- United States

- /

- Metals and Mining

- /

- NYSEAM:IE

Why Ivanhoe Electric (IE) Is Up After Clearing Final Land Hurdle for Santa Cruz Project

Reviewed by Sasha Jovanovic

- Ivanhoe Electric recently completed the final US$39.3 million land acquisition payments for the Santa Cruz Copper Project in Arizona, fulfilling all requirements of its agreement with Wolff-Harvard Ventures LLC.

- This milestone eliminates a major development barrier and sets the stage for mine construction to begin once permitting is finalized.

- We'll explore how clearing the last land acquisition hurdle positions Ivanhoe Electric to advance development at the Santa Cruz Copper Project.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Ivanhoe Electric's Investment Narrative?

To be a shareholder in Ivanhoe Electric right now means believing in its potential to convert a promising Arizona copper project into a major US-based producer, even as the company remains unprofitable. The completion of final land payments for the Santa Cruz Copper Project is a visible step forward, removing a material barrier to progressing toward initial mine construction. With cash in hand from recent equity offerings and the project’s permitting process underway, this milestone shifts the immediate catalyst firmly to permitting approval and the start of construction, expected in early 2026. While Ivanhoe continues to post sizeable losses and faces dilution risk from fresh equity, this news reduces one of the key execution risks investors previously faced. Still, funding the buildout and successfully advancing permitting now take center stage, and investors must balance recent progress with these persistent risks. Yet, spare a moment to consider what could happen if permitting timelines slip.

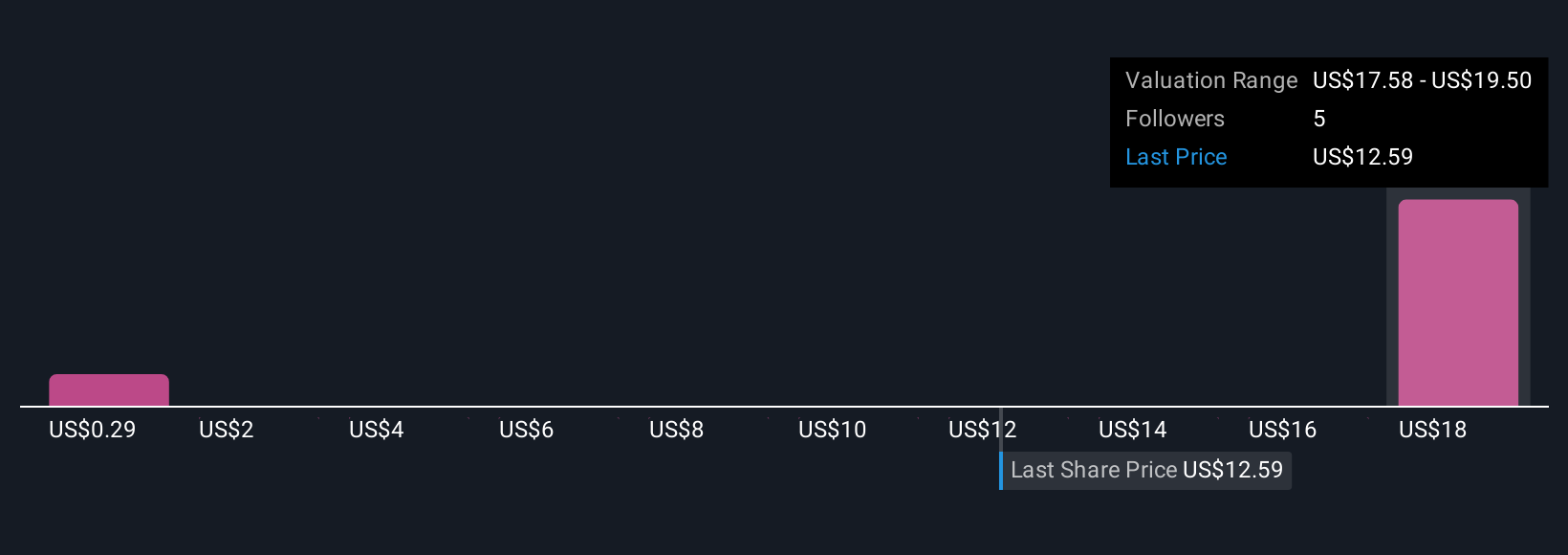

Insights from our recent valuation report point to the potential overvaluation of Ivanhoe Electric shares in the market.Exploring Other Perspectives

Explore 3 other fair value estimates on Ivanhoe Electric - why the stock might be worth as much as 60% more than the current price!

Build Your Own Ivanhoe Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ivanhoe Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Ivanhoe Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ivanhoe Electric's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:IE

Ivanhoe Electric

A mineral exploration company, focuses on developing mines from mineral deposits primarily in the United States.

Excellent balance sheet with low risk.

Market Insights

Community Narratives