- United States

- /

- Metals and Mining

- /

- NYSEAM:GROY

Will Gold Royalty's (GROY) Expanded Credit Facility Shape Its Next Phase of Growth?

Reviewed by Sasha Jovanovic

- Gold Royalty Corp. recently announced it has amended and expanded its revolving credit facility to US$75 million, with an option for an additional US$25 million, and extended the maturity to November 2028, along with the early redemption and conversion of its outstanding convertible debentures.

- This move improves the company's financial flexibility by securing better lending terms and lowering interest costs, freeing up capital for growth and acquisitions.

- We'll now examine how Gold Royalty's expanded credit facility and improved borrowing terms might affect its longer-term investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Gold Royalty Investment Narrative Recap

To own shares in Gold Royalty Corp., investors need to believe in the company’s ability to realize growing royalty revenue as its underlying mines ramp up production and gold prices hold firm. The recent expansion of its credit facility and early debenture redemption provide greater financial flexibility, supporting funding for new acquisitions and growth, but do not materially change the key short-term catalyst: successful production ramp-ups at core assets. The main risk, production delays or shortfalls at these key mines, remains front and center.

Among the company’s recent developments, the November 2025 production guidance update stands out. Management confirmed full-year attributable gold equivalent ounces are expected around or modestly below the low end of guidance, making operational execution at major assets closely tied to near-term outcomes, especially as expanded credit lines enhance funding capacity for future opportunities.

However, investors should also be aware that if one of these major mines encounters an unexpected regulatory or operational setback...

Read the full narrative on Gold Royalty (it's free!)

Gold Royalty's narrative projects $46.6 million in revenue and $14.7 million in earnings by 2028. This requires 55.5% yearly revenue growth and a $16.5 million increase in earnings from current earnings of -$1.8 million.

Uncover how Gold Royalty's forecasts yield a $4.79 fair value, a 9% upside to its current price.

Exploring Other Perspectives

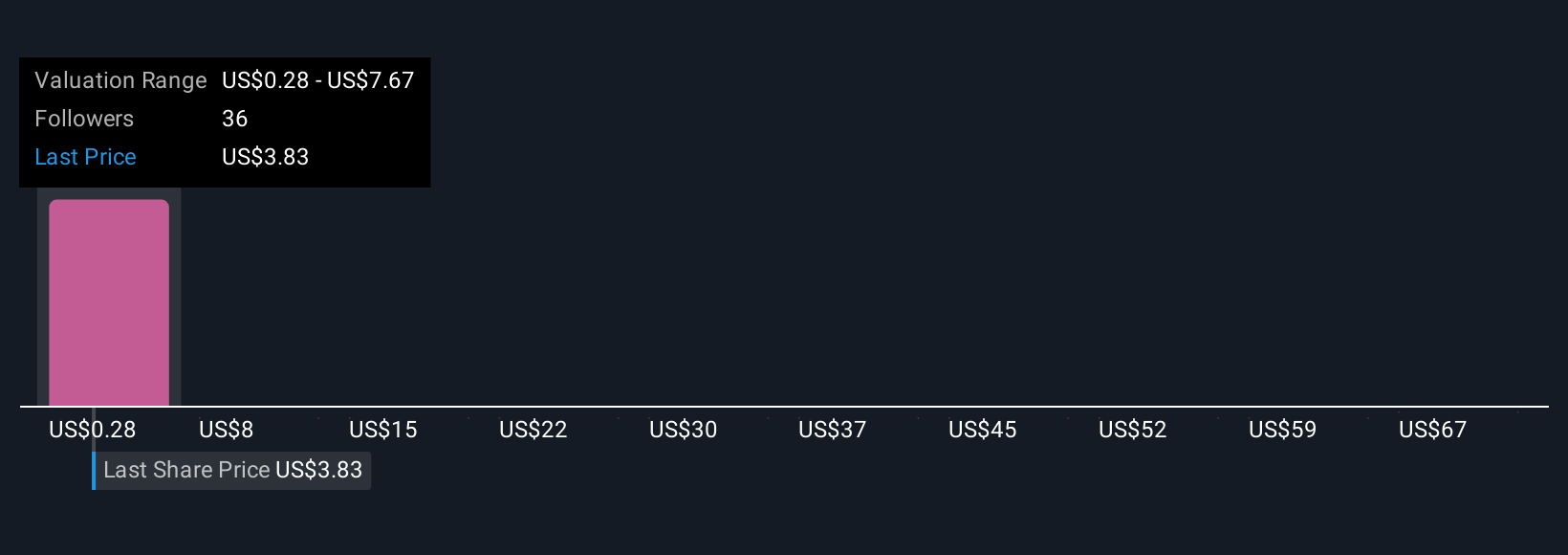

Simply Wall St Community users provided three fair value estimates for Gold Royalty, ranging from US$4.79 up to US$11.48 per share. While many market participants see strong revenue growth potential ahead, concentration risk linked to a small group of producing assets could have a significant influence on future results, reminding you to weigh multiple viewpoints before making decisions.

Explore 3 other fair value estimates on Gold Royalty - why the stock might be worth just $4.79!

Build Your Own Gold Royalty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gold Royalty research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Gold Royalty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gold Royalty's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:GROY

Gold Royalty

A precious metals-focused royalty company, provides financing solutions to the metals and mining industry.

High growth potential and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026