- United States

- /

- Metals and Mining

- /

- NYSEAM:GROY

Will Gold Royalty's (GROY) Rising Revenues Offset Its Growing Losses in the Long Run?

Reviewed by Sasha Jovanovic

- Gold Royalty Corp. recently announced its third-quarter 2025 earnings, reporting quarterly sales of US$4.15 million, up from US$2.06 million a year earlier, and a net loss of US$1.13 million, in contrast to net income of US$3.42 million for the same period last year.

- This mixed report highlights substantial revenue growth from operations but also points to expanding losses, prompting investors to reconsider the balance between top-line momentum and ongoing profitability challenges.

- We’ll now explore the impact of Gold Royalty’s higher sales but deeper quarterly loss on its previously positive investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Gold Royalty Investment Narrative Recap

To be a shareholder of Gold Royalty, you have to believe in its strategy of capturing outsized growth as new royalty streams on large gold assets begin ramping up, ultimately translating higher gold prices and production volumes into improved cash flow. The latest earnings report showed strong revenue gains yet a swing to net loss, but this shift does not appear to materially change the near-term catalyst: realizing commercial production and revenue from recently acquired and ramping assets, while the main risk remains delays or setbacks at these few critical mines.

Gold Royalty’s most relevant recent announcement is its October 2025 production update, which indicated 2025 production will come in at or just below the lower end of its guidance range of 5,700 to 7,000 gold equivalent ounces. With asset ramp-ups being central to the investment case, even minor production shortfalls could threaten the expected acceleration in revenue growth over the coming quarters, underscoring the importance of operational execution.

By contrast, investors should be aware that setbacks at just one or two of these cornerstone assets could...

Read the full narrative on Gold Royalty (it's free!)

Gold Royalty's outlook anticipates $46.6 million in revenue and $14.7 million in earnings by 2028. This scenario depends on a 55.5% annual revenue growth rate and a $16.5 million increase in earnings from the current level of -$1.8 million.

Uncover how Gold Royalty's forecasts yield a $4.89 fair value, a 32% upside to its current price.

Exploring Other Perspectives

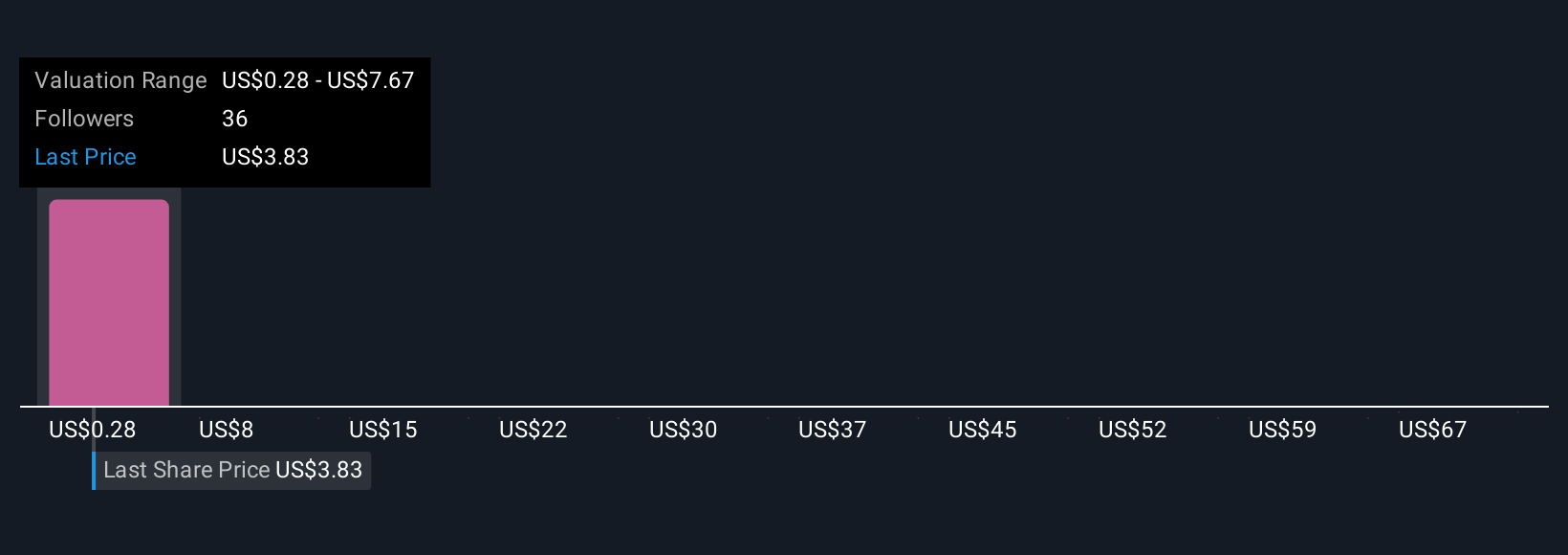

Three community member fair value estimates for Gold Royalty cluster between US$4.89 and US$11.52 per share, showing considerable variation in outlook. While the company’s recent sales growth reflects progress on new royalties, concern remains that overdependence on a handful of assets could magnify any operational disruptions.

Explore 3 other fair value estimates on Gold Royalty - why the stock might be worth over 3x more than the current price!

Build Your Own Gold Royalty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gold Royalty research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Gold Royalty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gold Royalty's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:GROY

Gold Royalty

A precious metals-focused royalty company, provides financing solutions to the metals and mining industry.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives