- United States

- /

- Basic Materials

- /

- NYSE:VMC

A Look at Vulcan Materials’s Valuation Following CEO Transition Plan and Strong Q3 Earnings

Reviewed by Simply Wall St

Vulcan Materials (VMC) shares drew renewed investor attention after the company revealed a CEO transition plan, naming Ronnie Pruitt as successor in 2026. This update follows stronger-than-expected Q3 earnings.

See our latest analysis for Vulcan Materials.

All of this comes amid steady momentum for Vulcan Materials. The share price is up more than 15% year-to-date, reflecting growing investor confidence after the strong Q3 earnings beat and newly announced leadership continuity. Over the last year, total shareholder return sits at 3.2%. Over the long run, Vulcan’s 64% three-year total return and 110% five-year total return indicate resilience and solid compounding for patient investors.

If leadership changes and long-term performance are on your radar, this could be an excellent moment to expand your search and discover fast growing stocks with high insider ownership

With such strong multi-year returns and bullish analyst targets in place, the key question now is whether Vulcan Materials shares remain undervalued, or if the market has already priced in the company’s future growth prospects. Could there still be a buying opportunity here?

Most Popular Narrative: 7.1% Undervalued

The current share price for Vulcan Materials sits below the most widely followed narrative's fair value. This draws attention to underlying drivers powering this upside potential. Today’s valuation reflects both market expectations and the company’s exposure to transforming infrastructure spending.

Accelerating infrastructure spending, driven by the ongoing rollout of IIJA funding, major state initiatives in core Southern and Sunbelt markets, and increasing local spending, is visibly expanding Vulcan's backlogs and contract awards. With over 60% of IIJA funds still to be spent and awards up over 20% in Vulcan-served regions, this points to multi-year growth in volumes and more predictable, compounding revenue.

Curious what bold financial forecasts make this valuation possible? The fair value hinges on high growth in backlog, surging infrastructure funding, and bullish multi-year operating leverage. Uncover which core projections rewrite the price expectations. See what makes this narrative tick.

Result: Fair Value of $317.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent construction project delays and increased exposure to regional weather disruptions could challenge Vulcan's projected growth and margin outlook.

Find out about the key risks to this Vulcan Materials narrative.

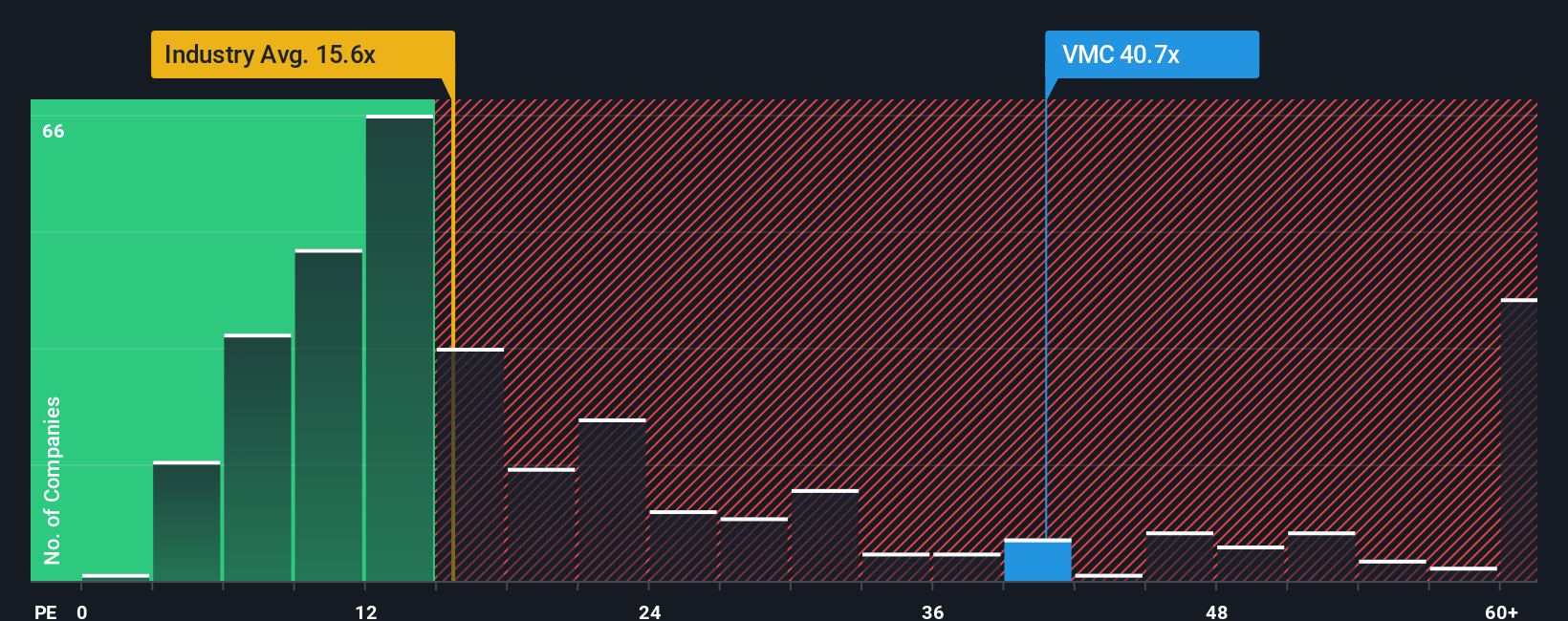

Another View: Multiples Signal a Premium

Looking from a different angle, Vulcan Materials is trading at a price-to-earnings ratio of 34.7x, far above both the global industry average of 15x and its peer average of 24.9x. This also exceeds the estimated fair ratio of 23.2x, suggesting investors are paying a significant premium for future growth. Does this premium set a higher bar for performance, or is it signaling valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vulcan Materials Narrative

If you want to challenge these conclusions or take a hands-on approach, you’re just a few clicks away from building your own Vulcan Materials view. Do it your way

A great starting point for your Vulcan Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let standout opportunities slip by. Set yourself up for smarter investing. Here’s where savvy investors are moving next on Simply Wall Street:

- Capture unique upside by targeting market leaders with strong cash flow in these 923 undervalued stocks based on cash flows, where solid fundamentals meet attractive prices.

- Power up your portfolio with steady yielders as you review these 15 dividend stocks with yields > 3% boasting returns above the 3% mark. This approach can be ideal for boosting income and addressing volatility.

- Jump into the fast lane of artificial intelligence with these 25 AI penny stocks and get ahead of game-changing innovation affecting every sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMC

Vulcan Materials

Produces and supplies construction aggregates in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.