- United States

- /

- Metals and Mining

- /

- NYSEAM:IE

Is Ivanhoe Electric’s (IE) Ambitious Equity Raise Shaping a New Capital Allocation Narrative?

Reviewed by Sasha Jovanovic

- Ivanhoe Electric recently completed a US$150 million follow-on equity offering, pricing 10,000,000 common shares at US$15 each with a US$0.60 discount per share, and filed additional offerings including one for US$125 million and another for 125,000,000 shares.

- This series of substantial equity offerings highlights the company's pursuit of significant new capital, which often raises questions about share dilution and future investment plans.

- We’ll explore how Ivanhoe Electric’s multifaceted approach to raising equity capital shapes the evolving investment narrative for the company.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

What Is Ivanhoe Electric's Investment Narrative?

To own Ivanhoe Electric shares today, investors first need to believe in the company's ambition to secure and develop major copper and nickel projects, banking on growing demand for these critical metals amid the energy transition. The recent US$150 million equity raise and subsequent filings for up to 125,000,000 shares significantly reshape near-term catalysts and risks. On one hand, this influx of capital could help advance key projects like Santa Cruz and expand promising partnerships in Côte d'Ivoire and Saudi Arabia, providing financial runway to pursue exploration and feasibility milestones. However, the added share count means existing shareholders face dilution, which could impact the stock’s price even if business milestones are reached. While the company is still unprofitable and not forecast to generate positive earnings soon, this aggressive capital raising likely shifts the short-term focus toward efficient capital deployment, potential project updates, and market reaction to dilution risk. Despite having an experienced board and management, the balance between funding growth and delivering value to shareholders is even more critical following these offerings. But with large new share offerings, dilution risk now deserves even closer investor attention.

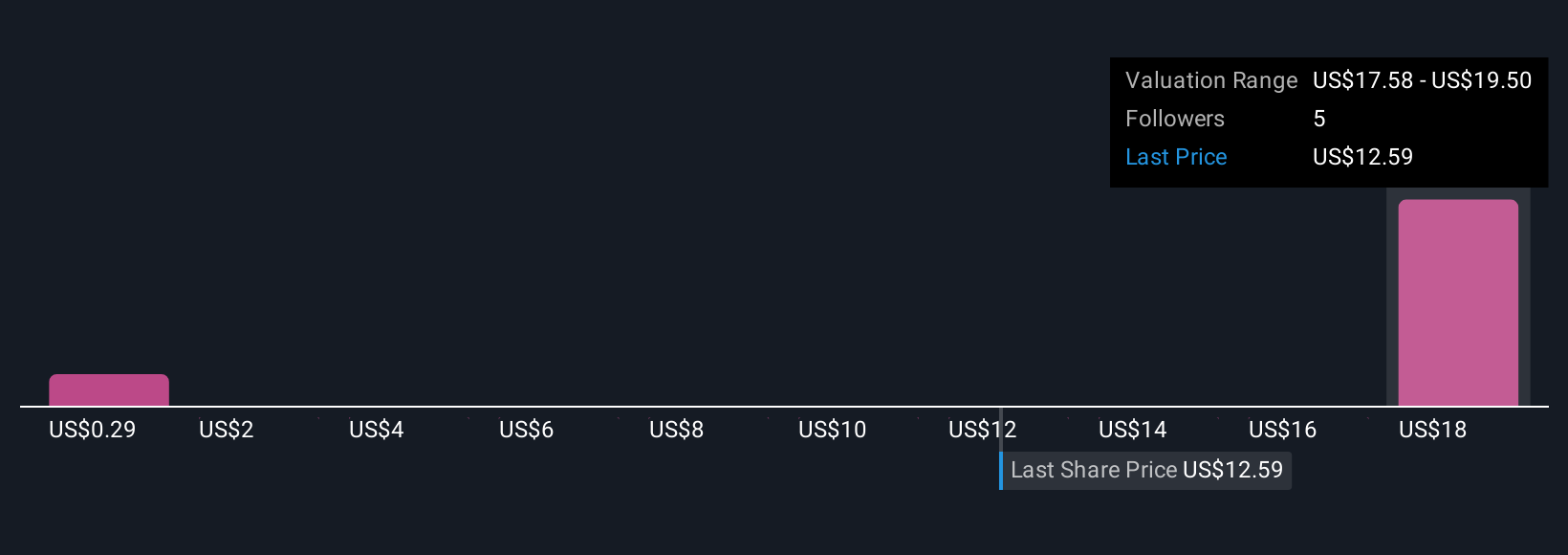

Our valuation report unveils the possibility Ivanhoe Electric's shares may be trading at a premium.Exploring Other Perspectives

Explore 2 other fair value estimates on Ivanhoe Electric - why the stock might be worth less than half the current price!

Build Your Own Ivanhoe Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ivanhoe Electric research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Ivanhoe Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ivanhoe Electric's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:IE

Ivanhoe Electric

A mineral exploration company, focuses on developing mines from mineral deposits primarily in the United States.

Excellent balance sheet with low risk.

Market Insights

Community Narratives