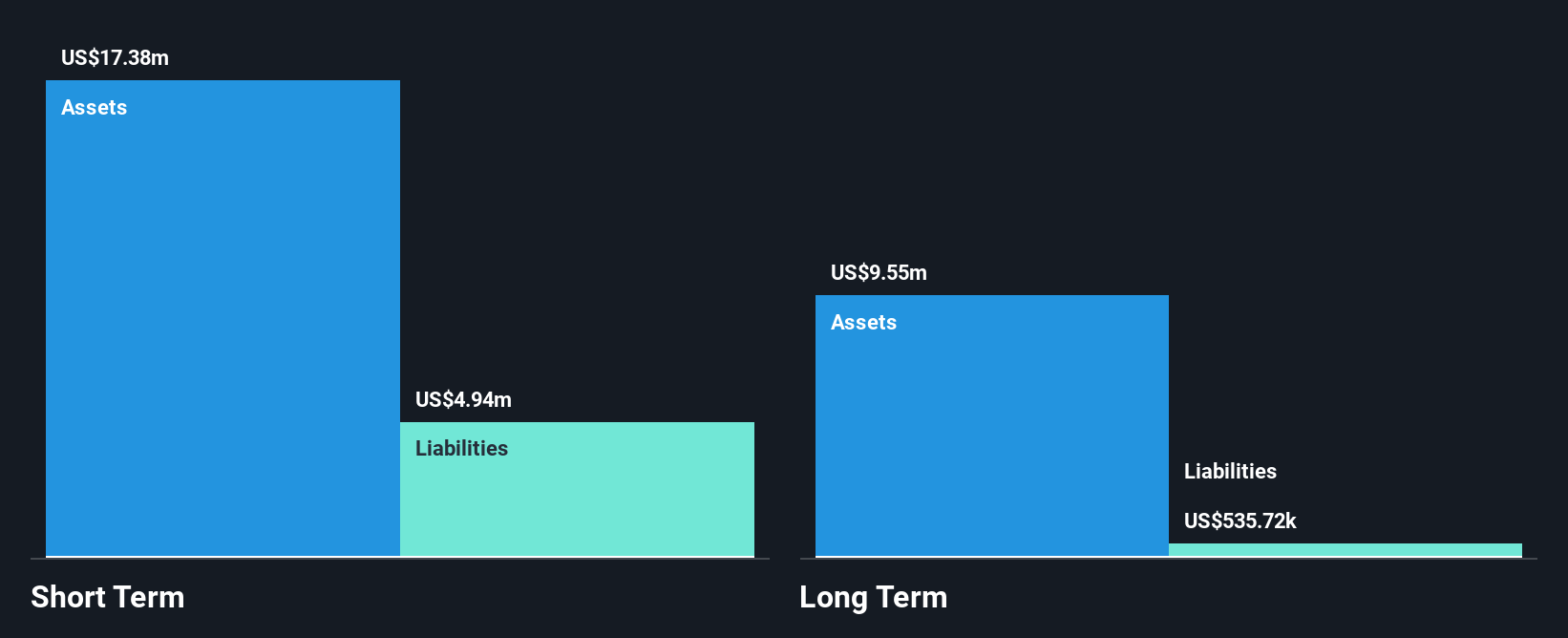

Data Storage Corporation, with a market cap of US$28.54 million, primarily generates revenue from its Cloudfirst Technologies segment. Despite becoming profitable recently, the company reported a net loss of US$0.24 million in Q2 2024 compared to a net income the previous year. The company is debt-free and its short-term assets exceed liabilities significantly, providing financial stability. However, shareholder dilution occurred over the past year. Recent strategic moves include appointing Colin Freeman to lead European expansion efforts for CloudFirst Europe, indicating potential growth opportunities despite current profitability challenges and low return on equity at 0.8%.

- Click here to discover the nuances of Data Storage with our detailed analytical financial health report.

- Evaluate Data Storage's prospects by accessing our earnings growth report.

Exagen (NasdaqGM:XGN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Exagen Inc. develops and commercializes testing products under the AVISE brand in the United States, with a market cap of $49.55 million.

Operations: Exagen generates revenue of $56.66 million from its Diagnostic Kits and Equipment segment.

Market Cap: $49.55M

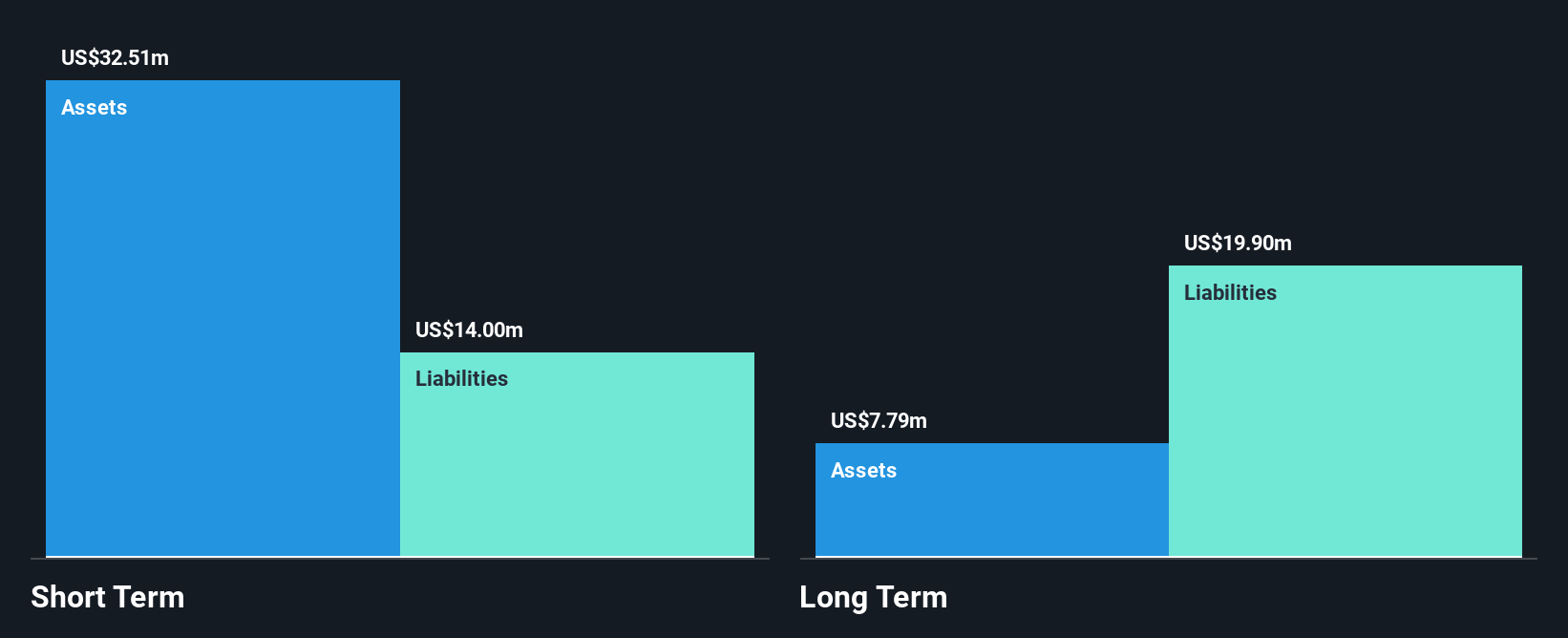

Exagen Inc., with a market cap of US$49.55 million, is currently unprofitable but shows potential for revenue growth in its Diagnostic Kits and Equipment segment, generating US$56.66 million. The company has more cash than total debt and maintains a sufficient cash runway for over three years based on current free cash flow. However, it faces challenges such as shareholder dilution and high share price volatility over the past three months. Although trading at good value relative to peers, Exagen's management team is relatively inexperienced with an average tenure of two years, which may impact strategic execution.

- Take a closer look at Exagen's potential here in our financial health report.

- Assess Exagen's future earnings estimates with our detailed growth reports.

Liquidmetal Technologies (OTCPK:LQMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liquidmetal Technologies, Inc. is a materials technology company that designs, develops, and sells custom products and parts made from bulk amorphous alloys to various industries globally, with a market cap of $46.55 million.

Operations: The company generates revenue of $1.02 million from developing and manufacturing products and applications using amorphous alloys.

Market Cap: $46.55M

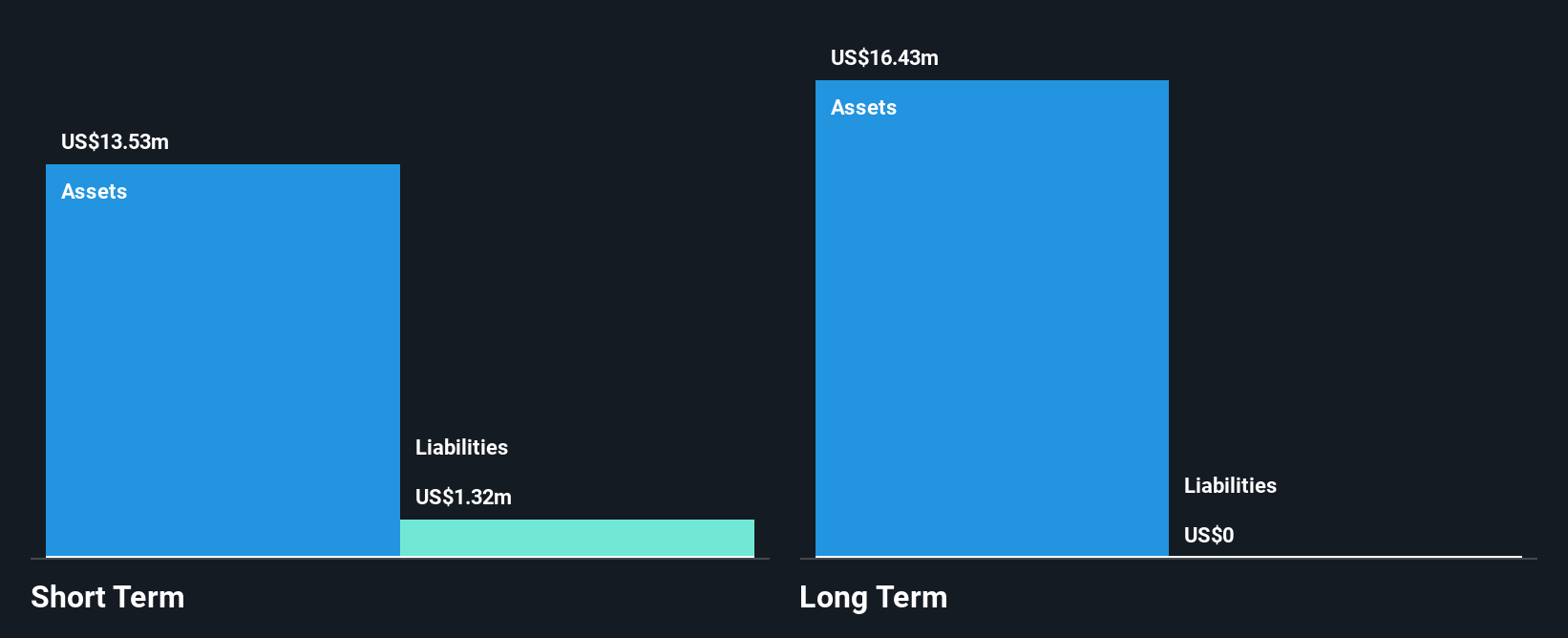

Liquidmetal Technologies, Inc., with a market cap of US$46.55 million, remains unprofitable but has shown revenue growth, reporting US$0.731 million for the first nine months of 2024 compared to US$0.224 million the previous year. Despite its volatile share price and significant insider selling recently, the company benefits from having no debt and sufficient short-term assets (US$17.3 million) to cover liabilities (US$1.3 million). The board is experienced with an average tenure of 8.1 years, providing stability in governance amidst recent auditor changes aimed at improving financial oversight and transparency.

- Unlock comprehensive insights into our analysis of Liquidmetal Technologies stock in this financial health report.

- Gain insights into Liquidmetal Technologies' past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Navigate through the entire inventory of 740 US Penny Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DTST

Data Storage

Provides enterprise cloud and business continuity solutions in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives